News Releases

Financial Report for the Fiscal Year Ended March 2021

Mori Trust Group recently announced its consolidated business performance for the year ended March 31, 2021(FY 2021).

The Group consists of 32 consolidated companies, including MORI TRUST CO., LTD., MORI TRUST BUILDING MANAGEMENT CO., LTD., and MORI TRUST HOTELS & RESORTS CO., LTD., and three equity-method affiliates.

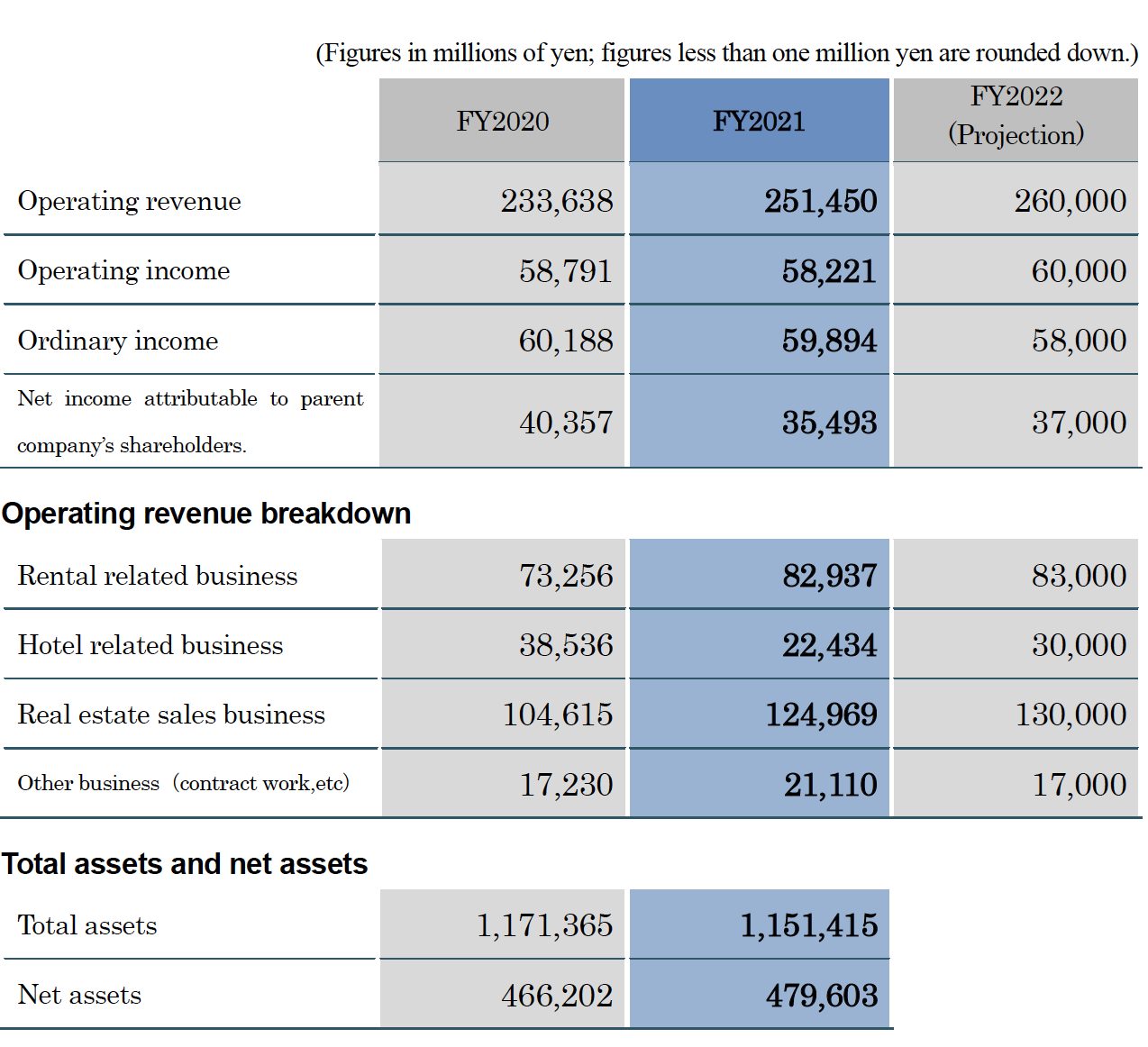

[Mori Trust Group Consolidated Financial Report] (April 1, 2020 – March 31, 2021)

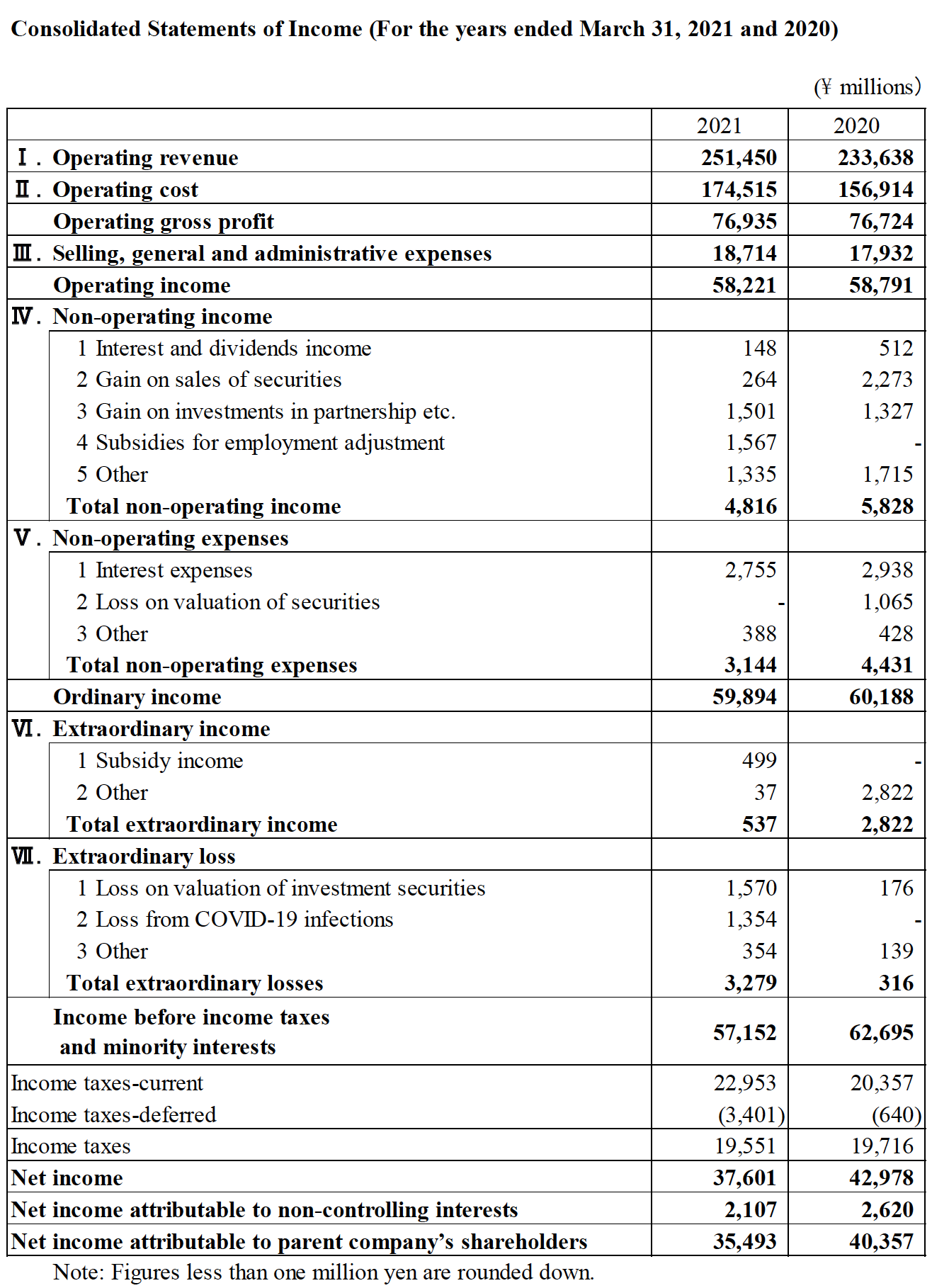

- In the fiscal year ended March 2021, operating revenue was 251.4 billion yen (up 7.6% compared to the previous term), and operating income was 58.2 billion yen (down 1.0% compared to the previous term). Despite the impact on the hotel-related business from the spread of COVID-19 infections, operating revenue increased for the fourth consecutive year, and operating income decreased only slightly. Newly operated properties in the leasing-related business and the strong performance of the real estate sales business contributed to the operating results.

- Income decreased, with ordinary income at 59.8 billion yen (down 0.5% compared to the previous term), and net income attributable to owners of the parent at 35.4 billion yen (down 12.1% compared to the previous term).

- For the fiscal year ending March 2022, we expect operating revenue of 260 billion yen (up 3.4% compared to the previous term), operating income of 60 billion yen (up 3.1% compared to the previous term), and net income attributable to owners of the parent of 37 billion yen (up 4.2% compared to the previous term).

Highlights of FY 2021 business performance

- In “leasing-related business,” we recorded operating revenue of 82.9 billion yen, an increase of 9.7 billion yen compared to the previous term. The following factors contributed to the increased operating revenue: contribution throughout the year from the operation of the “Kamiyacho Trust Tower,” the construction of which was completed in March 2020; the favorable occupancy rate of existing properties; and contribution throughout the year from the operation of the office buildings in San Jose, which we acquired in March 2019.

- In “hotel-related business,” the new operation of the “Hilton Okinawa Sesoko Resort” (opened in July 2020), the “JW Marriott Hotel Nara” (opened in July 2020), and “The Tokyo EDITION, Toranomon” (opened in October 2020) contributed to the operating revenue. However, operating revenue decreased by 16.1 billion yen compared to the previous term to 22.4 billion yen due to the impact of the spread of COVID-19 infections, including the temporary closure of 19 facilities following the declaration of a state of emergency.

- “Real estate sales business” recorded operating revenue of 124.9 billion yen, an increase of 20.3 billion yen compared to the previous term, due to the strong sales of office buildings and condominiums. Additionally, “other business” recorded operating revenue of 21.1 billion yen, an increase of 3.9 billion yen compared to the previous term.

As a result of the above, operating revenue finished at 251.4 billion yen, operating income at 58.2 billion yen, and net income attributable to owners of the parent at 35.4 billion yen. In addition, we also achieved the numerical targets established for the final year of “Advance 2027,” our medium- to long-term vision, of operating revenue of 230 billion yen and operating income of 55 billion yen. This is the second consecutive year of achieving the numerical targets continuing from the fiscal year ended March 2020.

Business Performance Projections for FY 2022

- In “leasing-related business,” the full-year occupancy rate of Kamiyacho Trust Tower is expected to improve. As a result, the business is expected to remain stable and generate 83 billion yen in operating revenue.

- In “hotel-related business,” although the outlook remains uncertain due to the spread of COVID-19 infections, we expect operating revenue of 30 billion yen. We anticipate the following factors will contribute to the increase in revenue: the expected improvement in the occupancy rate of existing hotels due to the moderate recovery in tourism demand, mainly from domestic tourists; and the full-year operation of three facilities newly opened in 2020.

- “Real estate sales business” is expected to generate 130 billion yen in operating revenue due to the strong performance of our residential property sales business, and we expect fruits from office building sales. In addition, “other business” is expected to generate 17 billion yen in operating revenue.

As a result of the above, for the fiscal year ending March 2022, we expect operating revenue of 260 billion yen, operating income of 60 billion yen, and net income attributable to owners of the parent of 37 billion yen.

| Projections contained in this document have been made on the basis of information available when it was released. Due to various unforeseeable factors, actual performance may differ from such projections. |

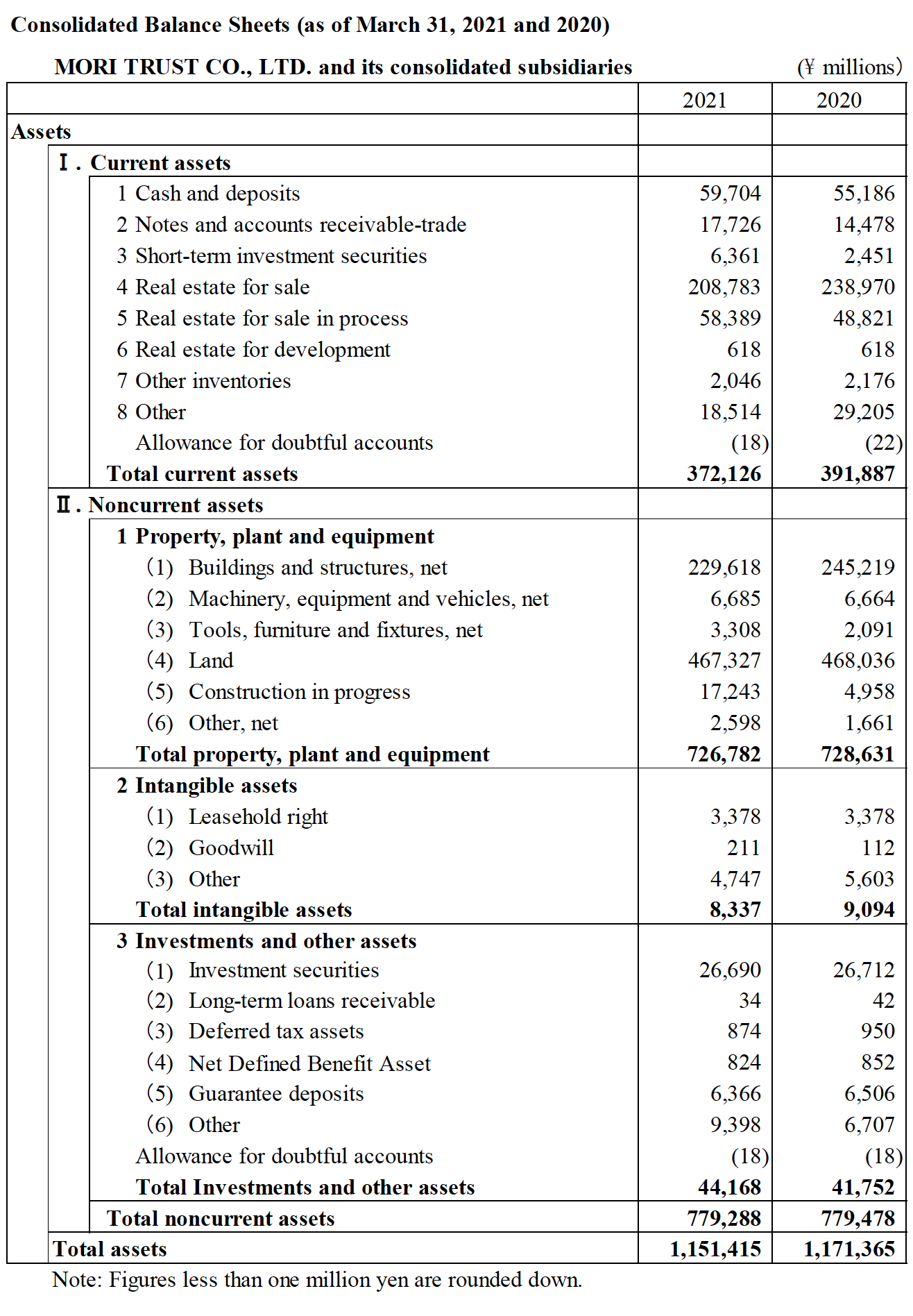

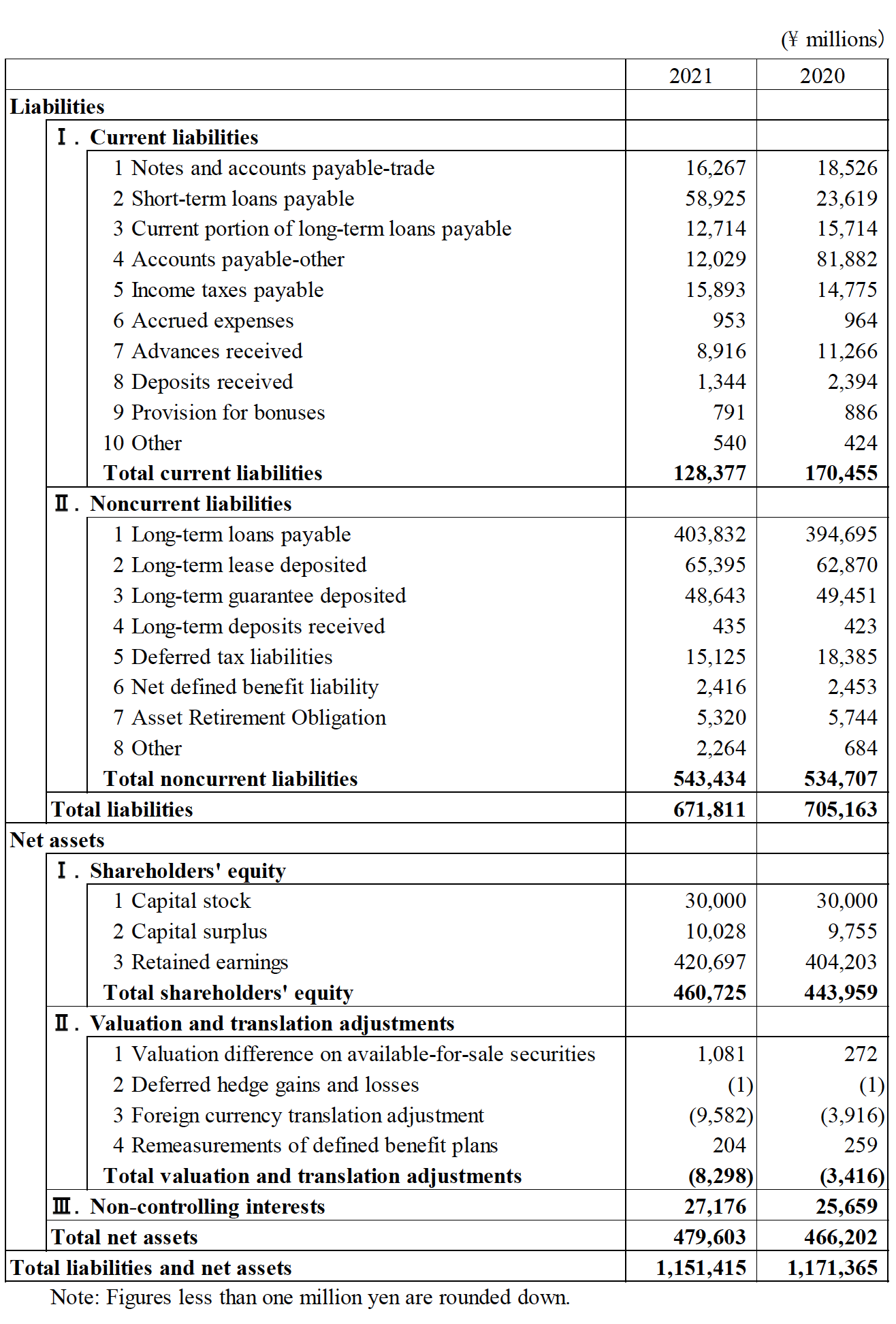

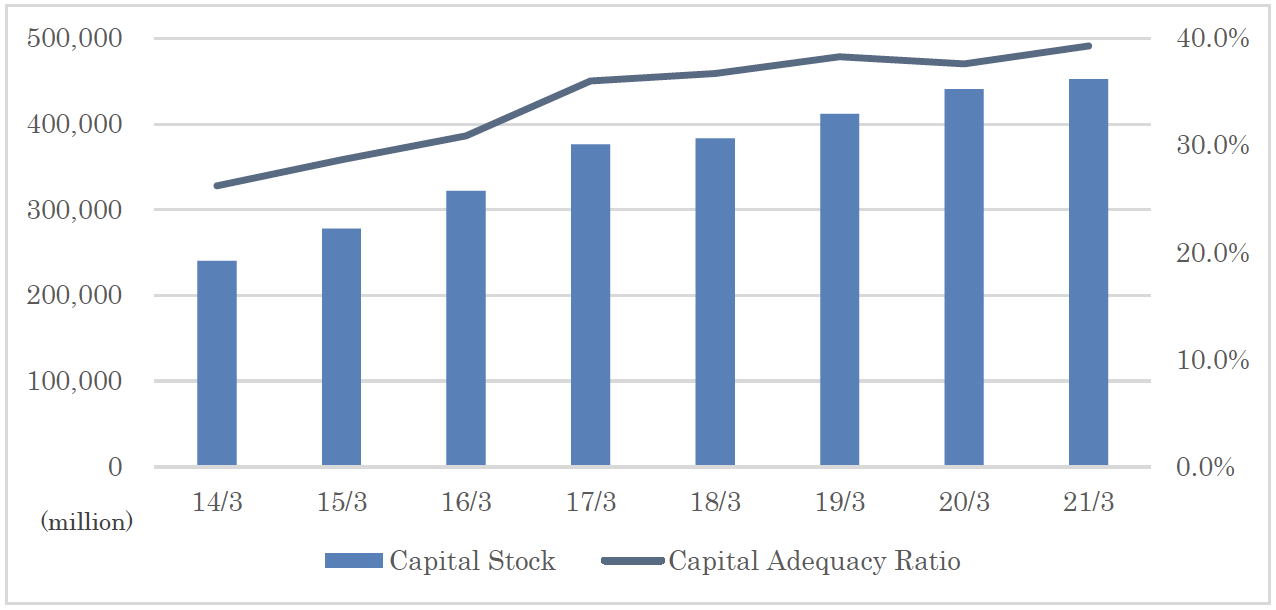

Financial Conditions of Mori Trust Group

Trends of Capital Stock and Capital Adequacy Ratio

The capital stock and capital adequacy ratio for the fiscal year ended March 2021 were 452.4 billion yen and 39.3% respectively.

FY 2021 Key Business Topics

REAL ESTATE

Under our office business vision, “Creative First,” we completed the construction of “Kamiyacho Trust Tower,” the large complex that forms the core of “Tokyo World Gate,” in March of last year. We constructed this building to supply an office building that meets diversifying office needs. A green space of about 5,000 m2 has been developed. In addition, various facilities for stores and conferences, etc., are opening successively. In March of this year, the construction of the “Akasaka 2-Chome Project (tentative name)” started in earnest. We are now developing a town that will serve as a destination for diverse people, looking beyond the new normal.

Tokyo World Gate/Kamiyacho Trust Tower

Site area | 16,210㎡ |

|---|---|

| Total floor area | 198,774㎡ |

| Number of floors | 38 floors above ground 3 floors below ground |

| Location | p.p1 {margin: 0.0px 0.0px 0.0px 0.0px; font: 8.0px Arial} table.t1 {border-collapse: collapse} td.td1 {padding: 0.0px 5.0px 0.0px 5.0px} 4-1-1, Toranomon, Minato-ku, Tokyo |

| Primary use | Offices, shared office, residence, luxury hotel and serviced apartments, medical facility for foreign patients, shop & restaurant, shrine |

AKASAKA 2-CHOME PROJECT

| Site area | 15,750㎡ |

|---|---|

| Total floor area | 220,000㎡ |

| Number of floors | 43 floors above ground 3 floors below ground |

| Location | 1-chome and 2-chome, Akasaka, Minato-ku, Tokyo |

| Primary use | Offices, hotel, serviced apartments, shop & restaurant, facilities to support tourism, facilities to promote history and culture, clinics |

Small offices “Cozy Works“

Based on the concept of “at living,” Gotenyama Trust Tower and Shiroyama Trust Tower provide private spaces where you can relax as though you are at home even while you are in an office.

| Cozy Works Gotenyama | |

|---|---|

| Starting date |

February 3, 2020 |

| Location | 3F, Gotenyama Trust Tower |

| Area | 622.83㎡ |

| Room | 11 rooms |

| Contents | Small offices, Exclusive lounges for members and residents, Exclusive meeting rooms for members and residents |

| Cozy Works Kamiyacho | |

|---|---|

| Starting date | September 1, 2020 |

| Location | 4F, Shiroyama Trust Tower |

| Area | 1,025.15㎡ |

| Room | 35 rooms |

| Contents | Small offices, Exclusive lounges for members and residents, Exclusive meeting rooms for members and residents |

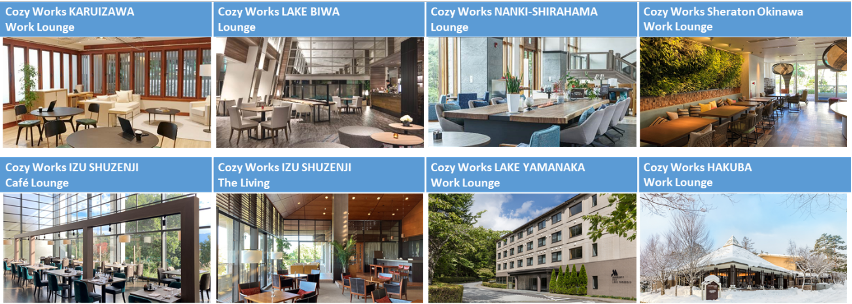

We have expanded our “Cozy Works” brand office spaces in the resort hotels operated by our Group.

HOTELS & RESORTS

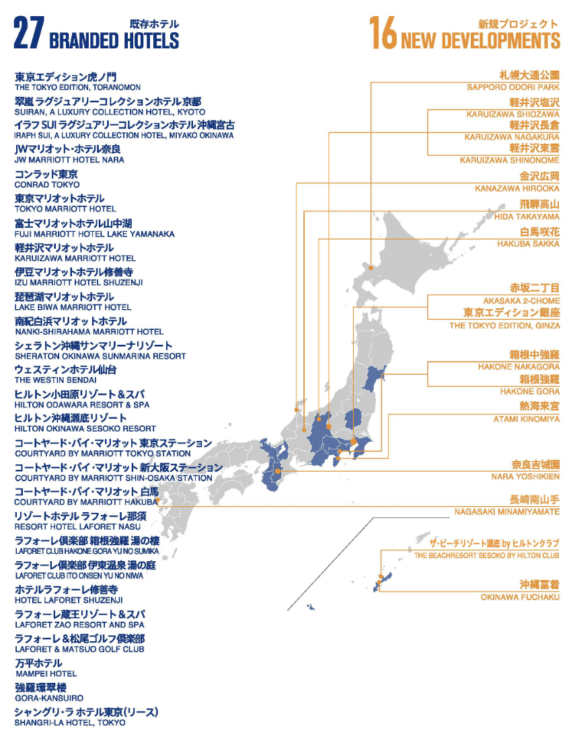

Apart from having 27 hotel facilities across Japan as of March 2021, we are also promoting new hotel plans for two hotels in central Tokyo and 14 hotels in regional areas.

Under the “luxury destination network” concept*, we provide comfortable stays to tourists from Japan and overseas utilizing the attractive tourism resources of various areas of Japan, such as promoting initiatives aimed at increasing inbound demand and increasing consumption per traveler.

* “Luxury destination network” concept: The Mori Trust Group’s business vision of creating a “luxury destination network” in Japan through the development of luxury hotels in attractive cities and resorts throughout Japan to contribute to making Japan a leading tourism country.

Hotels opened in FY2020

THE TOKYO EDITION, TORANOMON

We opened the luxury lifestyle hotel brand “EDITION” for the first time in Japan, offering new trends and sophisticated lifestyles in Tokyo.

| Location | Toranomon, Minato-ku, Tokyo |

|---|---|

| Room | 206 rooms |

JW Marriott Hotel NARA

We attracted the “JW Marriott Hotel” Marriott International luxury hotel brand to Japan for the first time. This hotel has good access to historic sites representative of Japan and is aiming to become a new tourist base.

| Location | Sanjooji, Nara-shi, Nara |

|---|---|

| Room | 158 rooms |

HILTON OKINAWA SESOKO RESORT

This is the first beach resort hotel in Japan opened by Hilton. Facing Sesoko Beach, which boasts the clearest water in Japan, the hotel provides a memorable stay where you can feel beautiful nature with your five senses.

| Location | Sesoko, Motobu-cho, kunigami-gun, Okinawa |

|---|---|

| Room | 298 rooms |

(Reference) Hotels scheduled to be developed

The Beach Resort Sesoko by Hilton Club

By developing medium- to long-term timeshare resorts, we aim to propose a new vacation style called “enjoy as if you live here” and contribute to the realization of affluent and fulfilling lifestyles for visitors.

THE TOKYO EDITION, GINZA

Affinity with surrounding global high-brand customer segments is high. We aim to contribute to the sustainable development of the Ginza area by attracting international travelers, including trendsetters and the wealthy.

WELLNESS BUSINESS

In an effort to create new value based on ideas outside the framework of existing businesses, our Group focused on the importance of wellness. Therefore, we launched a full-scale wellness business in October 2020. The wellness business aims to provide comprehensive support for workers’ lifestyles, including proposals for accommodation plans that allow them to experience wellness; developing a workcation environment; and wellness-related services in collaboration with startup companies. While focusing on wellness, which is an important theme for modern society, we will contribute to the realization of a wellness society by designing “safety and security” in various real spaces such as places to work and relax.

Exclusive Sales in Japan of Pure Wellness Room

【Program for Cleaning the Indoor Environment】

We have signed an exclusive distributor agreement in Japan for “Pure wellness room” (hereinafter referred to as the “Program”) with Pure Solutions, LLC. The Program purifies the indoor environment and maintains clear conditions through seven comprehensive processes. Pure Solutions, LLC has been developing its business to improve the quality of the air environment in the U.S. for more than 20 years. Through the development of the Program, we will respond to growing social needs for safe and secure air environments caused by the spread of COVID-19 infections.

Collaboration with Companies

【Concluded a Sales Agent Agreement with MRSO, Inc., a Company in Which We Have Invested】

The current COVID-19 pandemic has led to a decline in the rate of undergoing comprehensive medical examinations and health checkups. It has also led to the subsequent deterioration in the financial performance of medical institutions. Therefore, we aim to contribute to the realization of a sustainable medical system by promoting the introduction of “Pure wellness room” to alleviate the psychological barriers that people visiting medical institutions have.

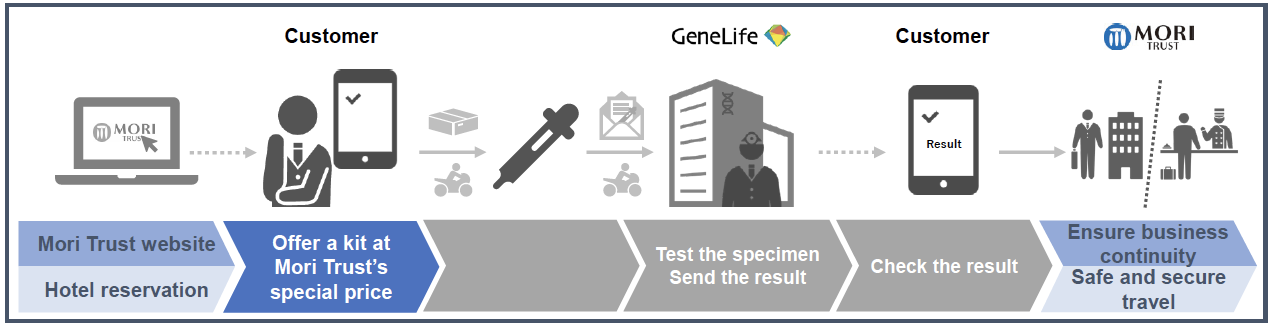

【Support the Safety and Security of Office and Hotel Users with PCR Test Kits】

Mori Trust Group is working to create a safe and secure environment for work and travel in the era of With Corona. As part of our efforts, we offer office tenants and hotel guests with reservations GeneLife’s COVID-19 PCR test kits at Mori Trust’s special price.

It is expected that people will gradually resume their daily lives. However, in order to prevent a resurgence in infections, we need to propose new ways of working and leisure in the era of With Corona while reducing the risk of infection. We offer Mori Trust’s special price to tenant companies and hotel guests with reservations. Thus, tenant employees can come to the office with as much peace of mind as possible, and hotel guests can enjoy their trip safely and securely with our support.

【Encourage Äb0WorkcatÄb0ion Äb0Promotion and Support WorkÄb0-Äb0Life Äb0Balance RealizationÄb0】

Together with the JAL Group, we are developing the “JAL×Marriott Workcation Debut Plan,” a one-package plan that even beginners can easily use. We provide this plan to support the realization of a rich work-life balance for workers through workcation promotion. We will expand the base of workcation users and support more workers in achieving a work-life balance.

Mori Trust Group : Total Floor Area Leased or Managed

Number of rental / managed facilities (as of March 31, 2021)

- Rental buildings:Approx. 1,790,000㎡ (80 buildings)

- Hotel & Resort facilities:27 facilities (Number of rooms:Approx. 4,400)

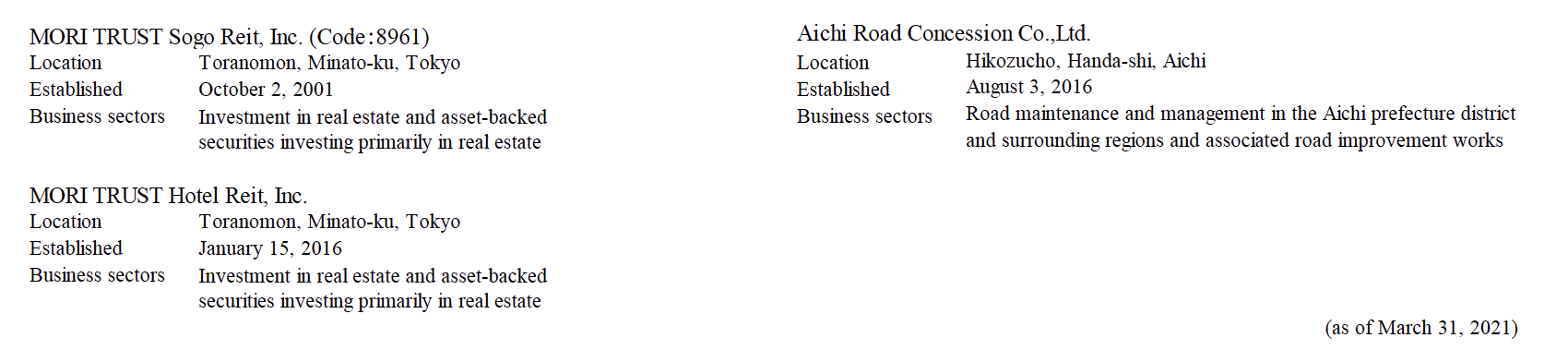

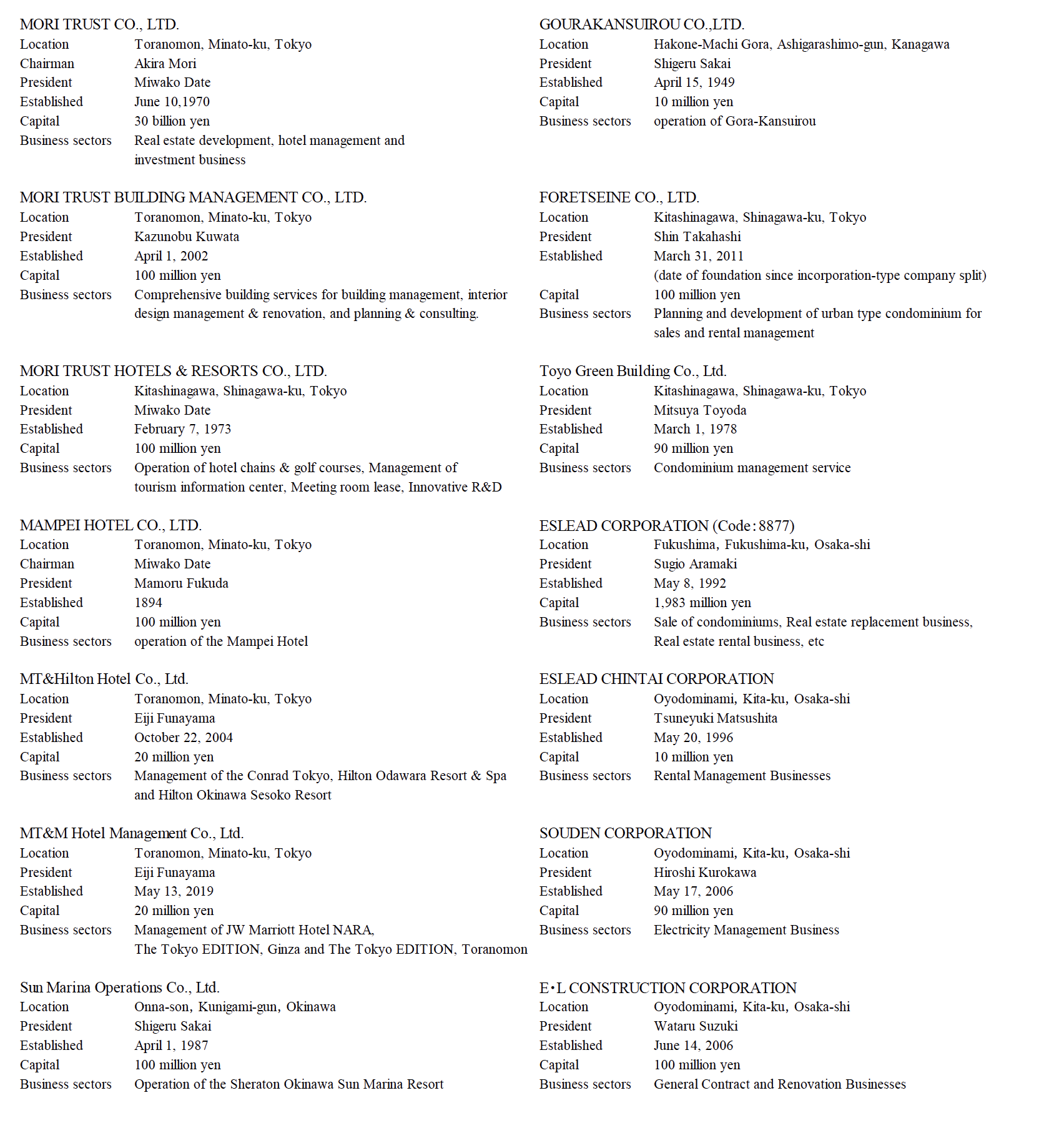

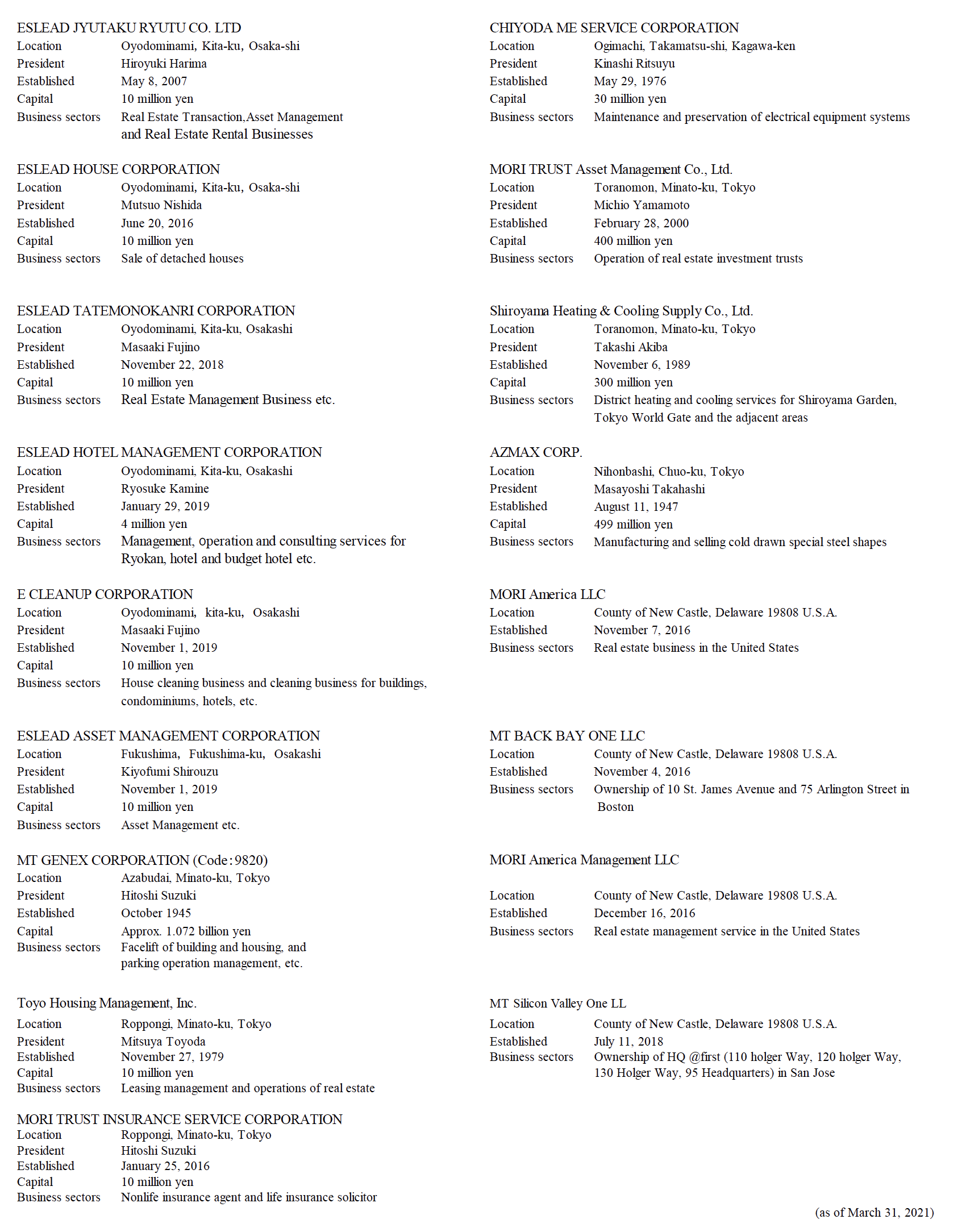

Mori Trust Group : Summary of Consolidated Companies

森トラストグループ 持分法適用会社