News Releases

Survey of Large-Scale Office Building Supply in Tokyo’s 23 Wards 2022

Mori Trust Co., Ltd., (Head Office: Minato-ku, Tokyo) has surveyed supply trends for large-scale office buildings with total office space of 10,000 square meters or more in Tokyo’s 23 wards since 1986 and for mid-size office buildings with total office space of 5,000 square meters to less than 10,000 square meters since 2013, based on various published materials, field surveys, and interviews. The results of the most recent survey are presented below. In calculating total office floor area, where the survey deals with multipurpose buildings—buildings that also contain retail space, residential space, or hotels—the calculation includes only the floor area set aside solely for office use.

[Survey Date: December 2021]

The supply for five years after 2022 is 30% lower than the historical average

Following on 2021, 2022, 2024, and 2026 are also at record lows

Main Results of This Survey

- 1. Supply of large-scale office buildings

The amount of new space introduced in large-scale office buildings in 2021 stayed low with 610,000m², the lowest supply of the past 20 years. While the supply in 2022, 2024, and 2026 will be limited, supply in 2023 and 2025 will exceed the average supply of 1,150,000m² in the past 20 years, resulting in a volatile supply environment. - 2. Supply trends by area

During the period from 2022 to 2023, the supply in Tokyo’s three central wards will remain over 70%. In the next five years, the supply share of Chiyoda Ward will decrease, and the share of Chuo Ward and Minato Ward will increase. In particular, Minato Ward will account for 50% of the total, and supply will increase mainly in Minato Ward. Otemachi, Marunouchi, and Yurakucho, which had an outstanding supply volume in the past five years, will fall out of the top 10 districts in the next five years. On the other hand, the development will proceed in Minato Ward, such as Toranomon and Shimbashi, Shirokane and Takanawa, Shiba and Mita, Akasaka and Roppongi, and Shibaura and Kaigan. - 3. Supply trends by type of development site

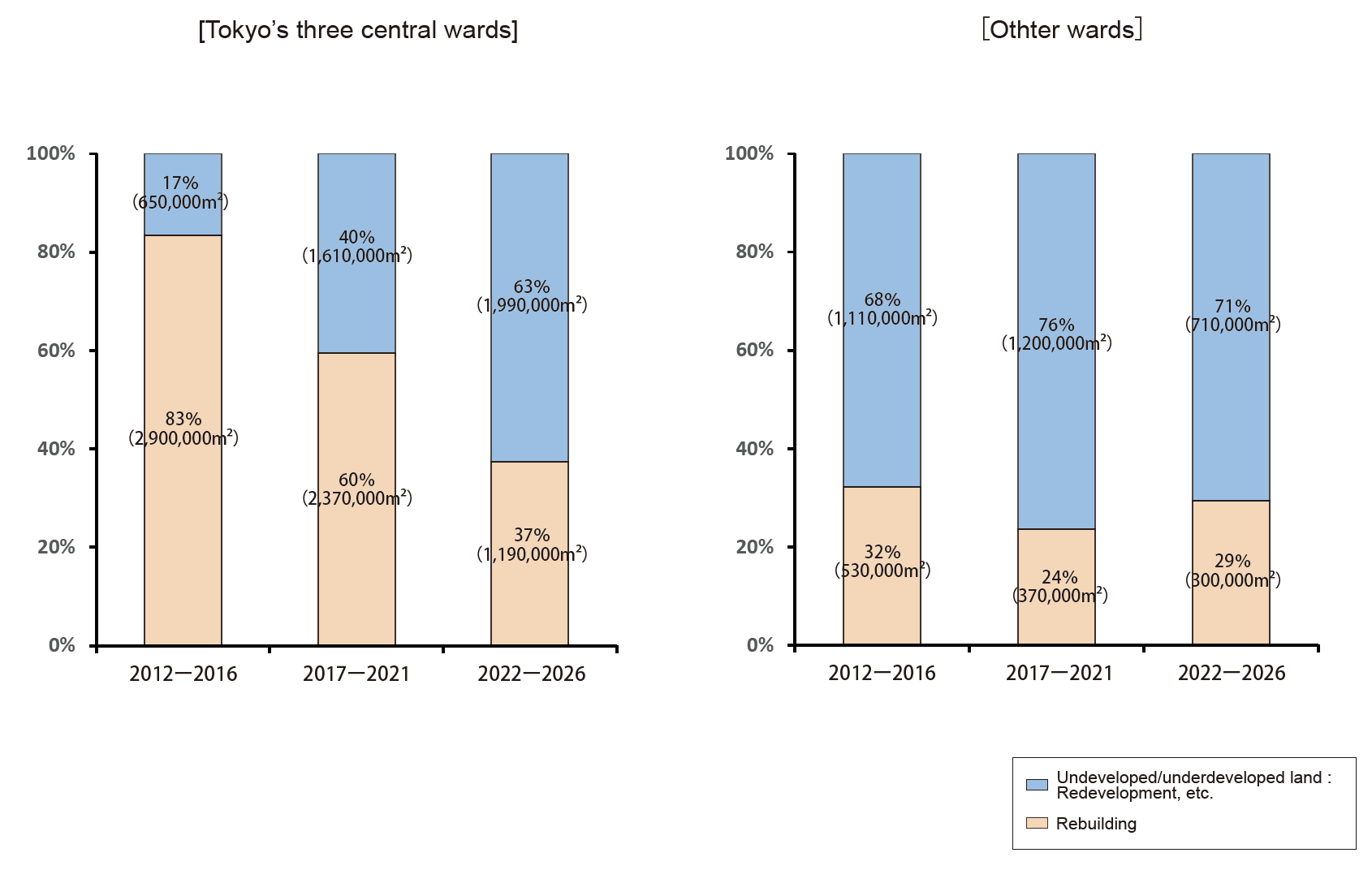

Looking into the share of new office space by type of development site from 2012, it can be seen that the development of “Undeveloped/underdeveloped land: Redevelopment, etc.” in the three central wards has been expanding. Land for the development of large-scale office buildings, for which “Rebuilding” was the main source of supply, is shifting to “Undeveloped/underdeveloped land: Redevelopment, etc.” - 4. Supply of mid-size office buildings

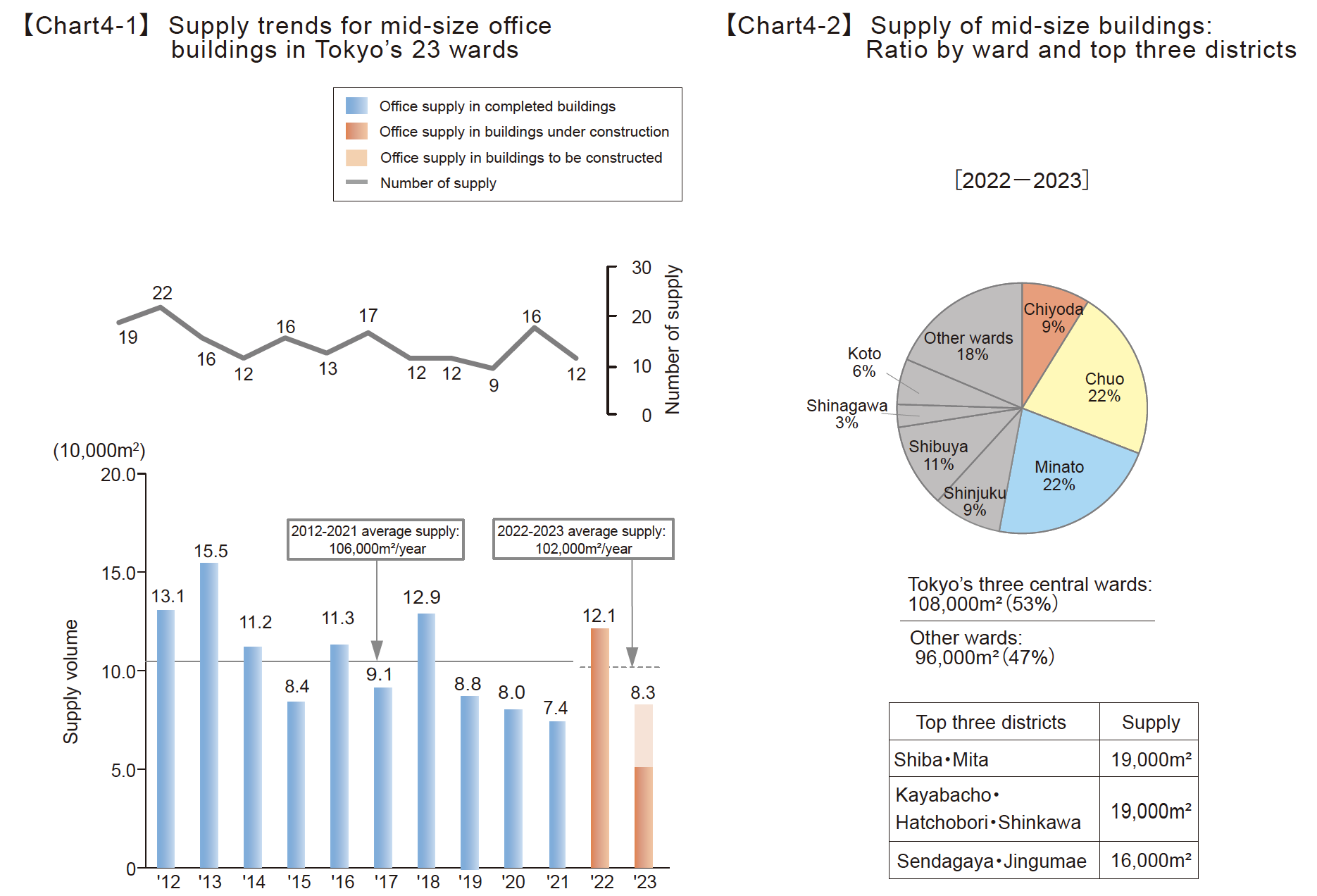

The amount of new office space introduced in mid-size office buildings in 2021 was 74,000m². The amount was lower than that of the previous year for three consecutive years; however, in 2022, the amount increases to 121,000m² in reversal. The average supply for the next two years is expected to be 102,000m², the same level as the average supply for the past ten years of 106,000m².

Conclusion

Regarding new large-scale office buildings constructed in 2021, and tenants were informally decided on for approximately 90% of the supplied floor space. About 50% of 2022 and about 30% of 2023 have been informally decided, and demand for new buildings is firm. Looking at existing buildings, the rising trend of vacancy rates in the five central wards settled in the second half of 2021. The total area contracted, which fell in 2020, is expected to reverse in 2021 and rise to a certain level in 2022. Rents have also risen to the same level as in2019 in some areas, showing steady growth. This trend in the rental office market indicates that companies have moved away from the “wait-and-see” attitude of holding back on restructuring their workplace strategies. The spread of telework provides an opportunity to recognize the importance of face-to-face communication, and the tendency to return to offices is increasing. Companies concerned about the decline in worker engagement and the dilution of their corporate culture have begun to improve the quality of face-to-face communication. To this end, companies redefine the role of the center office from broad perspectives, such as self-branding, the propagation of their own culture, improvement in worker wellbeing, and incorporate these into the space as a message. In addition to this solid demand, the average supply of large-scale office buildings over the next five years will be about 30% lower than in the past 20 years, and the supply-demand balance is expected to tighten.In this age of rapid changes in society, lifestyles, and ways of working, developers are expected to contribute to the sustainable growth of the Japanese economy by providing space services that capture the current trends toward companies’ unchanging demands, such as growth and innovation.

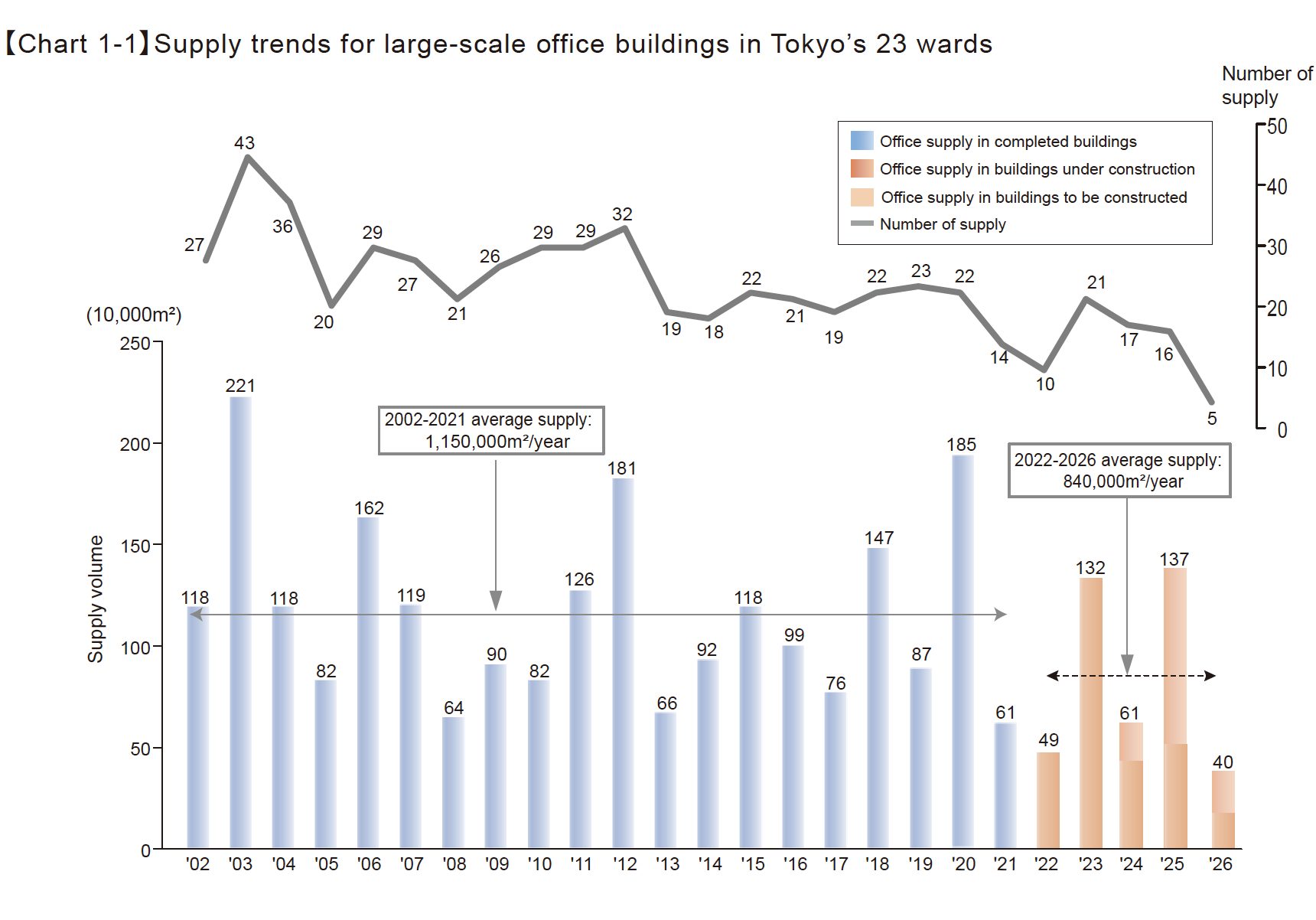

1. Supply of large-scale office buildings

The amount of new space introduced in large-scale office buildings in Tokyo’s 23 wards in 2021 stayed low with610,000m², the lowest supply of the past 20 years. Looking at the next five years, it is expected that while the supply in2022, 2024, and 2026 is limited, the supply in 2023 and 2025 exceeds the average supply of 1,150,000m² in the past 20years, resulting in a volatile supply environment. In addition, the average supply for the next five years will be limited to840,000m², so the supply for the next five years will tend to be lower than the average supply for the past 20 years forfive consecutive years. The supply of large-scale office buildings will remain at a low level for a while. (Chart 1-1)

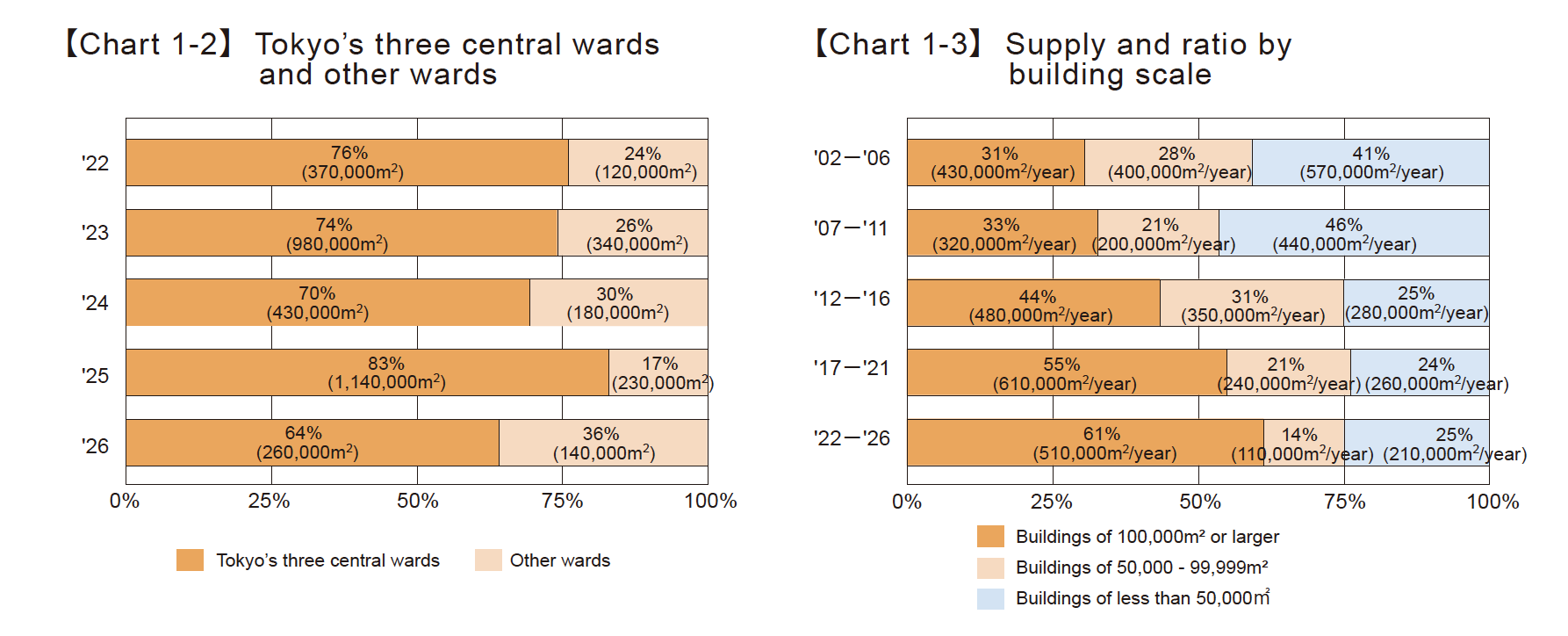

As a result of calculating supply shares of new office space after tallying the supply by ward and dividing them into the three central wards and other wards in order to investigate the supply trends, we have found that the share corresponding to the three central wards exceeds 60% from 2022. Tokyo’s three wards will remain the pillar of the supply of large-scale office buildings. (Chart 1-2)

By tallying the new office space of large-scale buildings by building scale in 5-year units and investigating the trends, wehave found that the share of large-scale buildings with total office floor space of 100,000m² or more, which was 30%during the period from 2002 to 2006, will double to 60% during the period from 2022 to 2026. The trend of large-scaleoffice buildings remains unchanged toward ultra-large-scale buildings. (Chart 1-3)

2.Supply trends by area

Supply trends of large-scale office buildings are investigated by area.

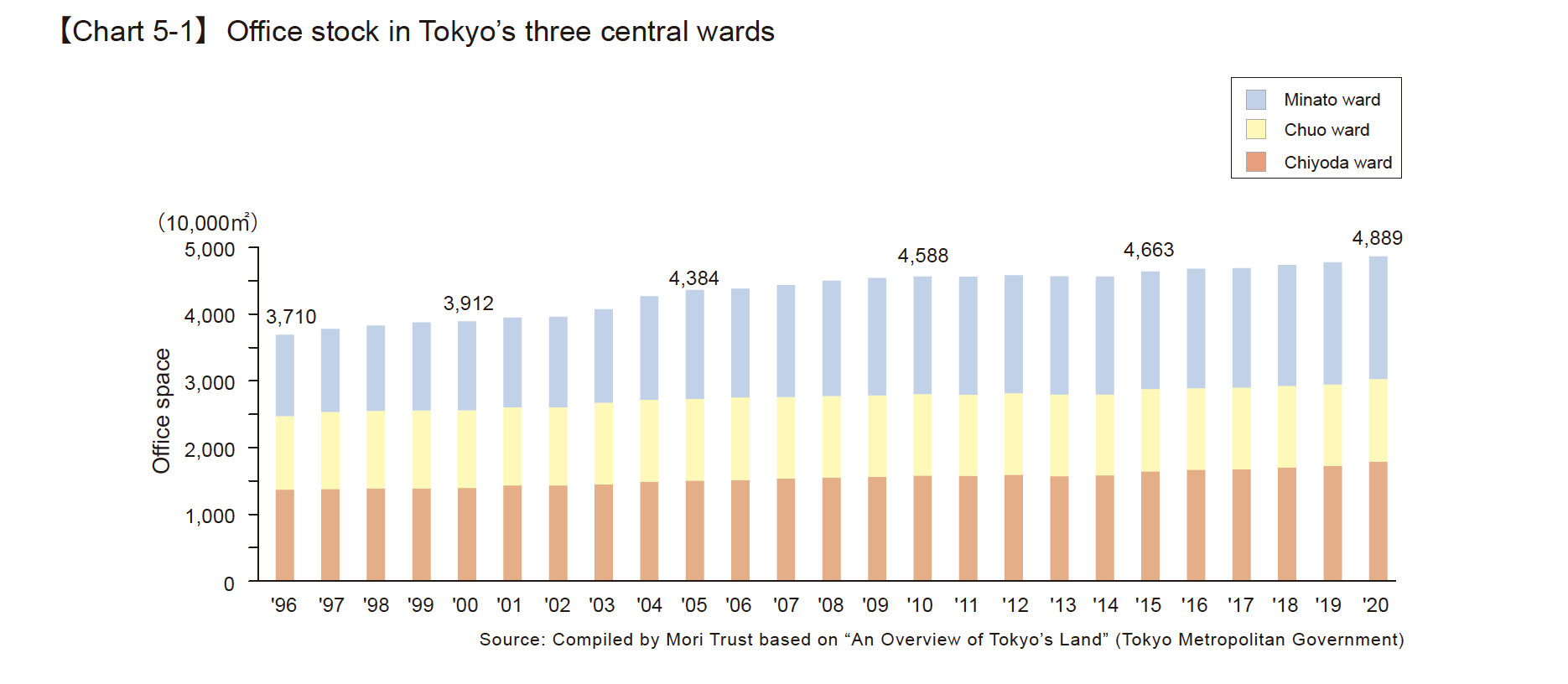

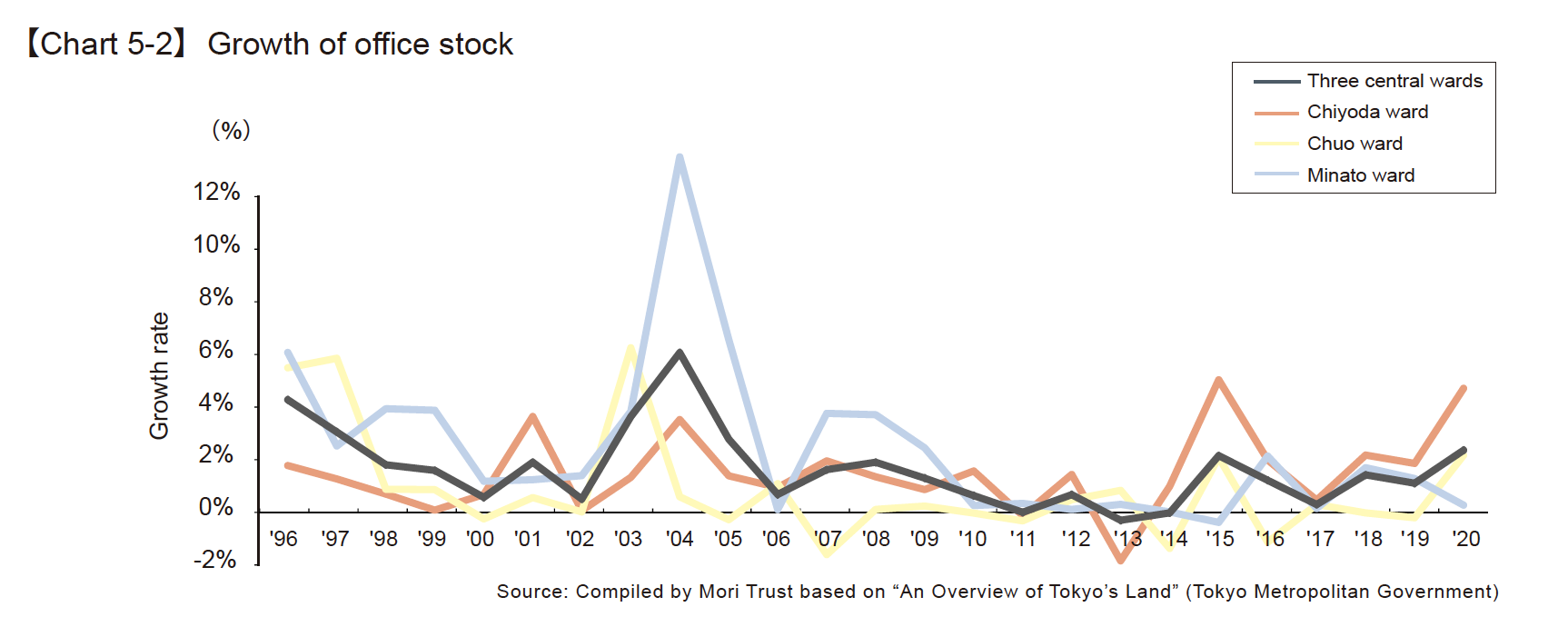

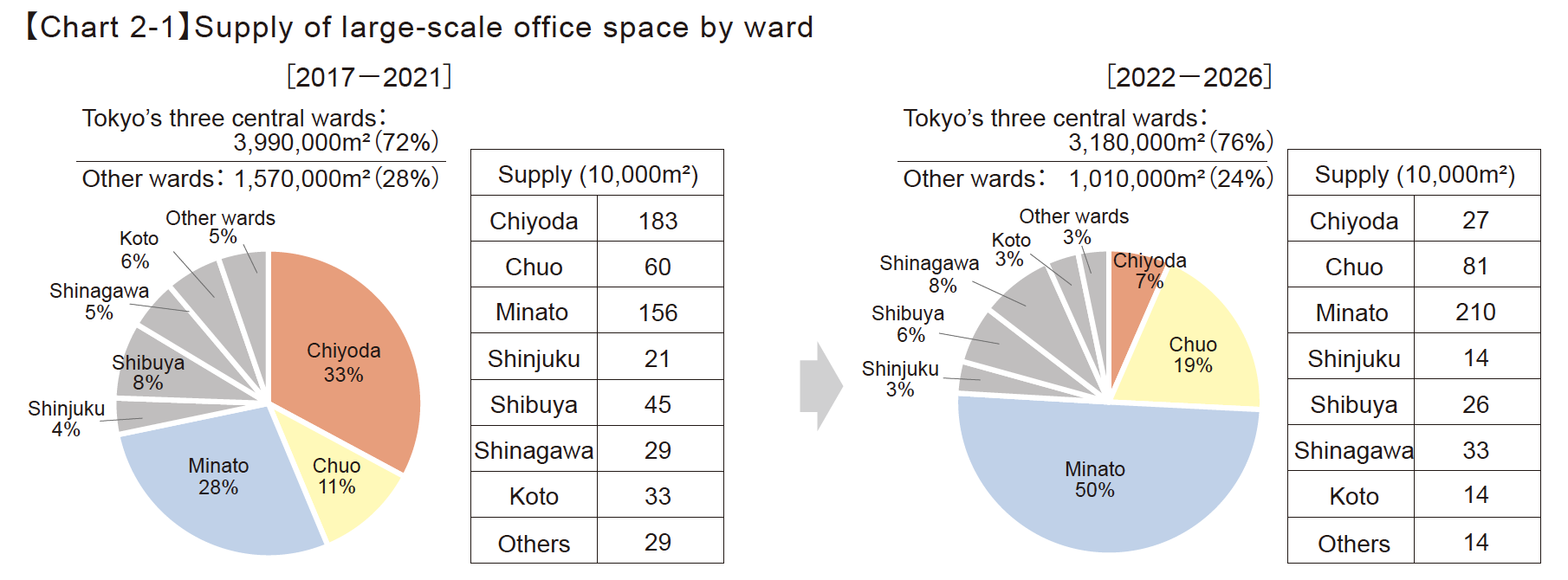

When the supply share by ward for the past five years and the future five years was calculated, the share of the threecentral wards exceeds 70% for both the past five years and the future five years. A comparison of the three centralwards during the two periods shows that Chiyoda Ward’s supply share is expected to decrease, while Chuo Ward’s andMinato Ward’s supply share are expected to increase. In particular, Minato Ward will account for 50% of the total, andsupply will increase mainly in Minato Ward. (Chart2-1)

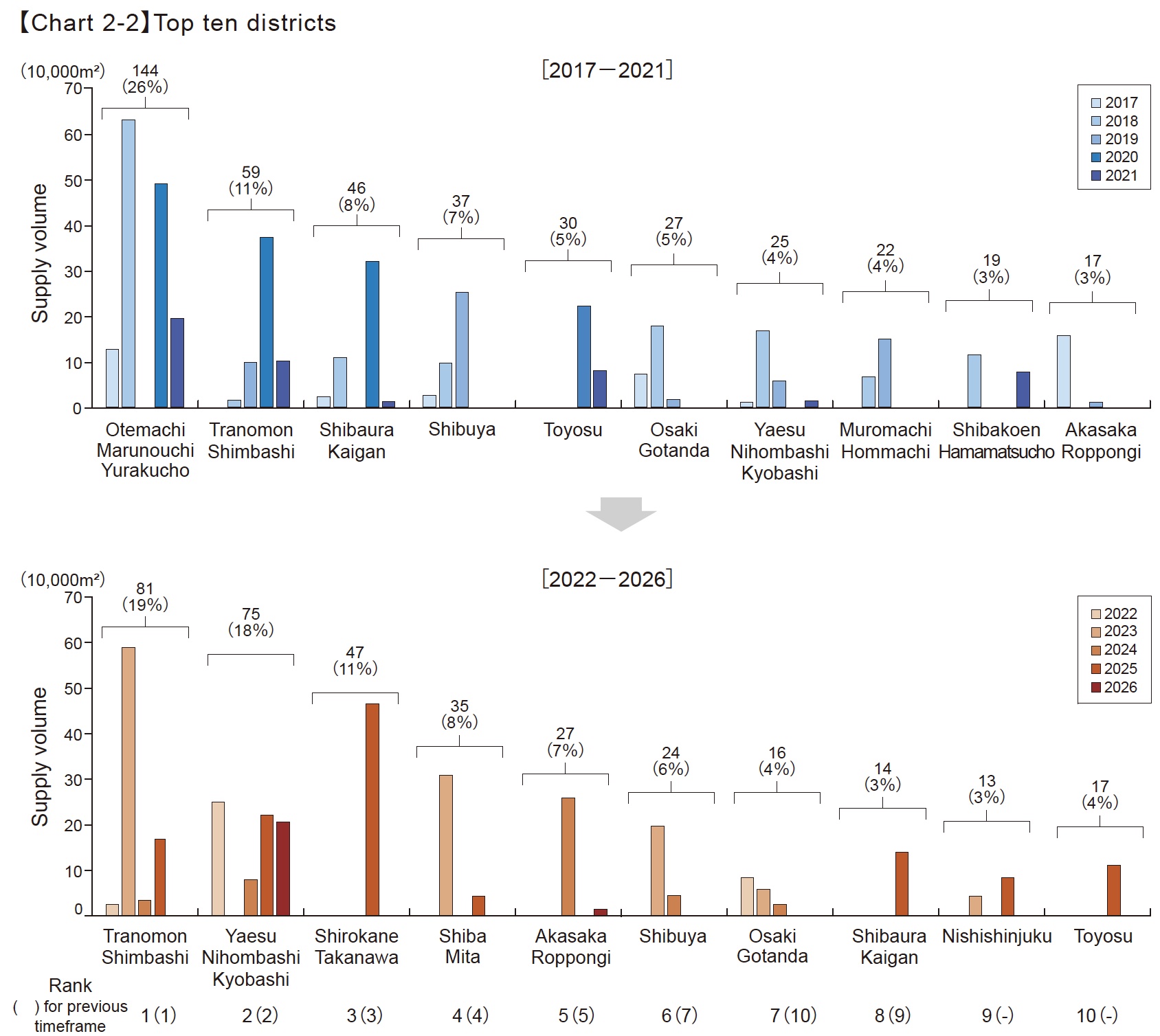

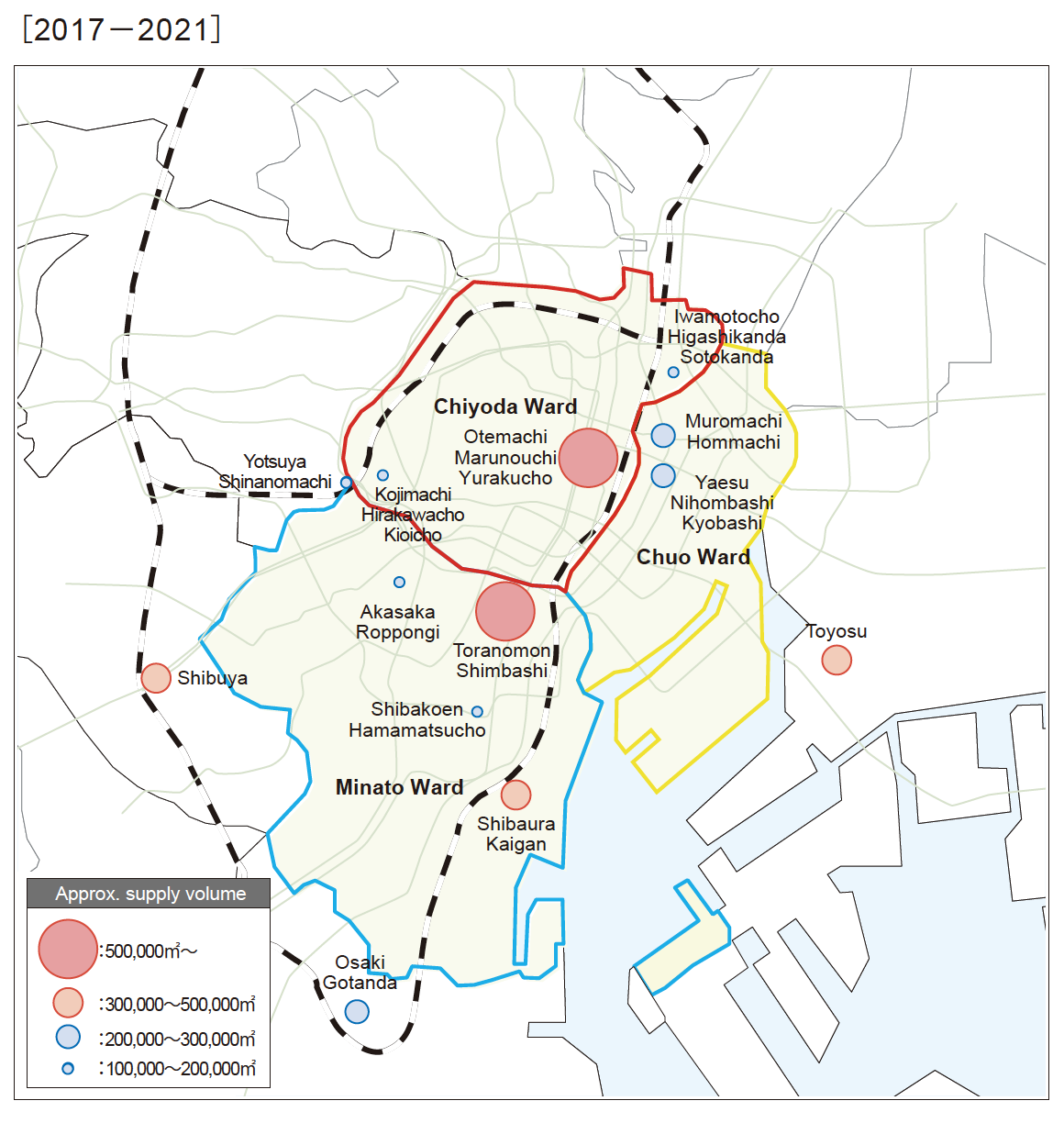

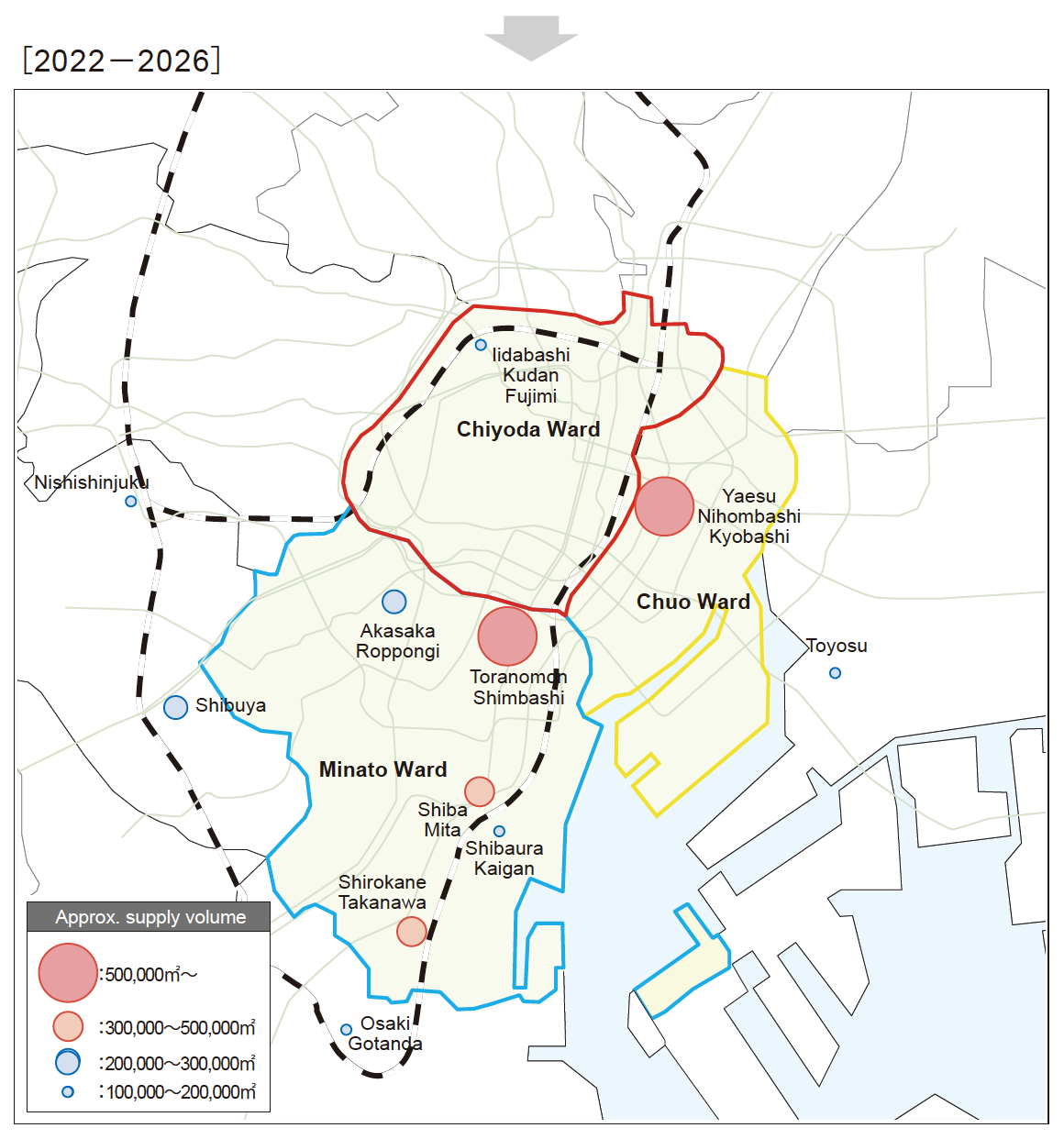

Next, we calculated the changes in supply of new office space by district and compared the top 10 districts. We havefound that the supply in Otemachi, Marunouchi, and Yurakucho, which was outstanding for the past five years, will fallout of the top 10 districts in the next five years. In the next five years, developments in Minato Ward, such asToranomon and Shimbashi, Shirokane and Takanawa, Shiba and Mita, Akasaka and Roppongi, and Shibaura andKaigan, will advance, according to the trend tabulation by district. (Chart2-2)

【Chart 2-3】Supply volume in the key business districts

3. Supply trends by type of development site

Looking into the share of new office space by type of development site from 2012, it can be seen that the development of “Undeveloped/underdeveloped land: Redevelopment, etc.” in the three central wards has been expanding. Land for the development of large-scale office buildings, for which “Rebuilding” was the main source of supply, is shifting to “Undeveloped/underdeveloped land: Redevelopment, etc.”

Except the three central wards, buildings on “Undeveloped/underdeveloped land: Redevelopment, etc.” has continued to be the major source for new office space. In the 23 wards of Tokyo overall, “Undeveloped/underdeveloped land: Redevelopment, etc.” will be the pillar of supply of lands for development for new office space from 2022 to 2026. (Chart3-1)

【Chart3-1】Supply volume and ratio by land for development

[Definitions]

Rebuilding: Land (or the development of such land) previously used as one site, occupied by a building for office, hotel, or residence which has been demolished.

Undeveloped/underdeveloped land: Land for highly effective use (or development of such land), including development of clusters of small buildings; land (or the development of such land) not used effectively; for instance, mixed zones of parking lots and older buildings, densely populated residential areas, former plant sites, railway sites, or idle land.

4. Supply trends for mid-size office buildings in Tokyo’s 23 wards

This section discusses supply trends in mid-size office buildings containing from 5,000m. to less than 10,000m..

The amount of new office space introduced in mid-size office buildings in 2021 was 74,000m². The amount was lower than that of the previous year for three consecutive years; however, in 2022, the amount will increase to 121,000m² in reversal. The average supply for the next two years is expected to be 102,000m², the same level as the average supplyfor the past ten years of 106,000m². Attention is drawn to whether the supply of mid-size office buildings, which has been on a declining trend in recent years, will improve in the future.(Chart4-1)

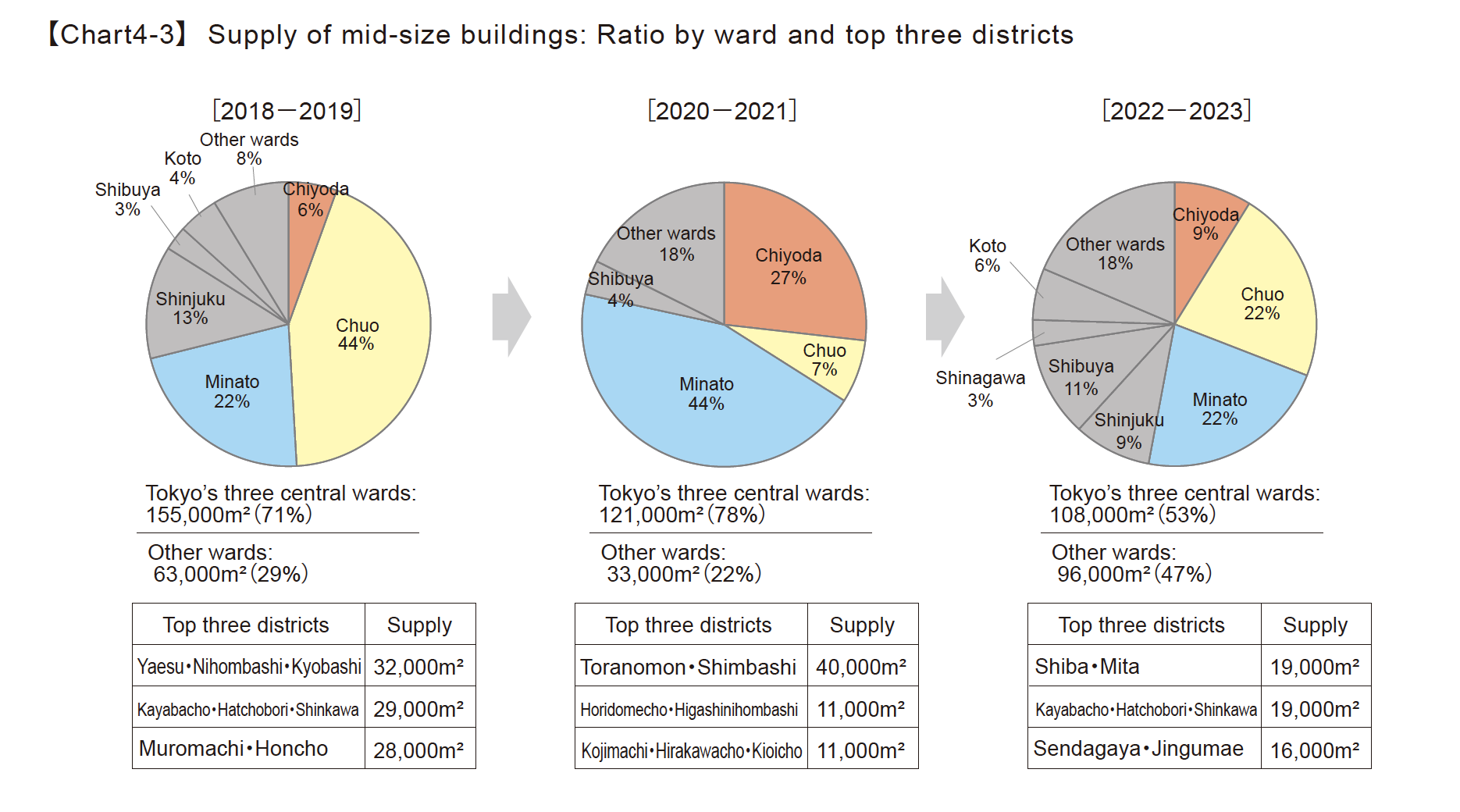

Looking at the supply share by ward during the period from 2022 to 2023, the supply share in areas other than the three central wards will approach 50%. (Chart4-2)

The supply share in areas other than the three central wards was only about 30% during the period from 2018 to 2019 and about 20% during the period from 2020 to 2021, indicating a change in the supply of land for mid-size office buildings. (Chart4-3 on following page)

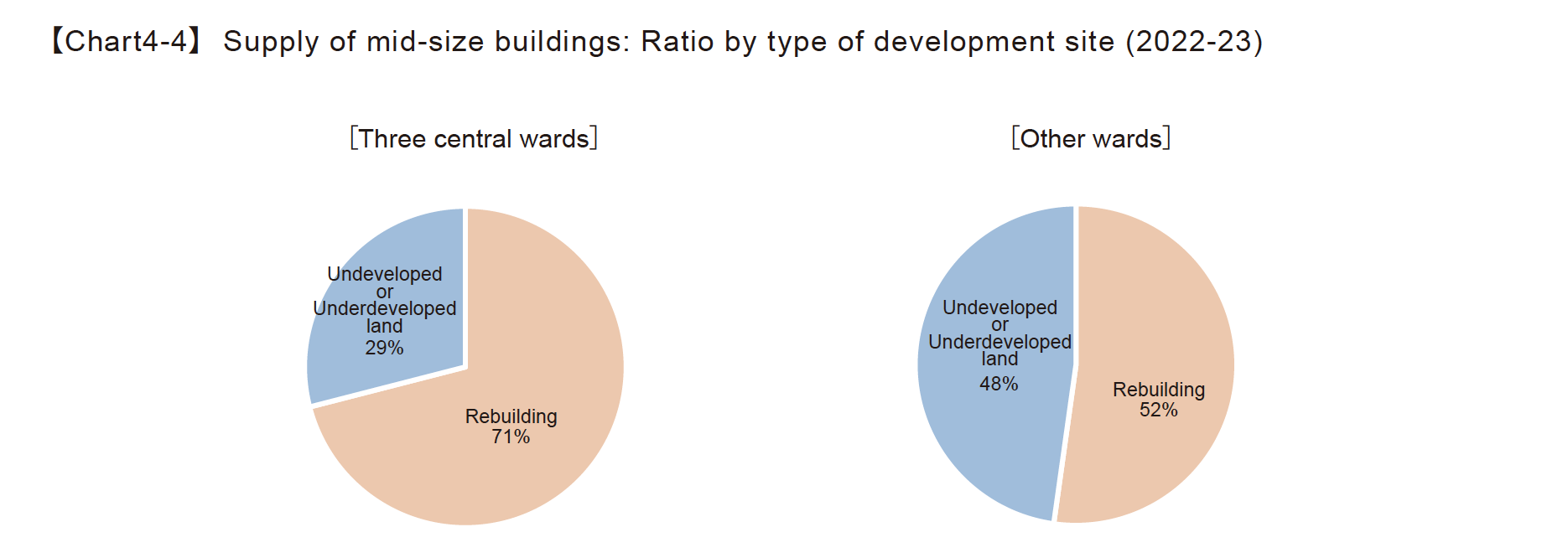

Looking at the supply trends for mid-size office buildings by type of development site, office space in rebuilt buildings (“Rebuilding”) is the main source of new space in mid-size office buildings in the 23 wards overall, which shows a trend distinct from the trend for large-scale office buildings, for which construction on “Undeveloped/underdeveloped land” is the main category. (Chart4-4 on following page)

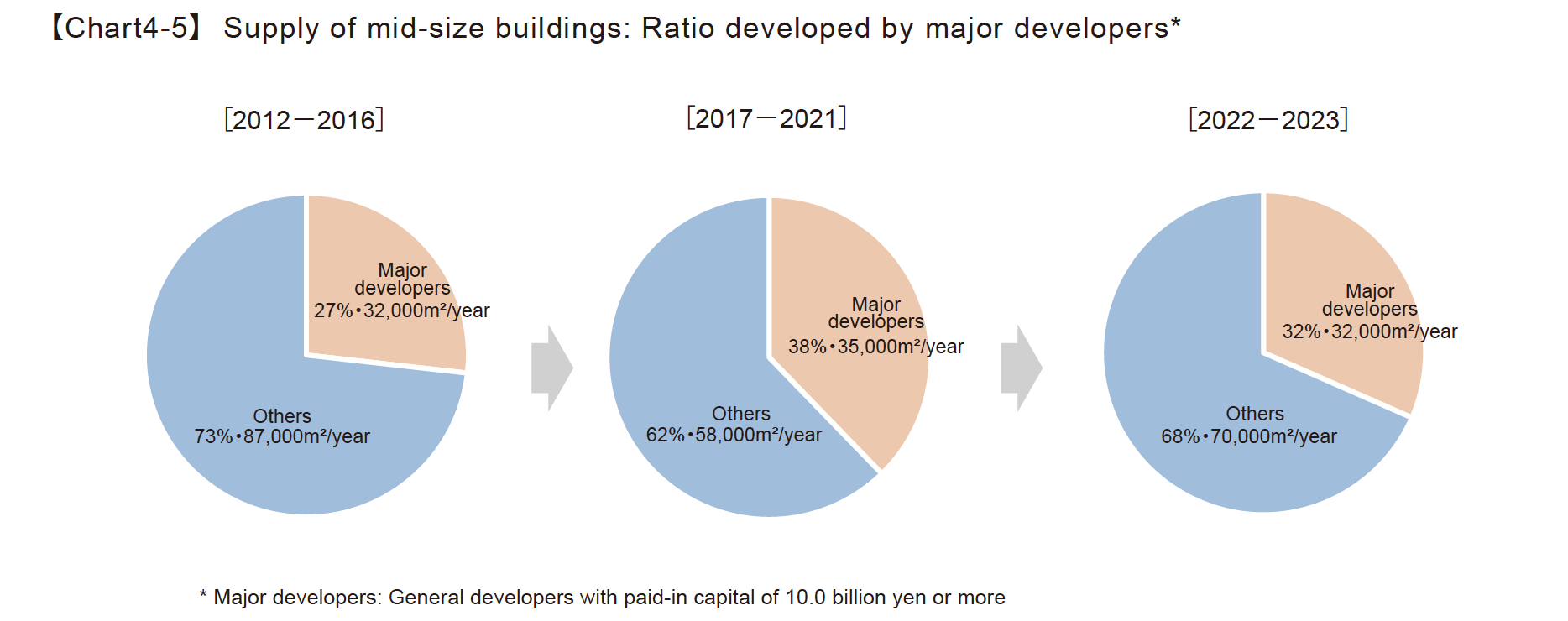

As for mid-size office building projects, the share of major developers, which has been on an increasing trend in recent years, will turn to decline during the period from 2022 to 2023. (Chart4-5 on following page)

5. Conclusion

Regarding new large-scale office buildings constructed in 2021, tenants were informally decided on approximately 90% of the supplied floor space, according to our survey. About 50% of 2022 and about 30% of 2023 have been informally decided, and demand for new buildings is firm.

Looking at the demand for existing buildings, the rising trend of vacancy rates in the five central wards settled in the second half of 2021. The total area contracted, which fell in 2020, is expected to reverse in 2021 and rise to a certain level in 2022. Rents have also risen to the same level as in 2019 in some areas, showing steady growth.

This trend in the rental office market indicates that companies have moved away from the “wait-and-see” attitude of holding back on restructuring their workplace strategies. The spread of telework resultantly provides an opportunity to recognize the importance of face-to-face communication, and the tendency to return to offices is increasing. Companies concerned about the decline in worker engagement and the dilution of their corporate culture have begun to improve the quality of face-to-face communication. To this end, companies redefine the role of the center office from broad perspectives, such as self-branding, the propagation of their own culture, improvement in worker wellbeing, and

incorporate these into the space as a message. In addition to this solid demand from the above background, etc., the average supply of large-scale office buildings over the next five years will be about 30% lower than in the past 20 years, and the supply-demand balance is expected to tighten steadily.

In this age of rapid changes in society, lifestyles, and ways of working, developers are expected to contribute to the sustainable growth of the Japanese economy by providing space services that capture the current trends toward companies’ unchanging demands, such as growth and innovation.