News Releases

Survey of Large-Scale Office Building Supply in Tokyo’s 23 Wards 2021

Mori Trust Co., Ltd., (Head Office: Minato-ku, Tokyo) has surveyed supply trends for large-scale office buildings with total office space of 10,000 square meters or more in Tokyo’s 23 wards since 1986 and for mid-size office buildings with total office space of 5,000 square meters to less than 10,000 square meters since 2013, based on various published materials, field surveys, and interviews. The results of the most recent survey are presented below. In calculating total office floor area, where the survey deals with multipurpose buildings—buildings that also contain retail space, residential space, or hotels—the calculation includes only the floor area set aside solely for office use.

[Survey Date: December 2020]

Supply of large-scale office buildings hovers at a low level

~ Lowest-ever levels in 2021, 2022, and 2024 ~

Main Results of This Survey

- 1. Supply of large-scale office buildings

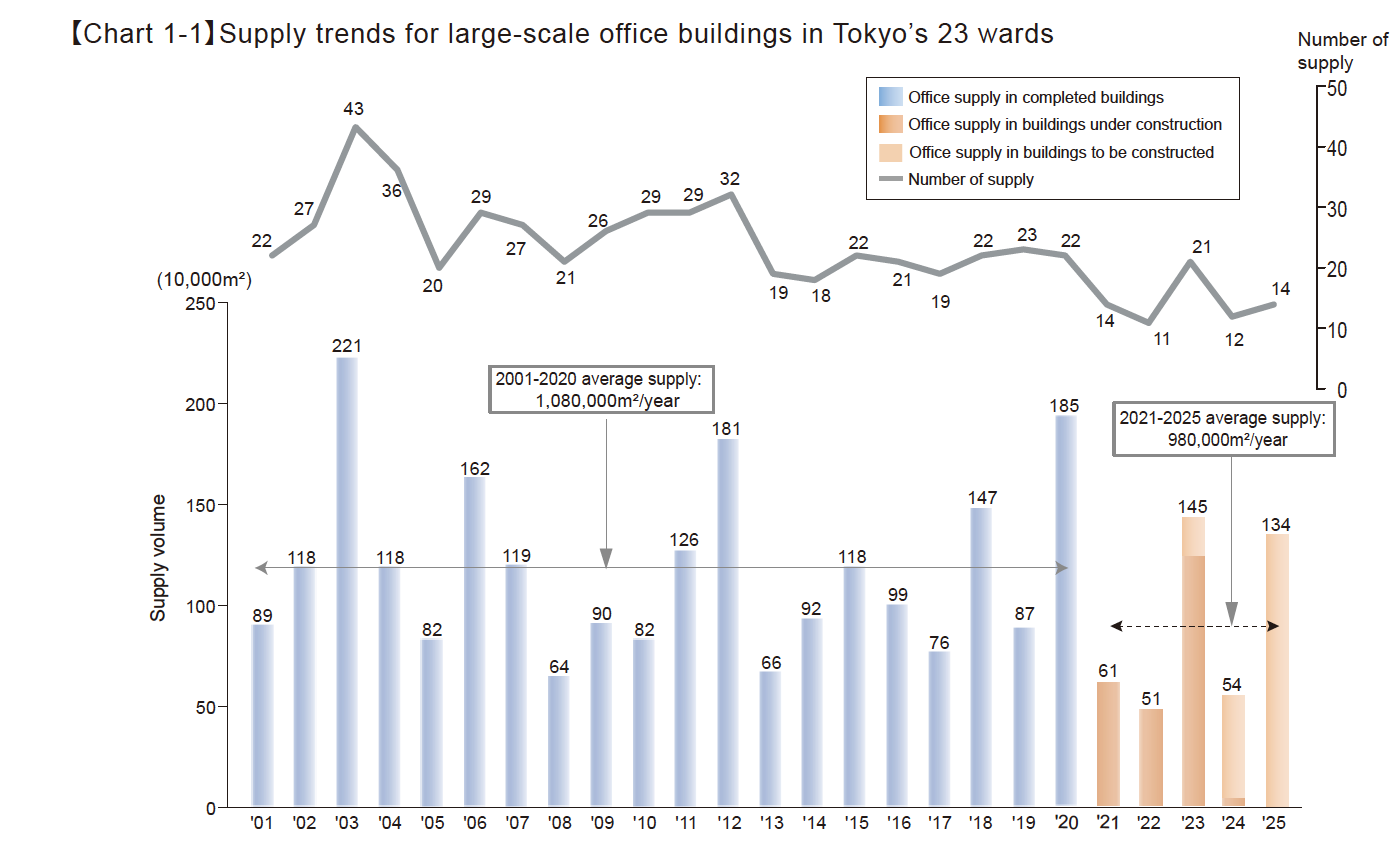

In 2020, large-scale office buildings introduced to market in Tokyo’s 23 wards added 1,850,000m² to the region’s total inventory of office space, the second-highest annual figure over the past 20 years. The amount of new space added is expected to drop sharply to 610,000m² in 2021, and is projected to stay low with 510,000m² in 2022, which is the lowest level in the past 20 years. The figure is projected to increase significantly to 1,450,000m² in 2023, but decline to 540,000m² in 2024, which is the lowest-ever level. In 2025, the figure is expected to increase once again to 1,340,000m². The supply for five years from 2021 is projected to hover at a low level. - 2. Supply trends by area

From 2021, the percentage of new space in Tokyo’s three central wards will consistently exceed 70%. Of the three wards, Minato Ward’s share is expected to rise and it will account for more than 50% of the total in Tokyo’s 23 wards. The supply trends by district suggest that the amount of new office space introduced in Otemachi, Marunouchi, and Yurakucho will subside, and that Toranomon and Shimbashi in Minato Ward will be the highest. In the said ward, development in Shirokane and Takanawa, Shiba and Mita, Akasaka and Roppongi, and Shibaura and Kaigan will become active. - 3. Supply trends by type of development site

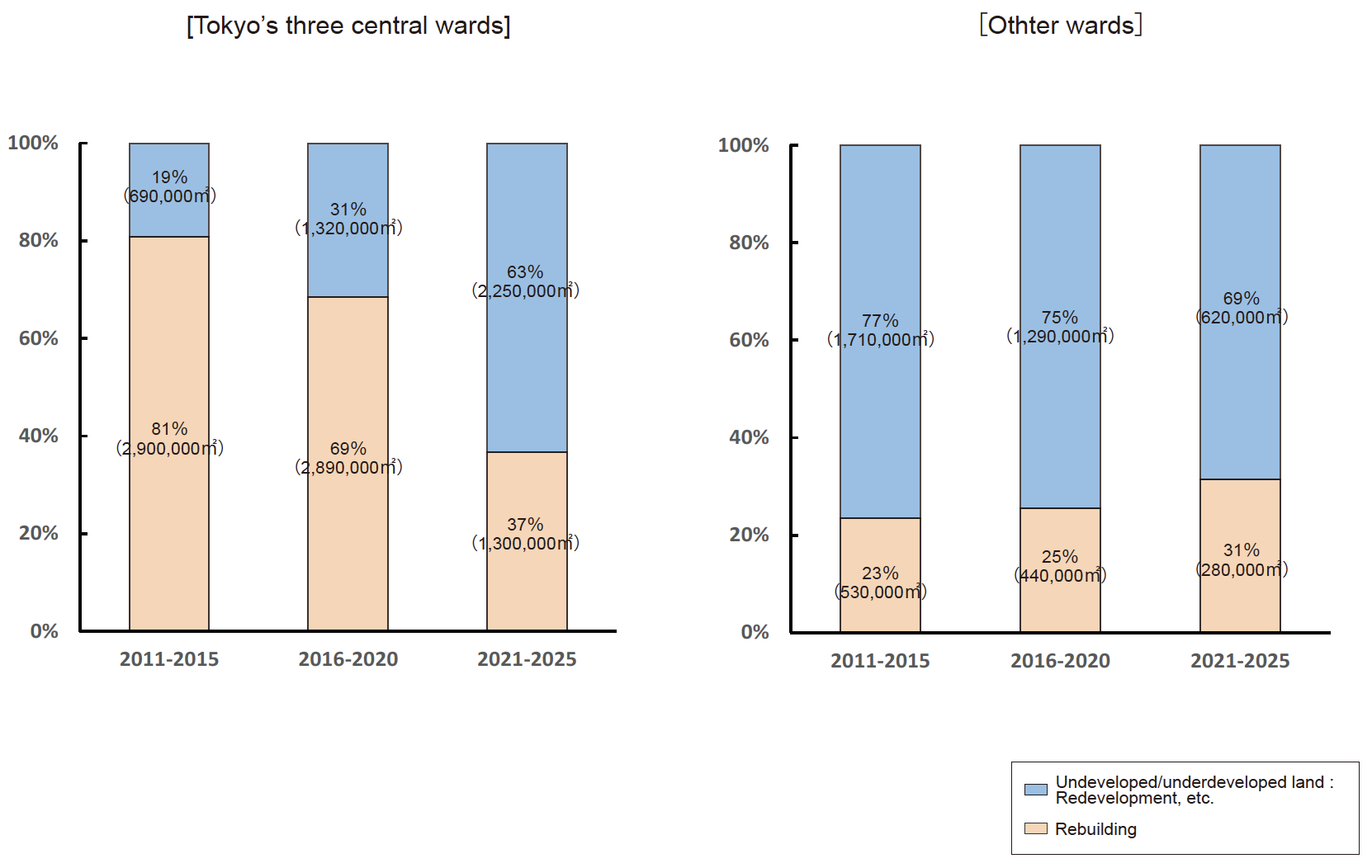

In the three central wards, “Rebuilding” was previously the pillar of supply. However, the share of “Undeveloped/underdeveloped land: Redevelopment, etc.” has been increasing, and during the period from 2021 to 2025, the share of “Undeveloped/underdeveloped land: Redevelopment, etc.” is projected to account for over 60% of supply. Outside the three central wards, “Undeveloped/underdeveloped land: Redevelopment, etc.” is projected to continue to be the pillar of supply. - 4. Supply of mid-size office buildings

The figure for new office space introduced in mid-scale office buildings in 2020 was 80,000m², and in 2021 it will be 69,000m², which shows that the figures are lower than those of previous years for two consecutive years. The figure for new office space introduced in mid-scale office buildings in 2022 is projected to go back up to 106,000m², but it is lower than the average for the past ten years (113,000m²), showing a gradual decrease in supply.

Conclusion

The supply of large-scale office buildings in 2020 was the second-highest in the past 20 years, but most of the buildings started operations with no vacancies. The number of contracts concluded has also been increasing in 2021, but the number of the contract cases concluded for 2022 and after remains low.

Looking at the trends of existing buildings, return of some surplus floor areas generated by the restrictions on going out to work for the purpose of measures against infections have been accelerating since mid-2020, and there are many cases where consolidation to a center office is planned as a temporary response. Although there were some large-scale returns aiming at reducing the number of offices themselves while announcing a shift to a work style centered on remote work, such trends have been limited to some industries. Companies keep a “wait-and-see attitude” for both new buildings and existing buildings.

For future office buildings, we will need to grasp the background of companies’ taking a “wait-and-see attitude” and respond to it. Companies are struggling to come up with workplace strategies in the hybrid work age that will bring diversification in the way they work and where they work. Office developers are increasingly required to present how center offices positioned in the center of workplace strategies should be and to solve issues faced by companies through creating and improving the office environment that embodies it so that they will contribute to the growth of those companies. It is important to support the construction of attractive center offices where workers will want to come.

1. Supply of large-scale office buildings

The amount of new space introduced in large-scale office buildings in Tokyo’s 23 wards in 2020 was 1,850,000m², the second-highest supply over the past 20 years. Looking at the future trends, the figure in 2021 will stay at 610,000m², and the figure is projected to decline to 510,000m² in 2022, which suggests that the lowest level of supply since 2001 is expected to continue for two consecutive years. In 2023, the figure is projected to increase to 1,450,000m², but in 2024 the figure is projected to decline to 540,000m², the lowest-ever level. In 2025, the figure is expected to increase once again to 1,340,000m². The average supply in the next five years will be 890,000m²/year, which is lower than the average of the past 20 years by 20% or more. This trend in which the supply in the next five years falls below the average of the past ten years will remain for four consecutive terms. The supply of large-scale office buildings will remain at a low level for a while. (Chart 1-1)

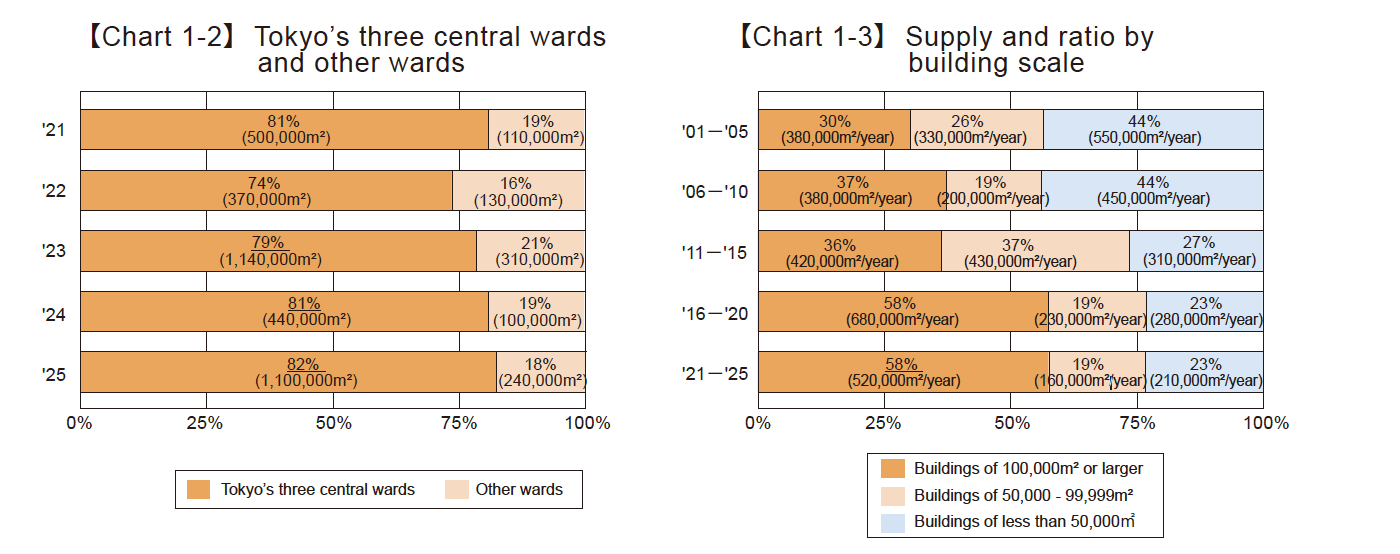

As a result of calculating shares of new office space after tallying new office space by ward and dividing them into the three central wards and other wards in order to investigate the supply trends, we have found that the share corresponding to the three central wards consistently exceeds 70% from 2021. Tokyo’s three wards will remain the pillar of the supply of large-scale office buildings. (Chart 1-2)

By tallying the new office space of large-scale buildings by building scale in 5-year units and investigating the trends, we have found that the share of large-scale buildings with total office floor space of 100,000m² or more, which was 30% during the period from 2001 to 2005, doubled to 60% during the period from 2016 to 2020, and the equivalent share will be constant during the period from 2021 to 2025. The trend of large-scale office buildings is toward ultra-large-scale buildings. (Chart 1-3)

2. Supply trends by area

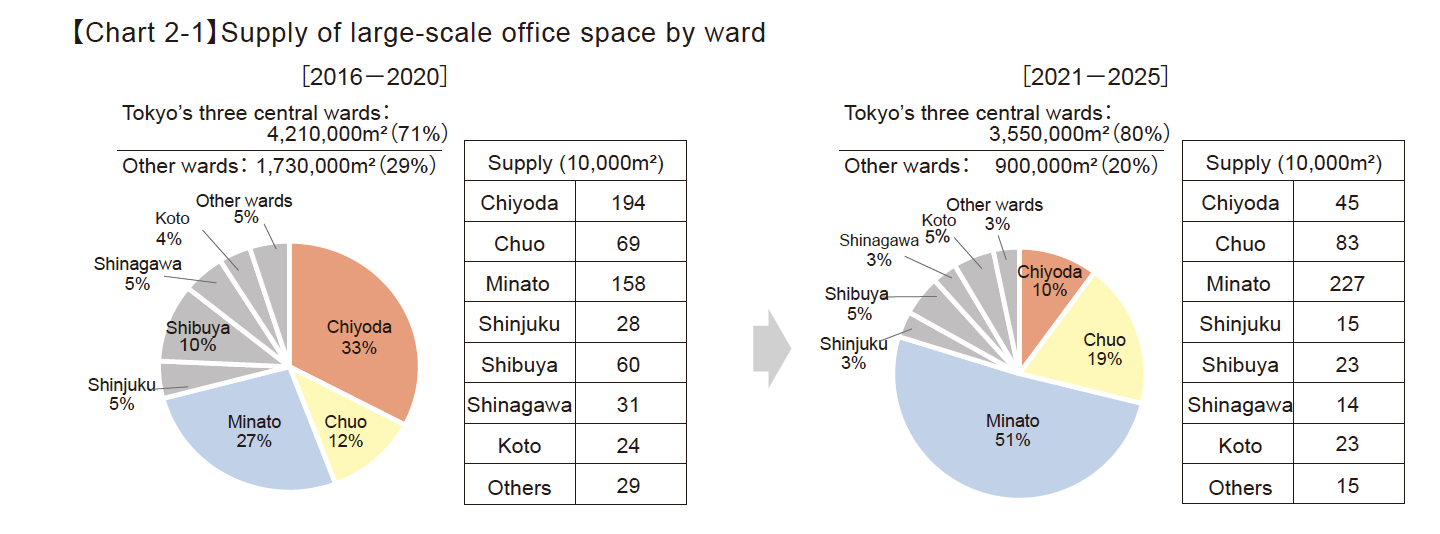

Continued from the previous page, in order to further explore the supply trends, we calculated the supply share for the past five years and the next five years by ward. In the past five years, the share of Tokyo’s three central wards was 70%, but in the next five years it will be 80%. Of the three central wards, Minato Ward’s share has been increasing, and it is expected to exceed 50% during the period from 2021 to 2025. (Chart2-1)

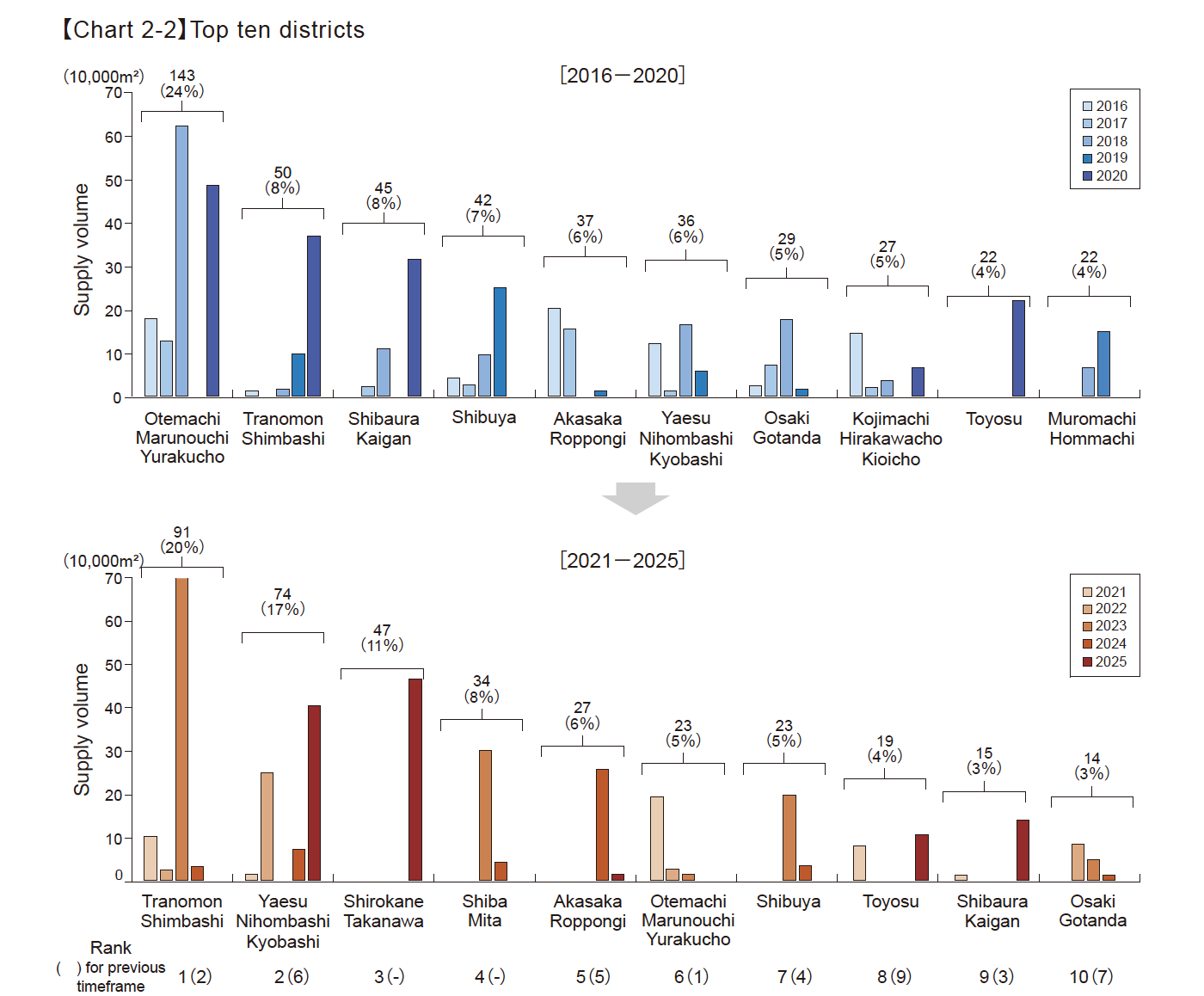

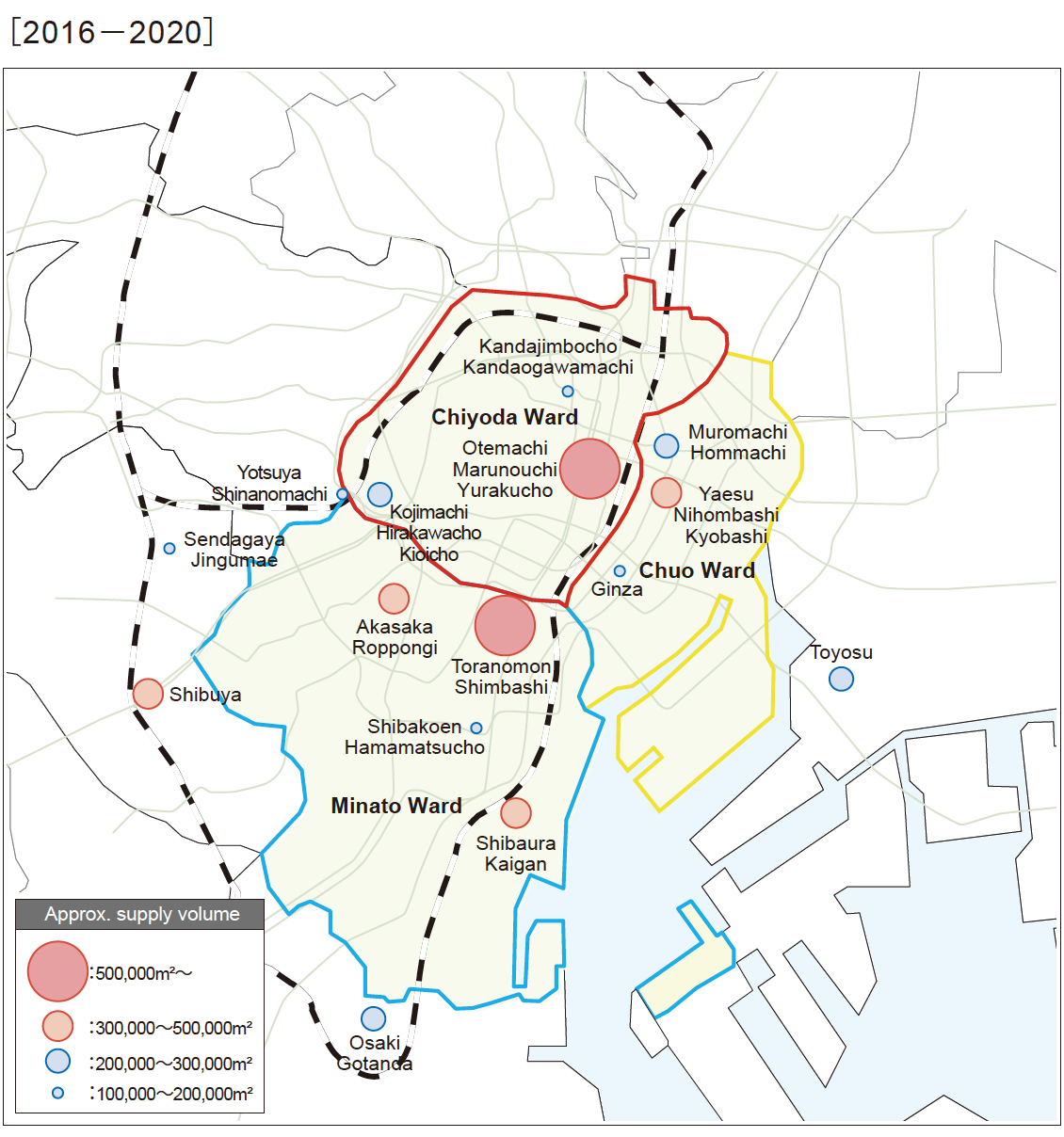

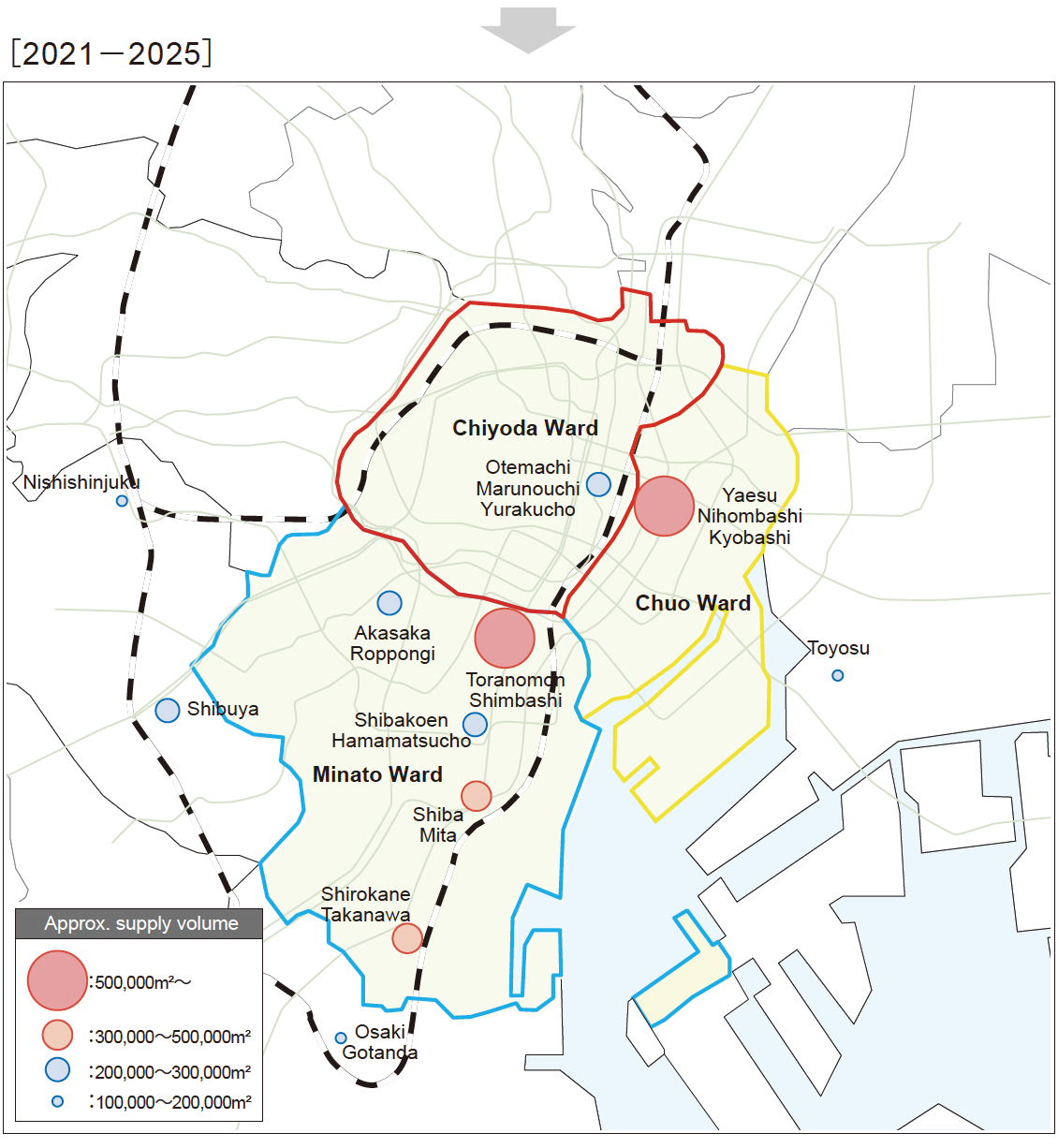

Next, we calculated the changes in supply of new office space by district and compared the top 10 districts. We have found that the supply in Otemachi, Marunouchi, and Yurakucho, which was outstanding for the past five years, will subside, while the supply in Toranomon and Shimbashi will be the highest. During the period from 2021 to 2025, Shirokane and Takanawa, Shiba and Mita, Akasaka and Roppongi, and Shibaura and Kaigan, all of which are also in Minato Ward, are on the list of top ten districts, and development in the said ward will get active. (Chart2-2)

【Chart 2-3】Supply volume in the key business districts

3. Supply trends by type of development site

Looking into the share of new office space by type of development site from 2011, “Rebuilding” was previously the pillar of supply in the three central wards. However, we can see that the office space created on “Undeveloped/underdeveloped land: Redevelopment, etc.” has been increasing. During the period from 2021 to 2025, office space created on “Undeveloped/underdeveloped land : Redevelopment, etc.” will account for more than 60% of all new office space.

Except the three central wards, buildings on “Undeveloped/underdeveloped land: Redevelopment, etc.” has continued to be the major source for new office space since 2011. In the 23 wards, “Undeveloped/underdeveloped land: Redevelopment, etc.” has been the pillar of supply of lands for development for new office space. (Chart3-1)

【Chart3-1】Supply volume and ratio by land for development

[Definitions]

Rebuilding: Land (or the development of such land) previously used as one site, occupied by a building for office, hotel, or residence which has been demolished.

Undeveloped/underdeveloped land: Land for highly effective use (or development of such land), including development of clusters of small buildings; land (or the development of such land) not used effectively; for instance, mixed zones of parking lots and older buildings, densely populated residential areas, former plant sites, railway sites, or idle land.

4. Supply trends for mid-size office buildings in Tokyo’s 23 wards

This section discusses supply trends in mid-size office buildings containing from 5,000㎡. to less than 10,000㎡.

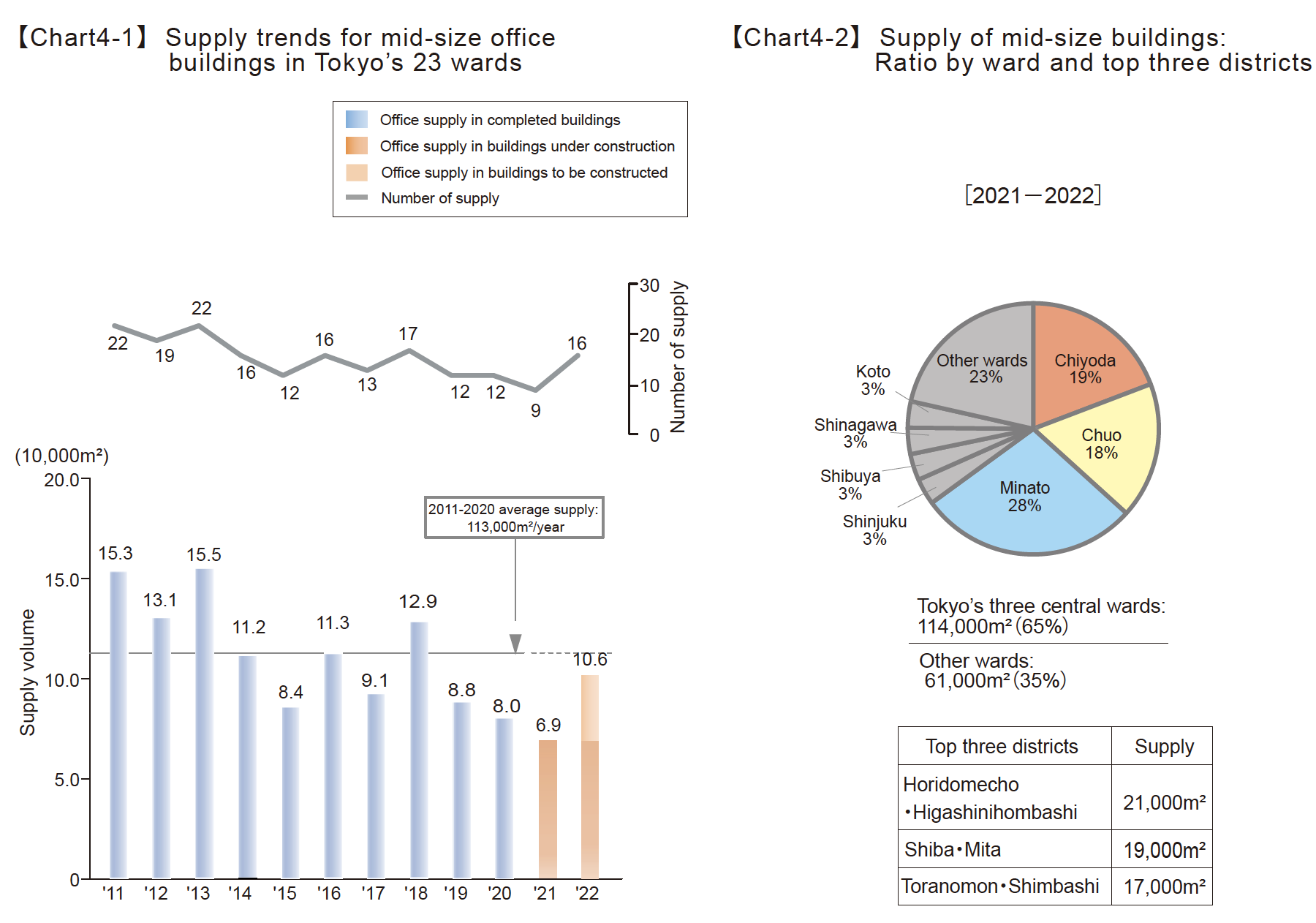

The figure for new office space introduced in mid-scale office buildings in 2020 was 80,000m², and that in 2021 will

be 69,000m², which shows that the figures are lower than those of the previous years for two consecutive years. The

figure for new office space introduced in mid-scale office buildings in 2022 is projected to go back up to 106,000m², but

it is expected to be lower than the average for the preceding ten years (113,000m²), showing a gradual decrease in the

supply of mid-scale office buildings. (Chart4-1)

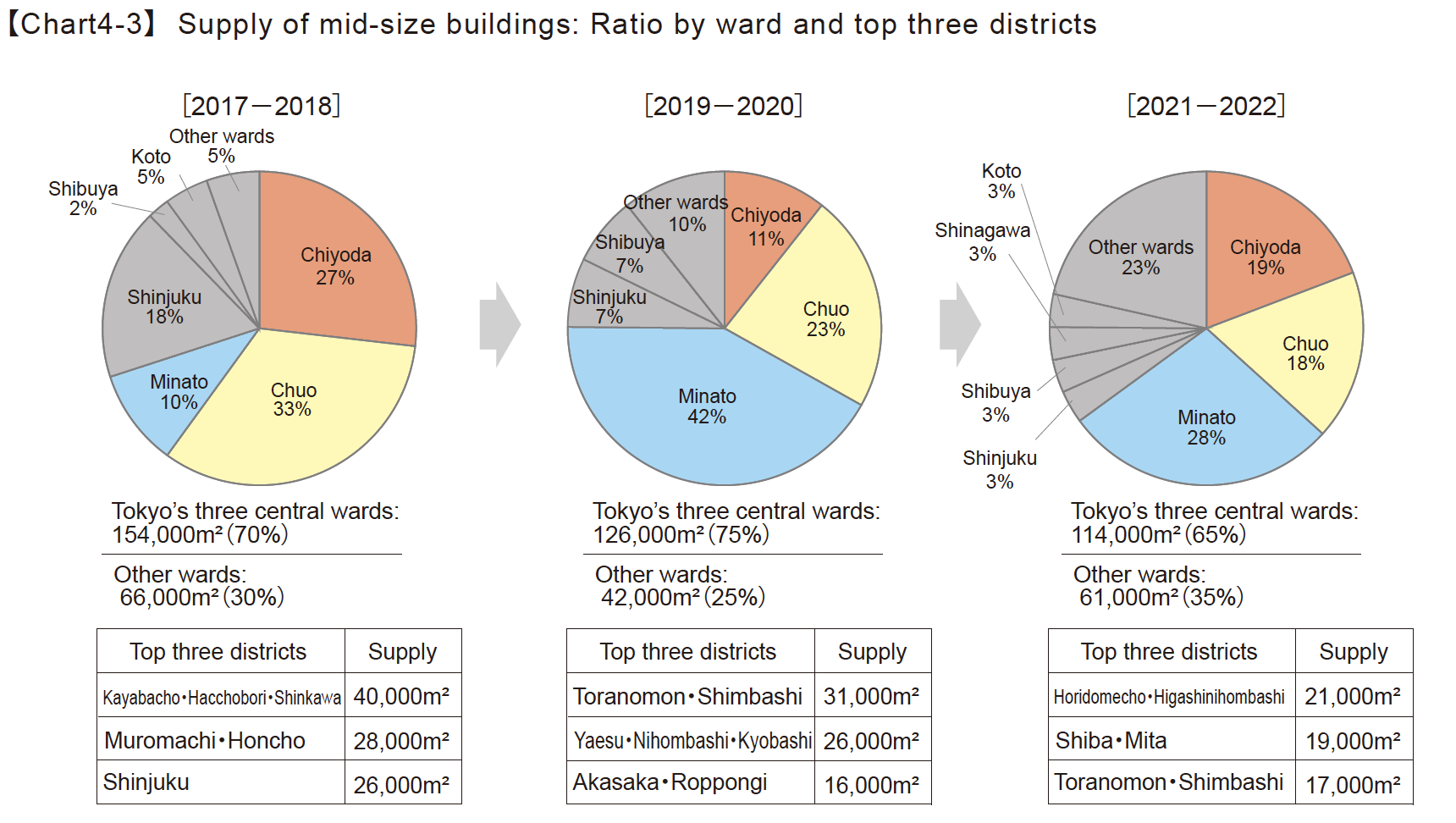

Looking at the percentage of supply by ward during the period from 2021 to 2022, Minato Ward has the largest share with 30%, and Shiba and Mita, and Toranomon and Shinbashi in the said ward are ranked among the top three districts in terms of supply by district. (Chart4-2)

Trends in shares of new office space by ward show that the share corresponding to the three central wards hover about 70% of the total, which is the pillar of supply. Since 2019, new office space in Minato Ward has been the main supply. (Chart4-3)

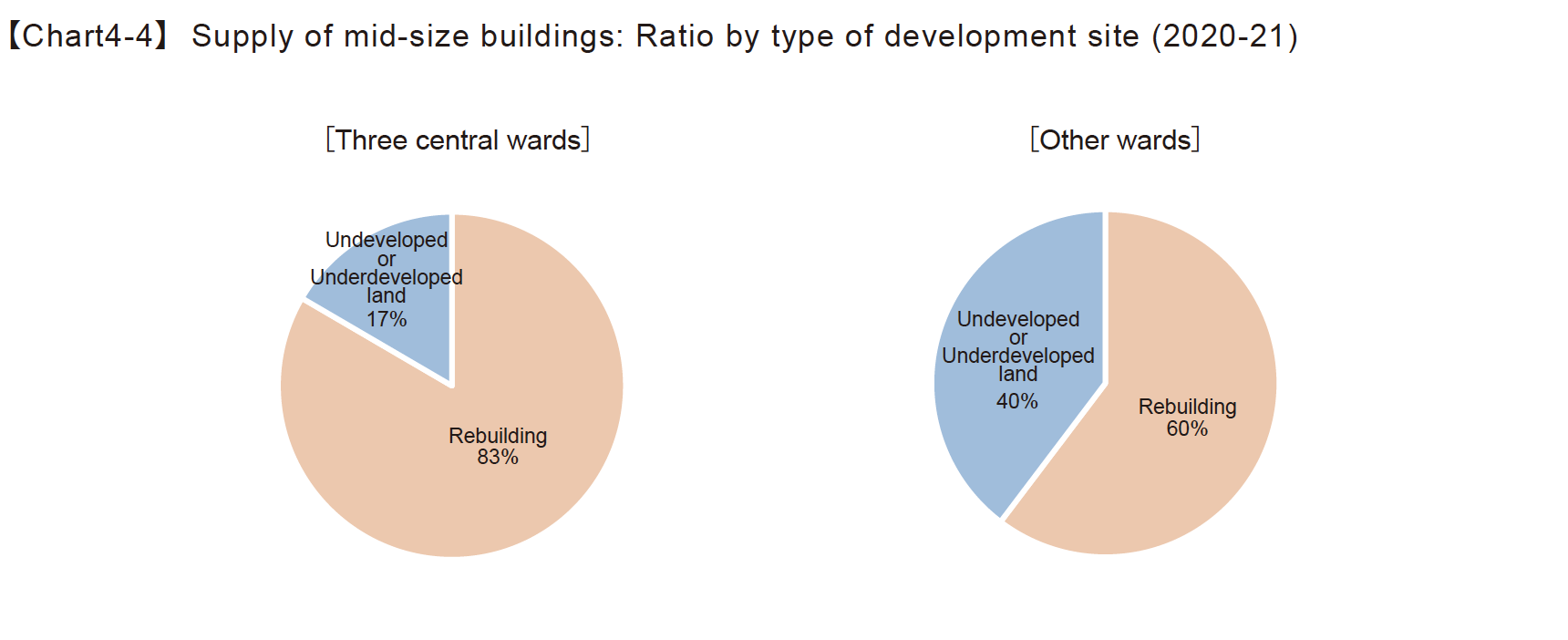

Looking at the supply trends for mid-scale office buildings by type of development site, office space in rebuilt buildings (“Rebuilding”) is the main source of new space in mid-scale office buildings in the 23 wards overall, which shows a trend distinct from the trend for large-scale office buildings, for which construction on “Undeveloped/underdeveloped land” is the main category. (Chart4-4)

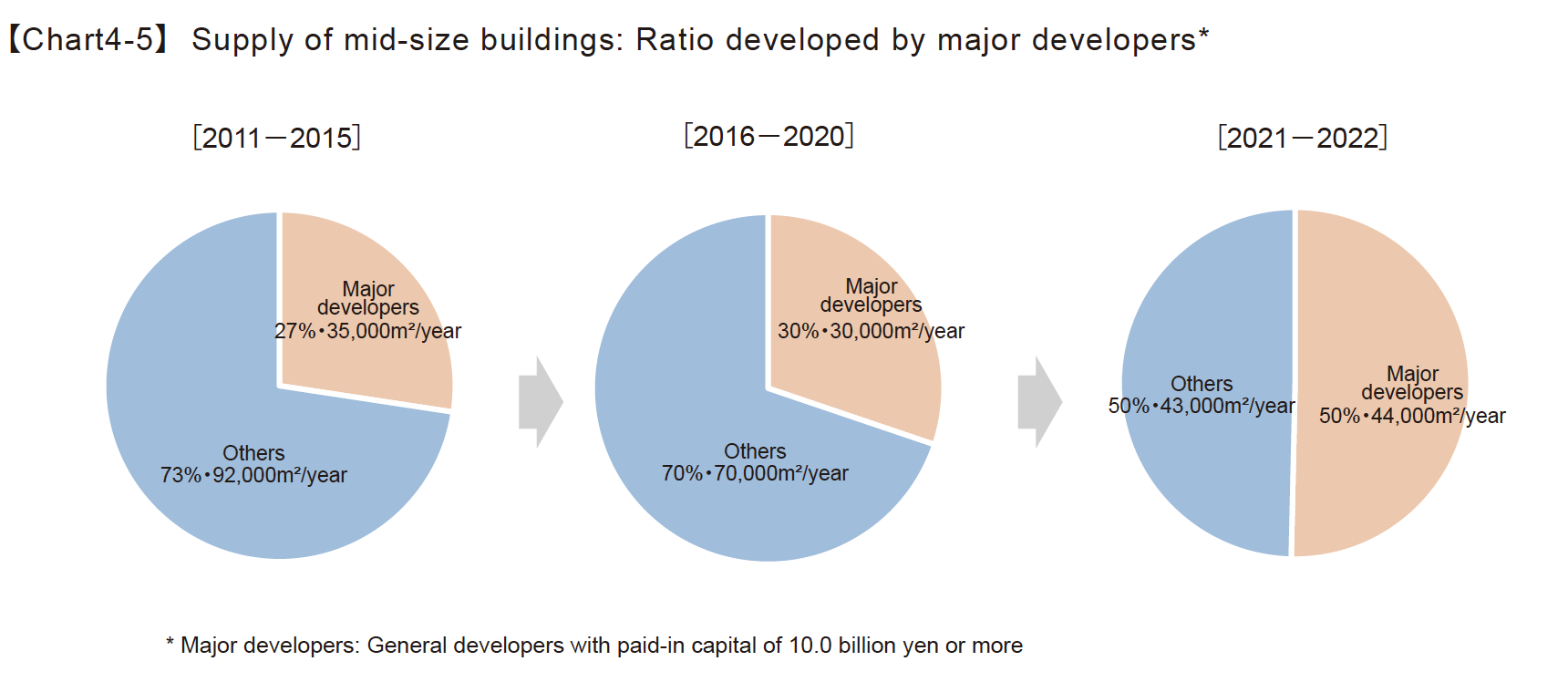

As for mid-scale office building projects, the share of major developers, which has been increasing in recent years, will rise sharply to more than half during the period from 2021 to 2022. (Chart4-5)

5. Conclusion

The supply of large-scale office buildings in 2020 was 1,850,000 m² , which is the second-highest in the past 20 years, but most of the buildings started operations with no vacancies. In 2021, 80% of the supply of new space has been contracted, but the number of the contract cases concluded will remain low from 2022. The strong demand for new office buildings began to stagnate rapidly due to the impact of COVID-19.

Looking at the trends of existing buildings, return of some surplus floor areas generated by the restrictions on going out to work for the purpose of measures against infections have been accelerating since mid-2020, and there are many cases where consolidation to a center office is planned as a temporary response. Although there were some large-scale returns aiming at reducing the number of offices themselves while announcing a shift to a work style centered on remote work, such trends have been limited to some industries. Companies keep a “wait-and-see attitude” for both new buildings and existing buildings.

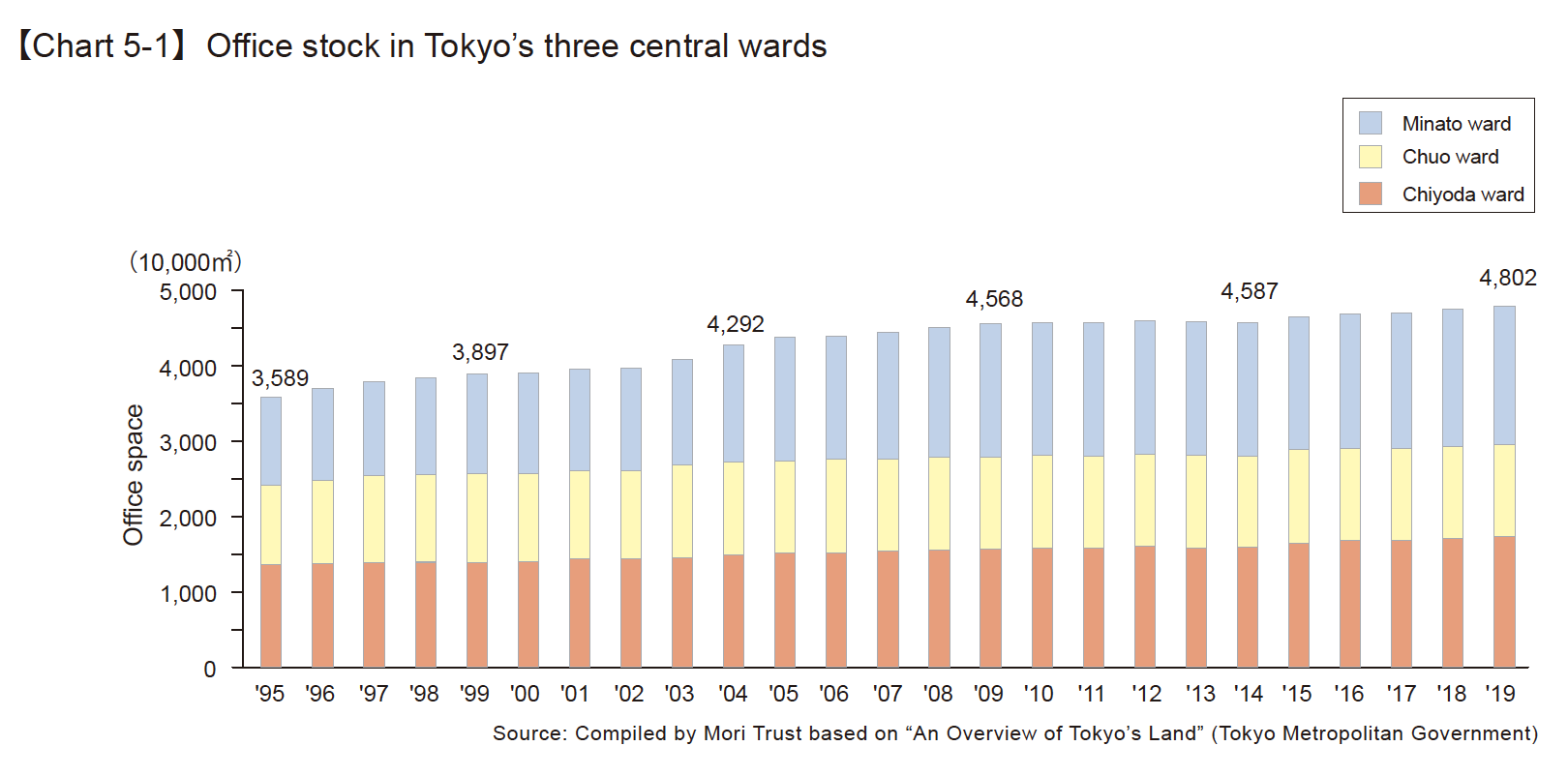

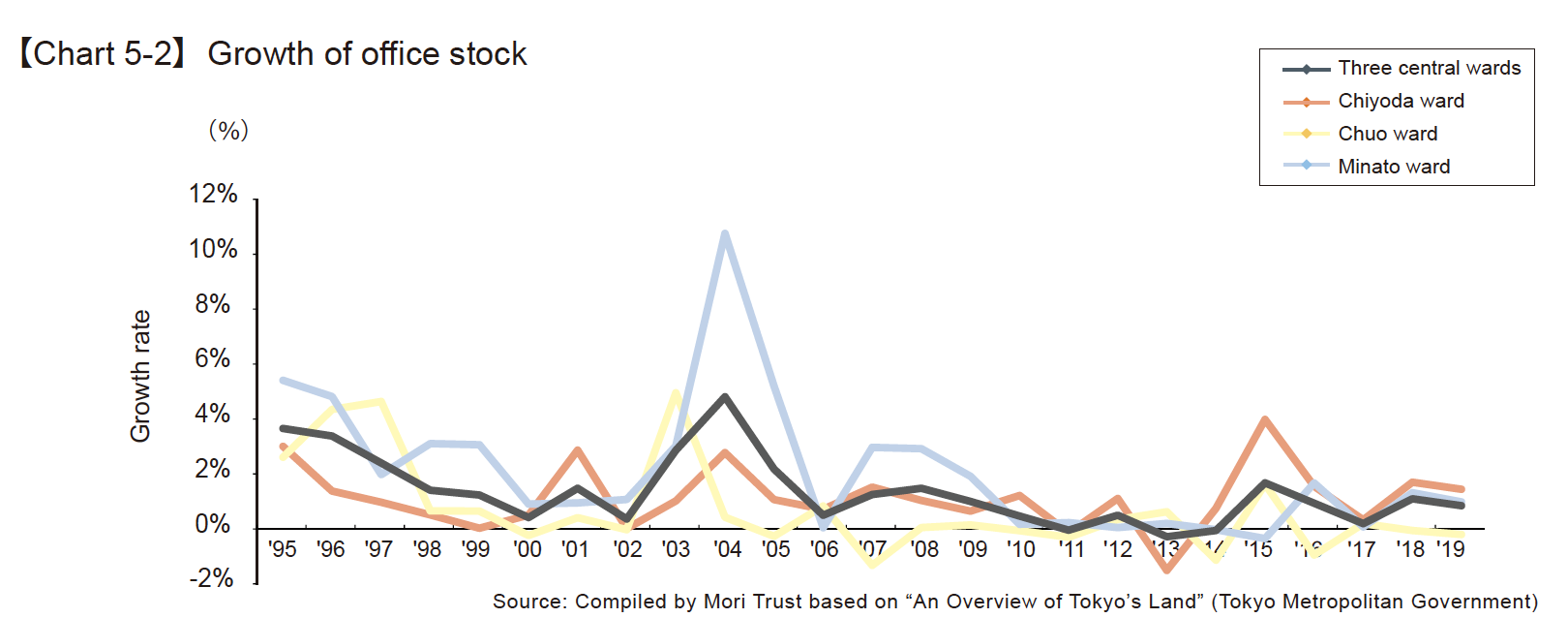

In some years in the future, except 2023, supply of new space introduced in large-scale office buildings will record the lowest-ever level and the average of supply will continue to be lower than that of the past 20 years, but the trend of gradual increase in stock will be maintained(Chart5-1, 5-2). As mentioned in this report, the supply trends by type of development site from 2021 show that “Undeveloped/underdeveloped land” will be the major source and “Rebuilding” will decrease. Therefore, stock will increase in central Tokyo while the supply of new buildings is secured to a certain extent.

Amid the continuing supply of office space in central Tokyo such as this, for future office buildings, we need to grasp

the background of companies’ taking a “wait-and-see” attitude and respond to it. As companies have various

remote-work-related problems that they are forced to face in the COVID-19 pandemic, including increased stress due to

lack of exercise and changes in work environments, and reduced engagement and creativity of workers due to poor

communication, companies are looking for ways to solve these problems. That is to say, companies are struggling to

come up with workplace strategies in the hybrid work age that will bring diversification in the way they work and where

they work. Office developers are increasingly required to present how center offices positioned in the center of

workplace strategies should be and to solve issues faced by companies through creating and improving the office

environment that embodies it so that they will contribute to the growth of those companies. It is important to support the

construction of attractive center offices where workers will want to come.