News Releases

Financial Report for the Fiscal Year Ended March 2023

Mori Trust Group recently announced its consolidated business performance for the year ended March 31, 2022 (FY 2023).

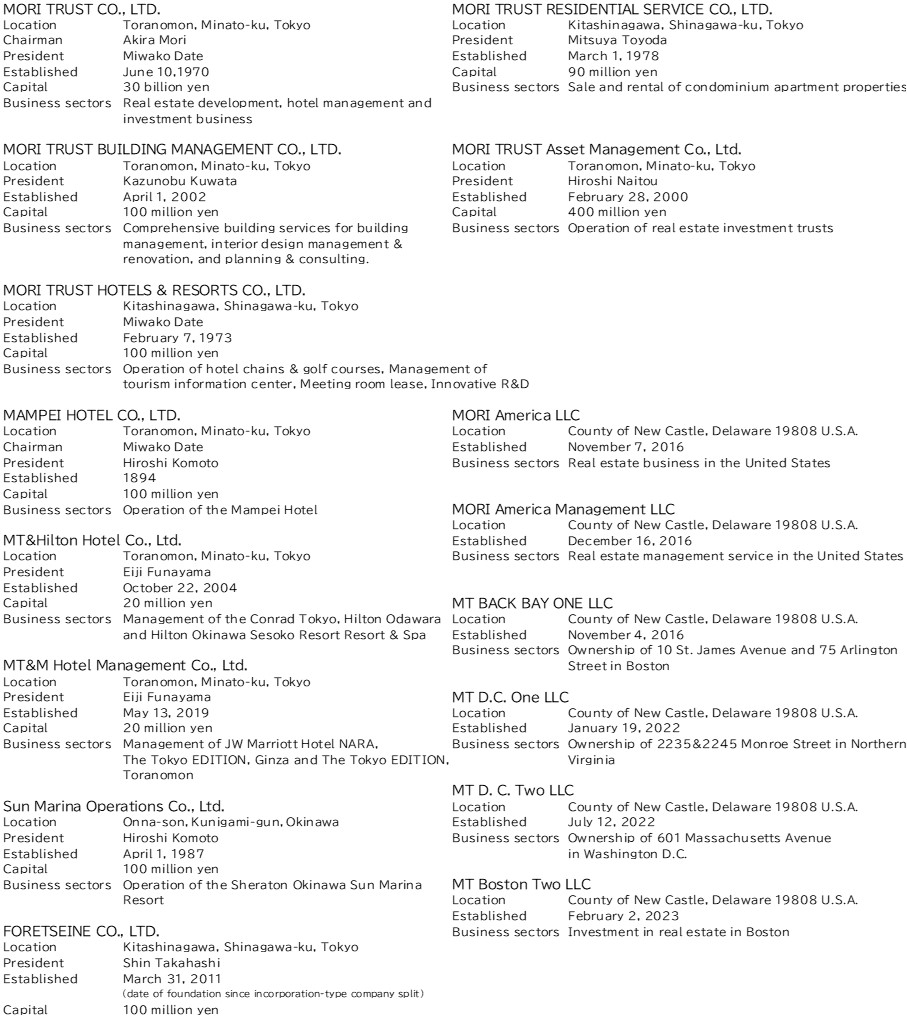

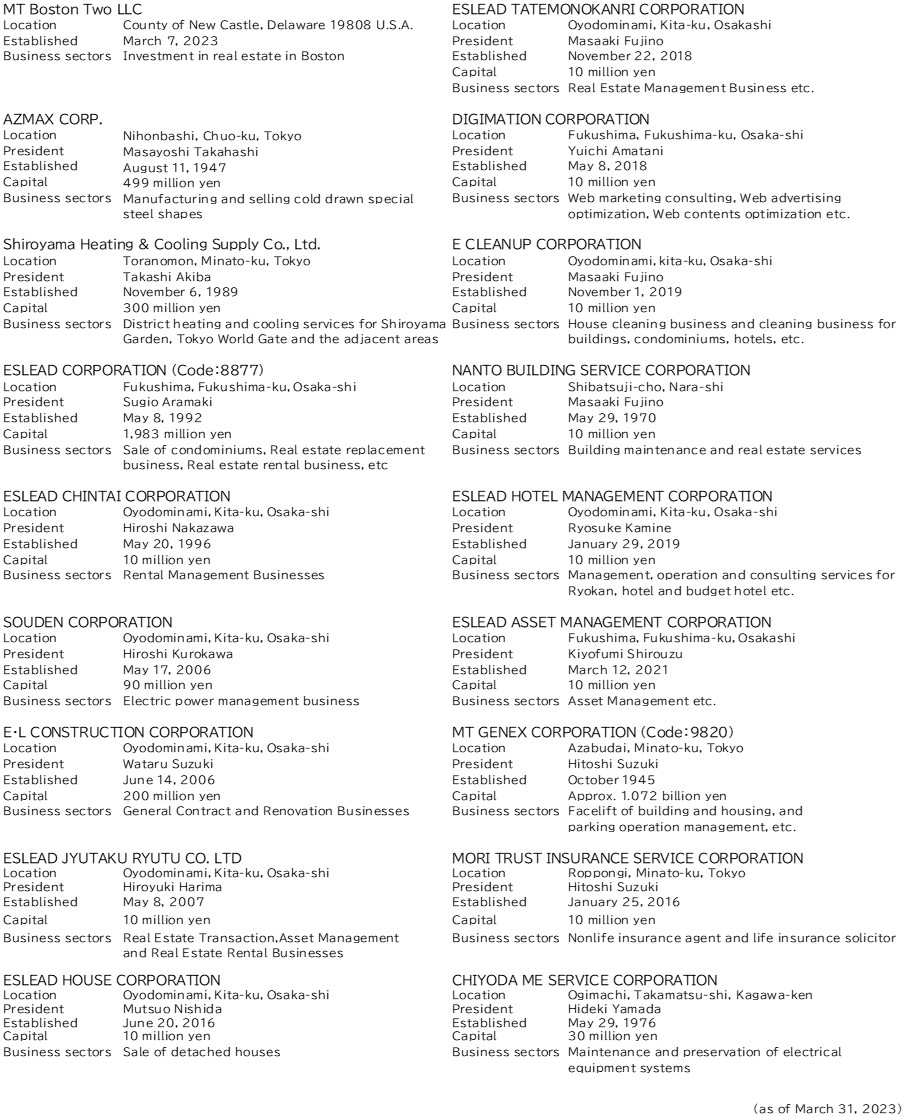

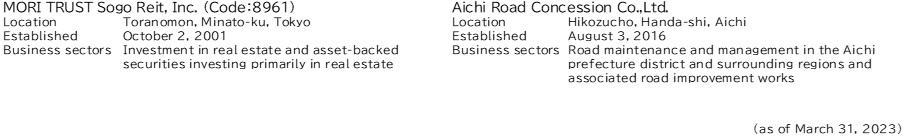

The Group consists of 36 consolidated companies, including Mori Trust Co., Ltd., Mori Trust Building Management Co., Ltd., and Mori Trust Hotels & Resorts Co., Ltd., and three equity-method affiliates.

[Mori Trust Group Consolidated Financial Report] (April 1, 2022 – March 31, 2023)

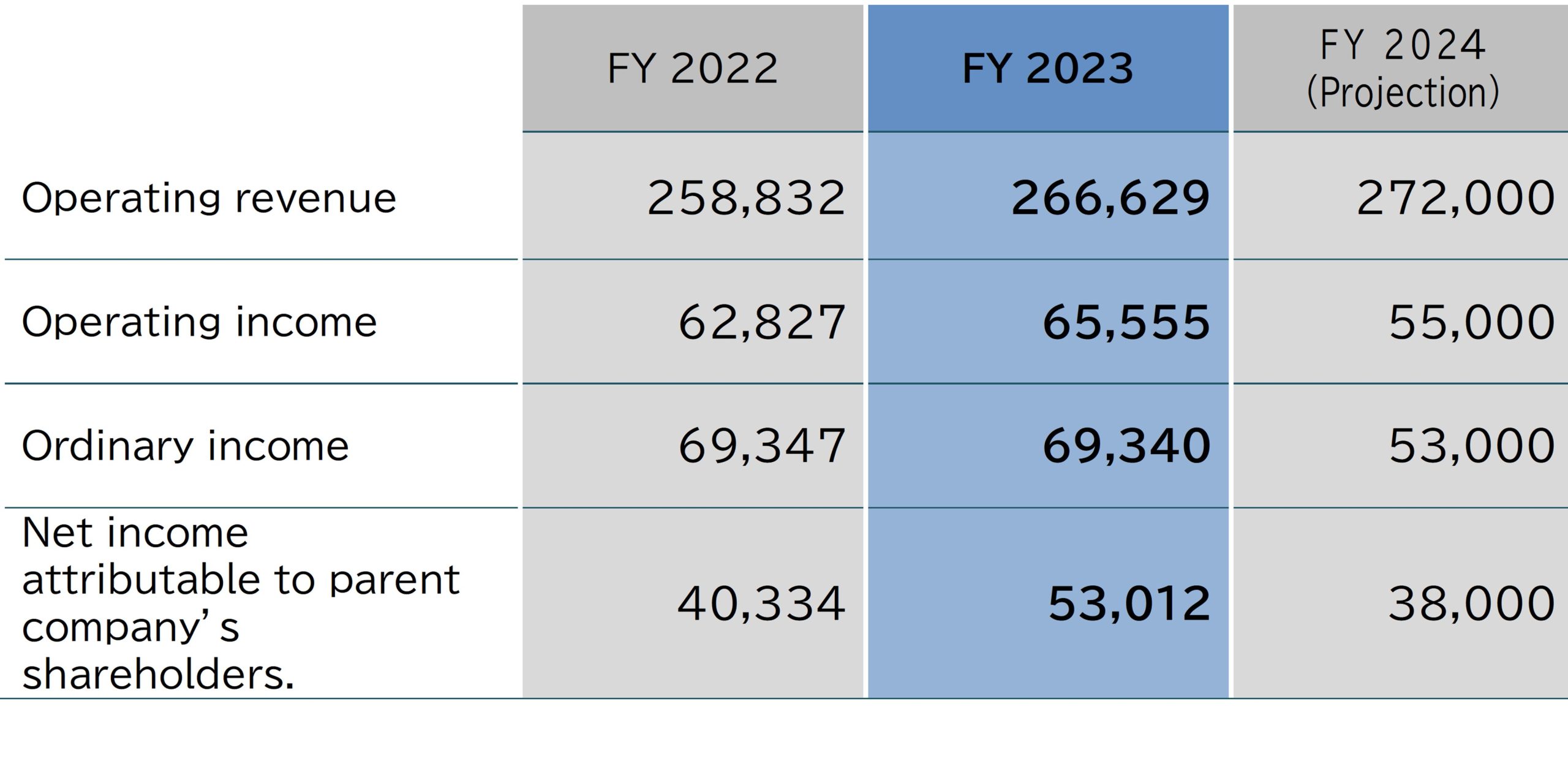

- In the fiscal year ended March 2023, operating revenue was 266.6 billion yen (up 3.0% compared with the previous term), and operating income came to 65.5 billion yen (up 4.3% compared with the previous term). Due to the easing of border measures against COVID-19 in addition to the acquisition of several real estate properties in the United States, higher hotel-related revenue contributed to an increase in both operating revenue and operating income. Both Rental related business and hotel-related revenues were at record highs.

- Income increased, with ordinary income at 69.3 billion yen (down 0.0% compared with the previous term), and net income attributable to owners of the parent posting 53.0 billion yen (up 31.4% compared with the previous term).

- For the fiscal year ending March 2024, the total operating revenue is expected to rise to 272.0 billion yen (up 2.0% compared with the previous term) due to an increase in leasing-related and hotel-related revenues for two consecutive years. We also expect operating income of 55.0 billion yen (down 16.1% compared with the previous term), and net income attributable to owners of the parent of 38.0 billion yen (down 28.3% compared with the previous term), due to scaled back sales plans.

(Figures in millions of yen; figures less than one million yen are rounded down.)

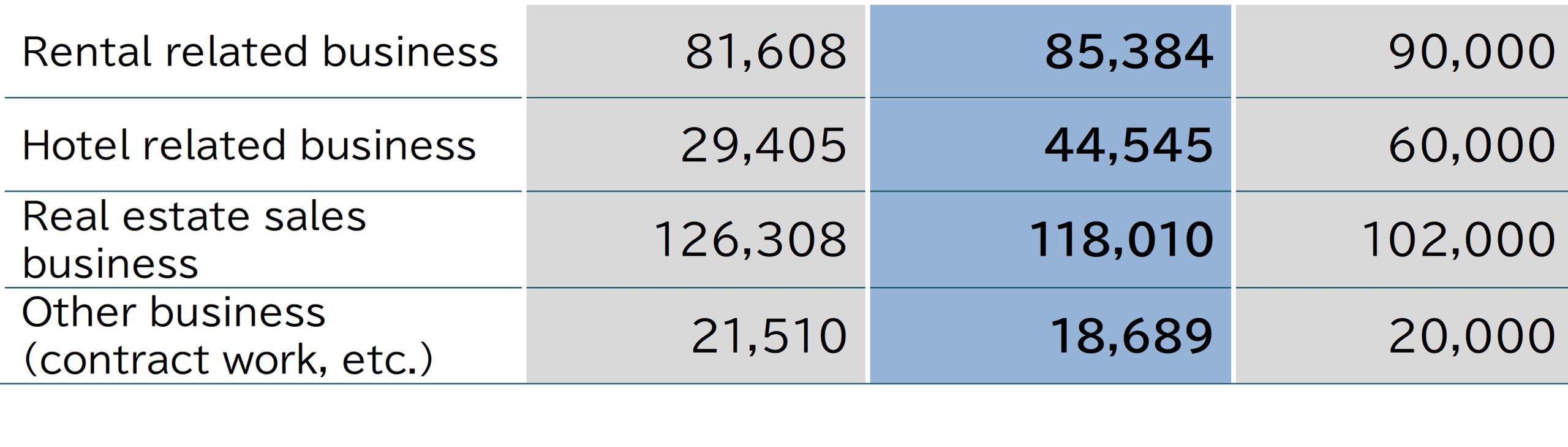

Operating revenue breakdown

Total assets and net assets

Highlights of FY2023 Business Performance

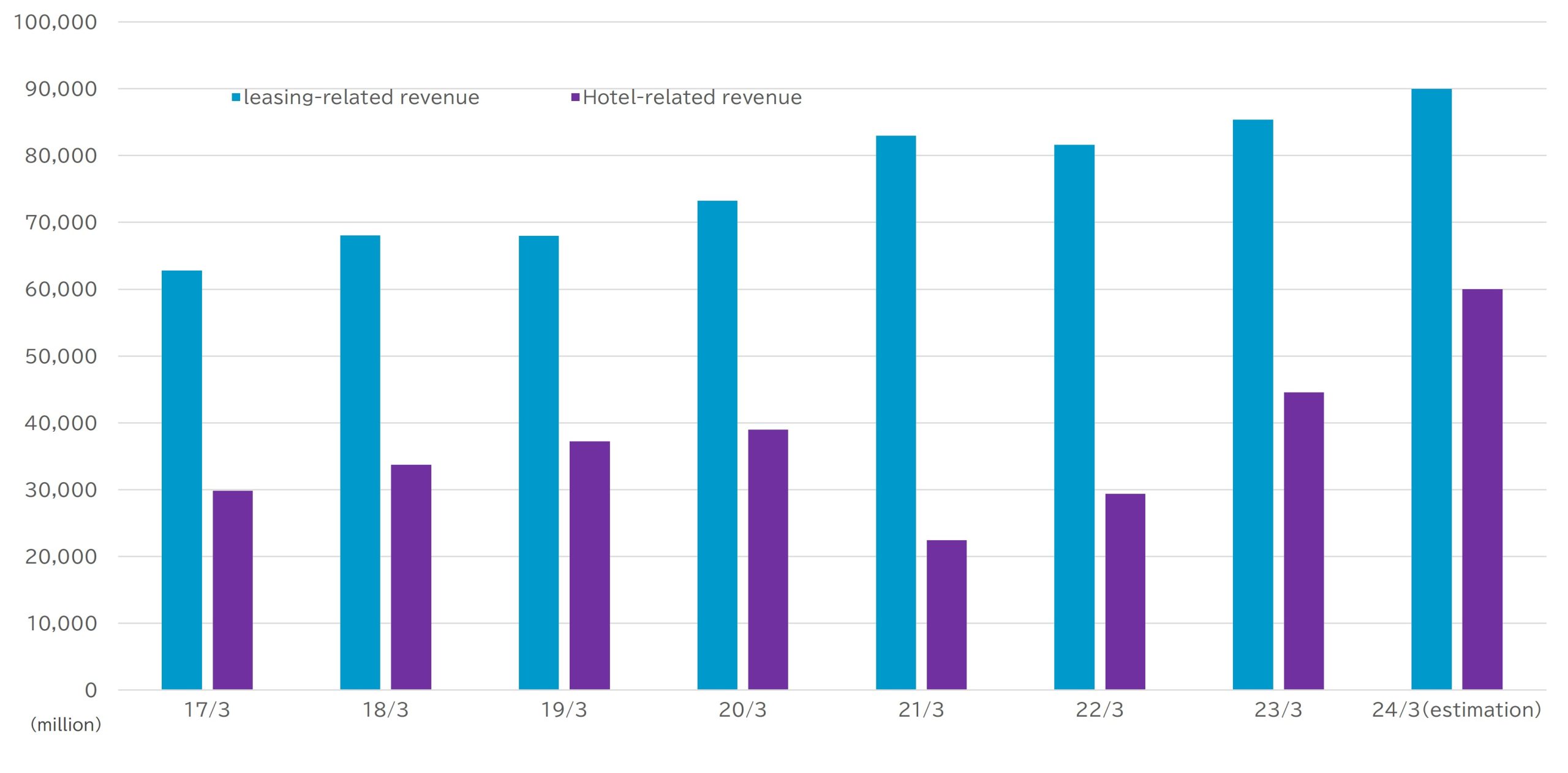

- In the leasing-related business, operating revenue was a record high at 85.3 billion yen, up 4.6% compared with the previous term, due to higher rental income from the acquisition of office buildings in Northern Virginia and Washington, D.C. in the United States, despite a decline in rental income from HQ @ First, a property in the Silicon Valley area of the United States sold in July 2021.

- In the hotel-related business, despite the impact of the continued spread of COVID-19 in Japan since 2020, the occupancy rate recovered mainly at hotels in urban areas due to the end of infection control measures such as the declaration of a state of emergency that had continued intermittently until September 2022 and the relaxation of border control measures in October of the same year. This resulted in a record operating revenue of 44.5 billion yen, up 51.5% compared with the previous term.

- The real estate sales business generated operating revenue of 118.0 billion yen, down 6.6% compared with the previous term, due to a decline in sales revenue from the high-class condominiums THE RESIDENCE ROPPONGI and FORETSEINE SHIBUYA TOMIGAYA in central Tokyo, which were sold in the previous year, despite strong sales of condominiums by Eslead Corporation. Other business posted operating revenue of 18.6 billion yen, down 13.1% compared with the previous term, due to a decline in contract construction orders for tenant move-in construction and other projects.

As a result of the above, operating revenue finished at 266.6 billion yen, operating income at 65.5 billion yen, and net income attributable to owners of the parent at 53.0 billion yen. In addition, we achieved the numerical targets established for the final fiscal year of “Advance 2027,” our medium- to long-term vision, of operating revenue of 230.0 billion yen and operating income of 55.0 billion yen. This is the fourth consecutive year of achieving the numerical targets continuing from the fiscal years ended March 2020, March 2021 and March 2022.

Business Performance Projections for FY2024

- In the leasing-related business, operating revenue is expected to increase to 90.0 billion yen due to rental income from two real estate properties in the United States acquired in 2022 contributing to the full-year rental income, and an increase in the occupancy rate of existing office buildings.

- The hotel-related business is expected to achieve a significant improvement in the occupancy rate of existing hotels due to a further recovery in tourism demand from domestic and inbound tourists, affected by COVID-19 being shifted to a Category V infectious disease in May 2023. As a result of this factor in addition to the opening of two hotels in Ginza of Tokyo and Nara, operating revenue is expected to increase for three consecutive years to 60.0 billion yen, which will be a record high for the second consecutive year.

- The real estate sales business is expected to generate 102.0 billion yen in operating revenue mainly due to the residential property sales business, and other business is expected to generate 20.0 billion yen in operating revenue.

As a result of the above, for the fiscal year ending March 2024, we expect operating revenue of 272.0 billion yen, operating income of 55.0 billion yen, and net income attributable to owners of the parent of 38.0 billion yen.

※Projections contained in this document have been made on the basis of information available when it was released. Due to various unforeseeable factors, actual performance may differ from such projections.

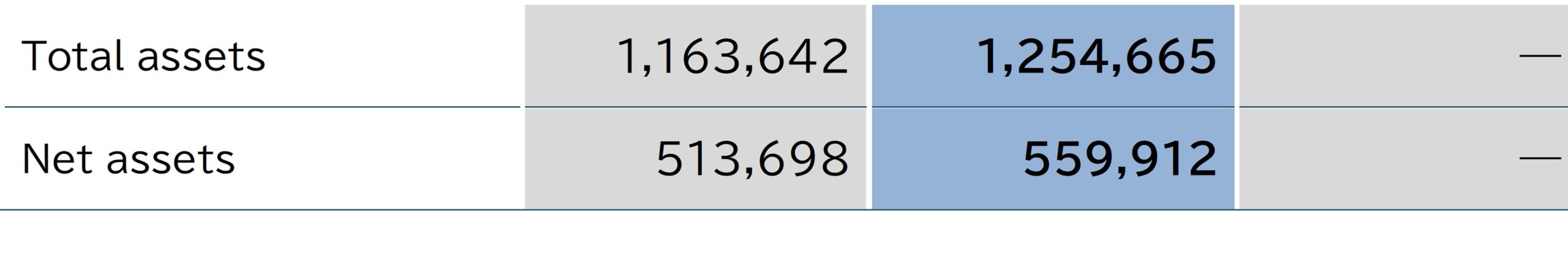

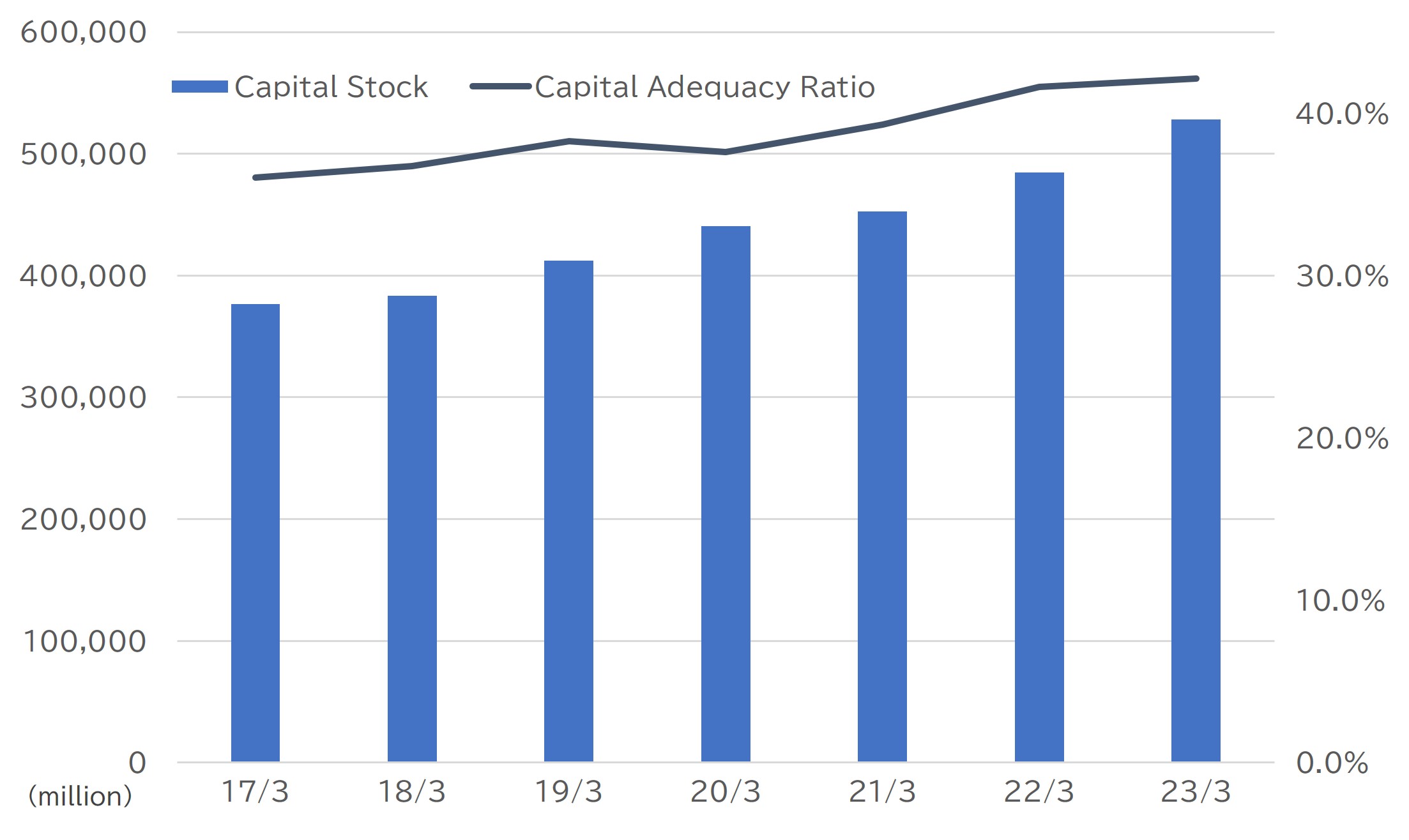

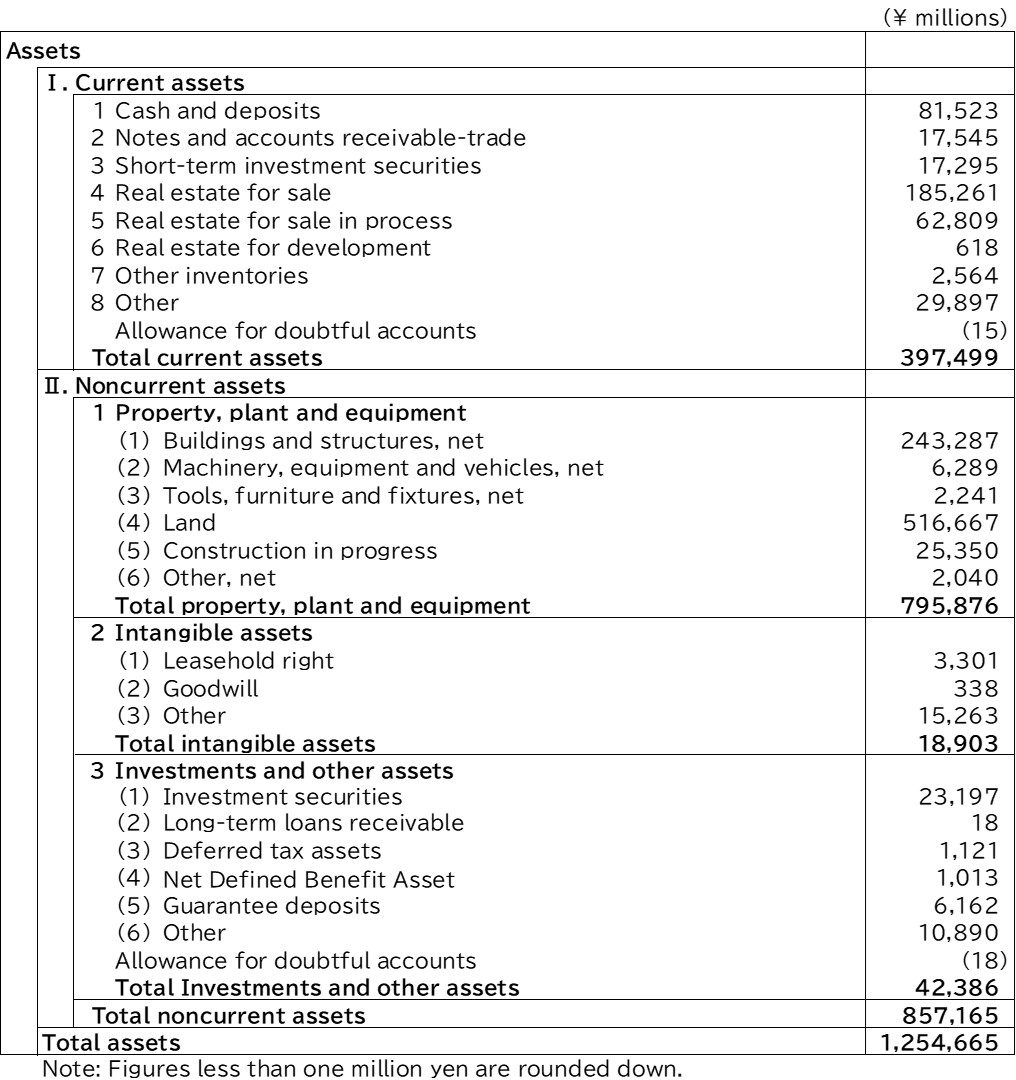

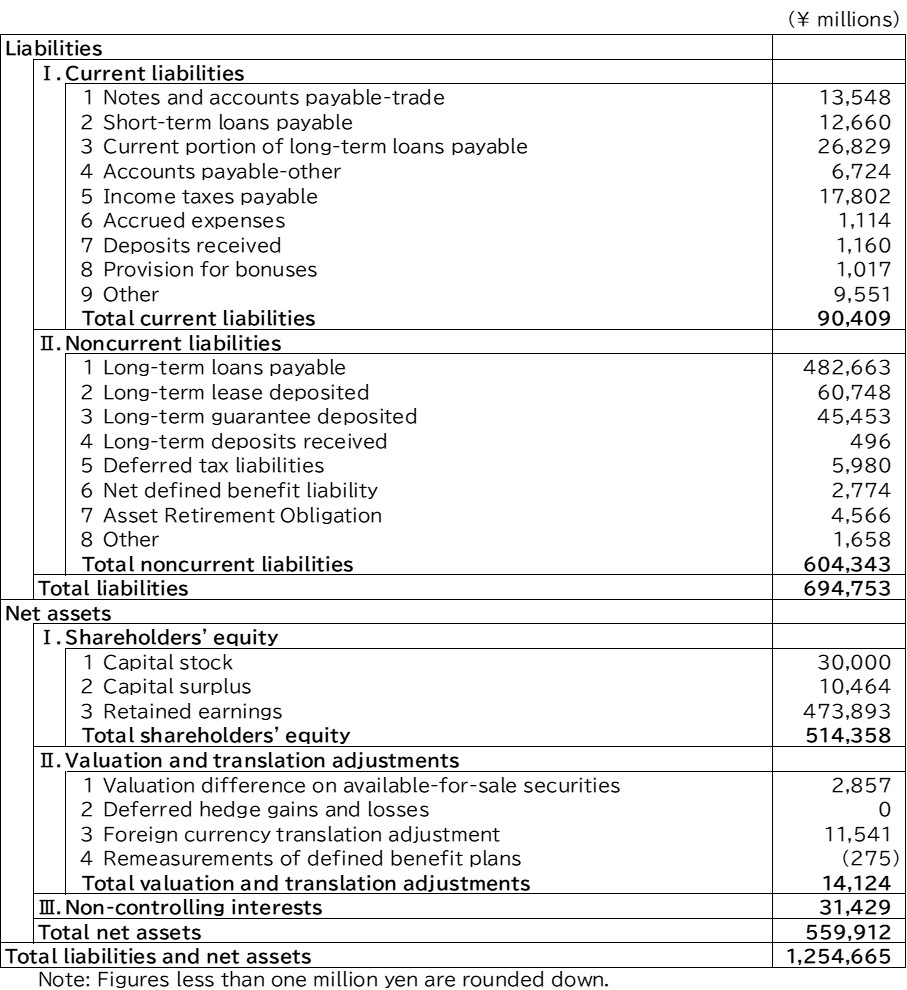

Financial Conditions of Mori Trust Group

Trends of Capital Stock and Capital Adequacy Ratio

The capital stock and capital adequacy ratio for the fiscal year ended March 2023 were 528.4 billion yen and 42.1% respectively

Trends of Lease-related and Hotel-related Businesses

Hotel-related revenue for the fiscal year ended March 2023 exceeded revenue for the fiscal year ended March 2020, and reached a record high along with leasing-related revenue.

FY2023 Key Business Topics

REAL ESTATE

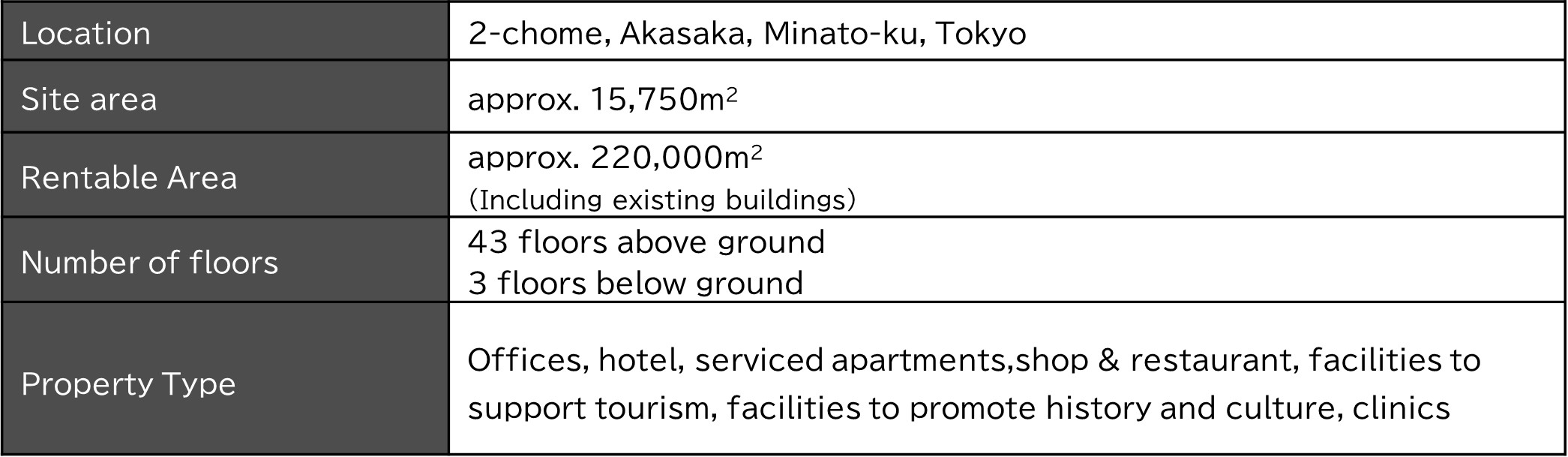

Tokyo World Gate Akasaka, a project in central Tokyo, is being developed toward its completion in 2024. Overseas investment, which is a key strategy set forth in our medium- to long-term vision, Advance 2027, achieved the investment target of 200 billion yen through the acquisition of real estate in Washington D.C., the United States. In addition, in the fiscal year ending March 2024, which is a progression stage, we participated in an overseas real estate development project in Boston, Massachusetts, which is the first time to do so for Mori Trust. We also relocated our headquarters, for the first time in 24 years, to the Tokyo World Gate Kamiyacho Trust Tower.

Tokyo World Gate Akasaka/Akasaka Trust Tower

Based on the district concept “Next Destination: Meet Up Again in the City,” we are promoting development with the aim of creating a city that will become a destination for diverse people to meet again and interact with each other in the future, in a way that goes beyond the new normal (behaviors, etc. that will remain after COVID-19).

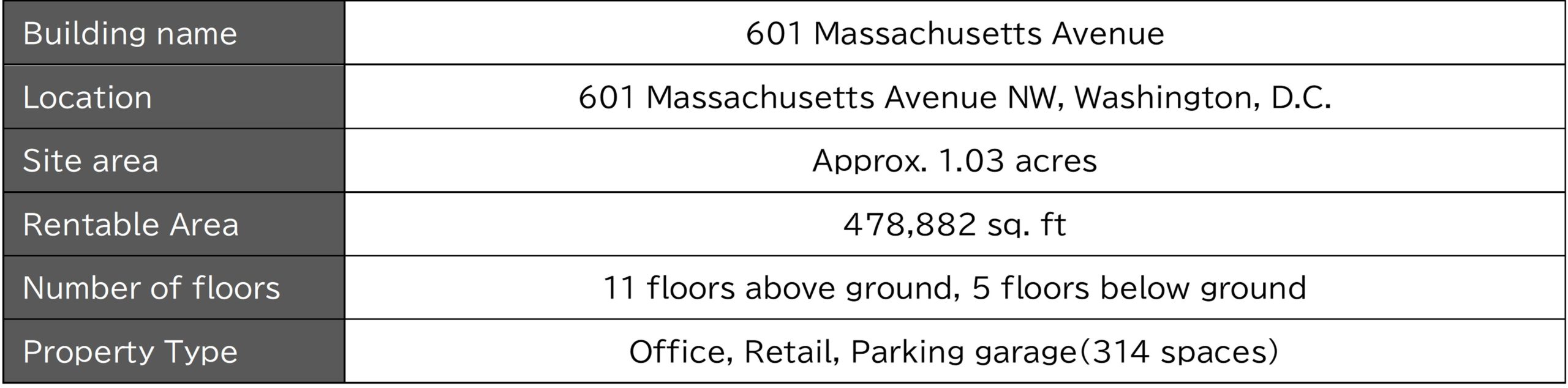

Acquisition of real estate in Washington D.C., U.S.A.

Through our U.S. subsidiary, MORI America LLC, we acquired an office building located in Washington D.C., the United States, in August 2022.

Located in a district called Mount Vernon Triangle, which has been redeveloped by the public and private sectors since 2002, this property is an office building developed by a leading real estate company in the United States. It has received gold certification in LEED, an international environmental performance evaluation indicator for buildings, and has excellent environmental performance.

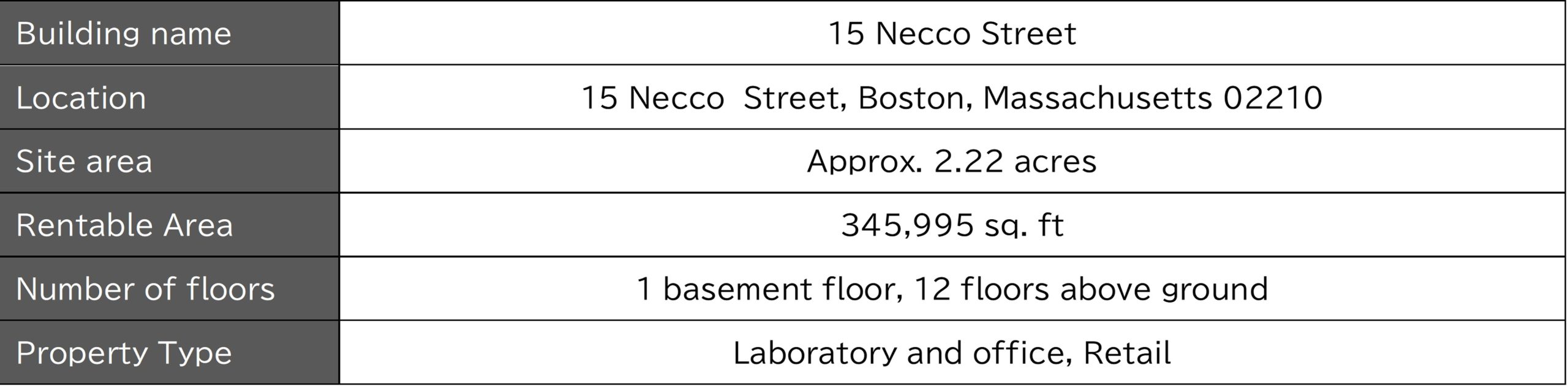

Participation in development in Boston, Massachusetts, U.S.A.

Through MORI America LLC, we participated in a development project for a laboratory and office located in Boston in the United States, aiming for completion in November 2023.

This property is a laboratory and office to meet growing interest in the life science field and demand for research facilities as a result of experiencing the global pandemic and the rapid development of advanced therapeutic drug science. The Seaport District in Boston, where the property is located, has been designated as an innovation district led by the city and is expected to grow in the future.

Mori Trust’s new office (Tokyo World Gate/Kamiyacho Trust Tower)

At the new headquarters, Mori Trust has realized a new office that will remain a place where people wish to be by increasing employee engagement through our office business vision, DESTINATION OFFICE, and adding the idea of a versatile office.

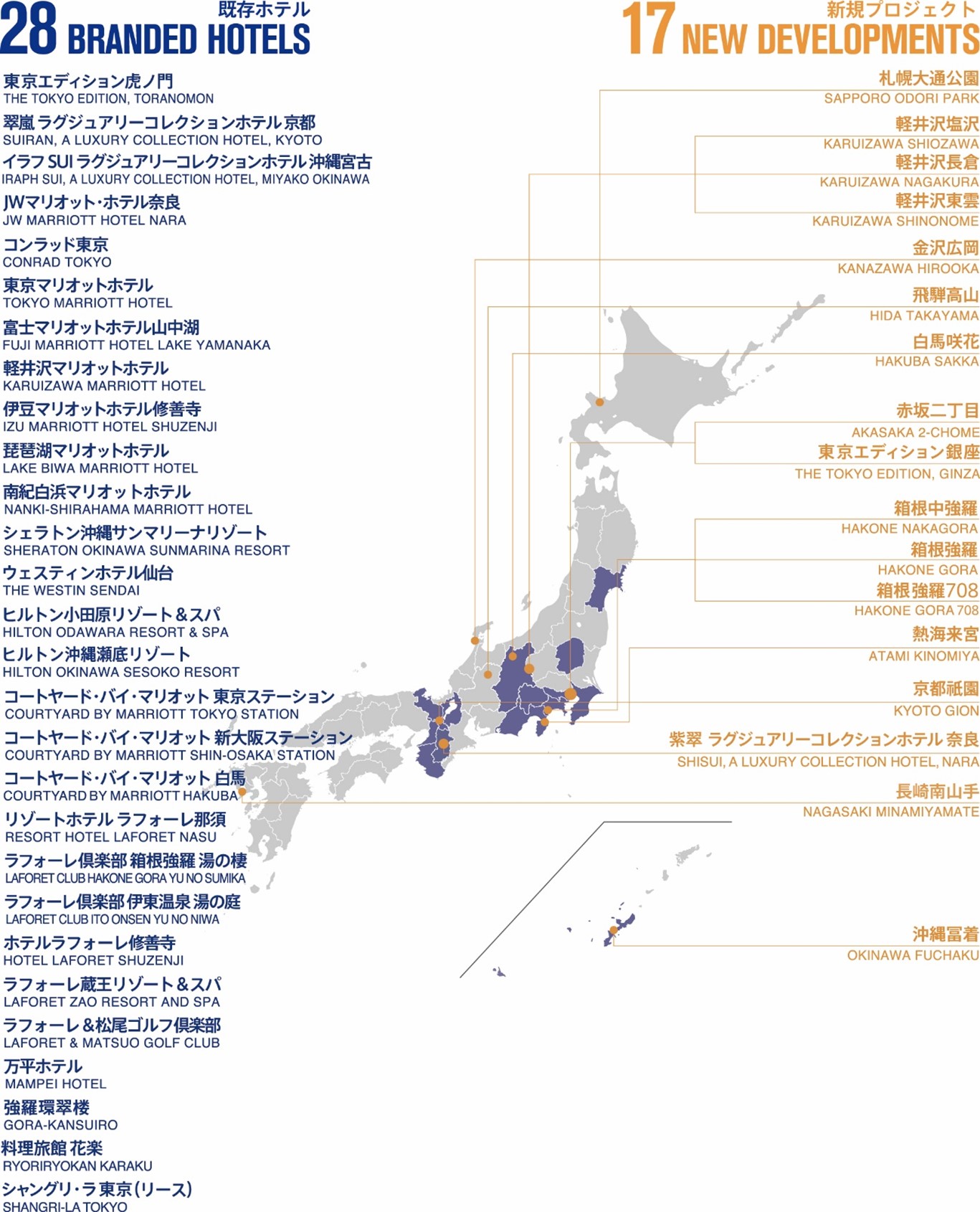

HOTELS & RESORTS

Apart from having 28 hotel facilities across Japan as of March 2023, the Mori Trust Group’s hotels & resorts business, which is our core business, is also promoting new hotel plans for two hotels in central Tokyo and 15 hotels in regional areas. Under the “Luxury Destination Network” concept*, we provide comfortable stays to tourists from Japan and overseas utilizing the attractive tourism resources of various areas of Japan, such as promoting initiatives aimed at increasing inbound demand and boosting consumption per traveler.

List of existing hotels and new hotel projects

Luxury Destination Network concept: Mori Trust believes that it is necessary to increase consumption per traveler, to connect not only individual tourist destinations but also wide areas to encourage round-trips, and to promote regions with history, culture, nature, and other tourism resources to the world, in addition to increasing the number of inbound visitors. For that purpose, we are promoting the concept of developing and expanding international hotels across Japan under the name “Luxury Destination Network.”

(Reference) Hotels scheduled to be developed

The Tokyo EDITION, Ginza

Affinity with surrounding global high-brand customer segments is high. We aim to contribute to the sustainable development of the Ginza area by attracting international travelers, including trendsetters and the wealthy.

Shisui, a Luxury Collection Hotel, Nara

This project is being promoted in Nara Prefecture’s public-private partnership project, “Yoshikien’s Surrounding Area Preservation, Management, and Utilization Project.” The hotel is scheduled to open on Tuesday, August 29, 2023 as the third double-brand hotel in Japan under the luxury hotel brands “SUI” and “Luxury Collection.

Major renovation project for Mampei Hotel

This is a major renovation project for Mampei Hotel, which will celebrate its 130th anniversary in 2024. This project aims to preserve the tradition as a valuable historic landmark in the history of hotels in Japan, and to provide a dignified stay at a classic hotel for a long time to come.

Minamiyamate District in Nagasaki

This property is located at the southern end of the exotic Minamiyamate District in Nagasaki, where there is a concentration of cultural and tourist attractions close to the important cultural property Former Glover House and the national treasure Oura Church.While preserving, restoring, and utilizing the red brick exterior, which is rare even in the city of Nagasaki, we are proceeding with plans to open the international hotel.

NEW FIELD

Aiming to create new value by thinking outside the framework of existing businesses, we are working on businesses in new areas.

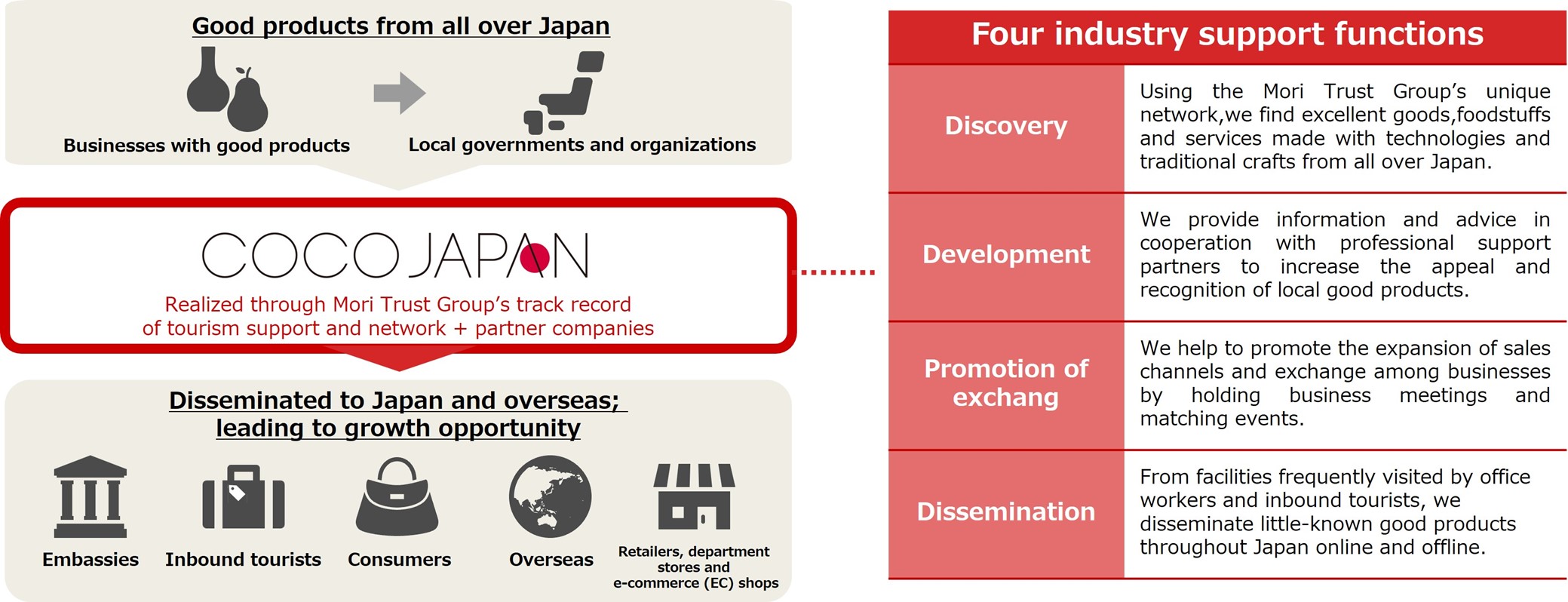

Last year, we fully launched CoCo JAPAN, a project to support the dissemination and development of manufacturing industries across Japan, at TOKYO WORLD GATE CoCo Lounge, an industry development facility in Tokyo World Gate.

We also started a SaaS project as a solution to various workspace issues and developed the workspace management tool WORK AGILE. We will continue striving to solve issues regarding ever-changing work styles in companies.

Full-scale launch of CoCo JAPAN

Leveraging knowledge accumulated by Trust and its network with local governments and local companies, we are promoting the industry support project CoCo JAPAN to further contribute to regional revitalization by helping to develop the Japanese manufacturing industry.

Through the four industry support functions of “discovery,” “development,” “promotion of exchange,” and “dissemination,” this project helps local governments and businesses around the country to promote local products to Japan and overseas.

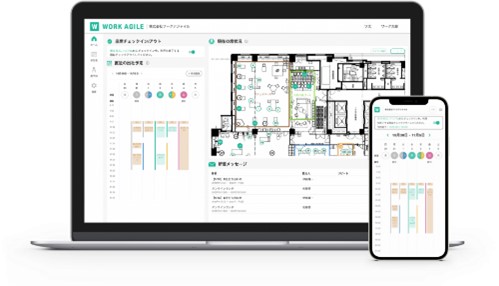

Start of development and sales of WORK AGILE

We developed the workspace management tool WORK AGILE, which aims to maximize the performance of workers and space in the era of hybrid work.

Equipped with functions for reserving seats and detecting employee positions, it helps to create office environments that encourage communication in real places. It also has a function to collect and analyze data related to office space such as seat usage.

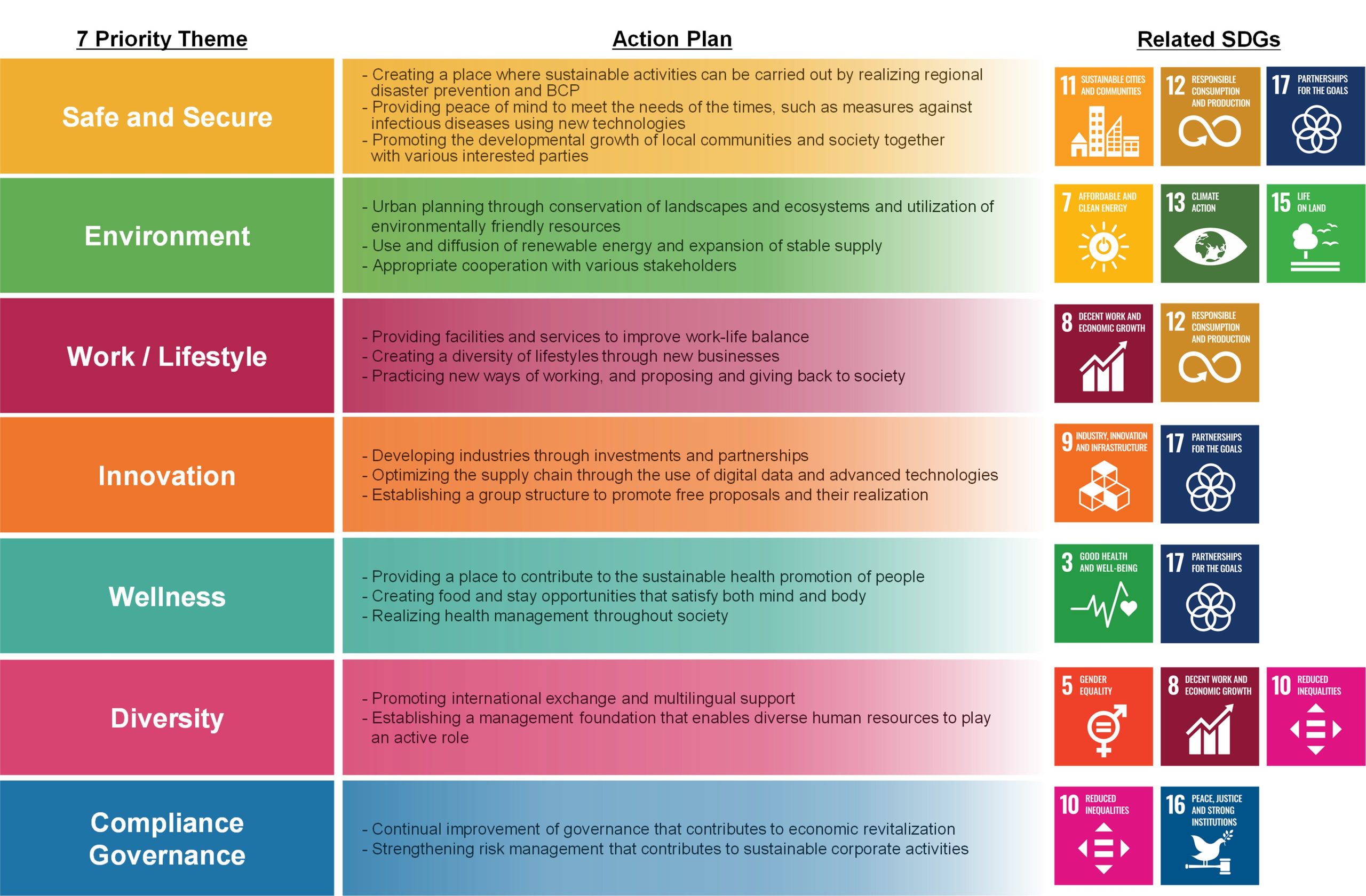

Sustainability Activity Report

Mori Trust Sustainability Vision

From Urban Planning to Future Planning

Under our corporate slogan “Create the Future,” we aim to create an exciting future.

Just as our mission once changed from building planning to urban planning, creating a new society will change us along with society.

Results of Initiatives in the Fiscal Year Ended March 2023 (Excerpt)

Safe and secure urban planning and community revitalization

- Provision of a lounge space open to the local community

Number of actual users of TOKYO WORLD GATE CoCo Lounge: 125,030

- Local community-building through area management activities

Number of events held in Kamiyacho, Gotenyama and Marunouchi areas: 15

- Preparation for safety by conducting disaster drills

Number of disaster drills conducted: 4

Realization of a sustainable environment and society

- Introduction of renewable energy power to rental buildings

Introduced to eight rental buildings in total, including Marunouchi Trust Tower and Kamiyacho Trust Tower: Progress rate 44.5% (target rate of introduction to rental buildings by FY2025: 100%)

- Investment in and partnership with startup funds that help realize a sustainable environment

Number of investments: 2 (PowerX, Inc., Luup, Inc.)

- Acquisition of environmental certifications for rental buildings

Certifications acquired: 3 (10 St. James: LEED Gold, 75 Arlington: LEED (pending application), 601 Massachusetts Avenue: LEED Gold)

(Reference)

Tokyo World Gate Fukishiro-no-Mori receives the 42th Green City Award from the Chairman of the Organization for Landscape and Urban Green Infrastructure

In the external structure of Tokyo World Gate, we have developed Fukishiro-no-Mori, a green space of about 5,500 m2, where we are working to preserve biodiversity by transplanting and conserving a large camphor tree, which has been on the premises since ancient times and developing a biotope using rainwater circulation. We have also installed terraces and benches in the lush green plaza and along garden I paths to develop an environment where everyone can spend time in nature safely and comfortably, creating traffic and the bustle of residents, visitors, and workers.

Reduction in plastic use for hotel amenities by approximately 15 tons

Mori Trust Hotels & Resorts is implementing initiatives to reduce the plastic contained in hotel amenities used at the 18 hotels it operates, 16 tons per annum, by 15 tons by FY2024.

[1] Replacement with wood, bamboo, andproducts containing less plastic.

[2] Initiatives to encourage guests to bring their own amenities with them.

[3] Abolishment of some free hotel amenities.

Proposal of new work and life styles

- Acquisition of certifications for the workplace environment

Acquisition of the Health and Productivity Management Organization certification for four consecutive years, and acquisition of the Platinum Kurumin Certification

Creation of a new era and development of industries

- Exhibitions and sales that contribute to dissemination of culture and industries.

Actual exhibition and sales activities at TOKYO WORLD GATE CoCo Lounge: Permanent exhibitions for 36 weeks, planned exhibitions for 10 weeks.

- Development of DX analysts

Number of analysts developed: 27

Promotion of wellness and health

- Promotion of projects in the wellness field

Development and sales of health-conscious or environmentally friendly lunch boxes

Sales of home-grown herbal teas

Introduction of pure wellness rooms: 20 facilities

- Childcare leave acquisition rate

Acquisition rate: Total 71.4%, female 100.0%, male 55.6% (target by FY2025: 100%)

Initiatives for diversity

- Support for foreign residents with life concierges

Number of cases handled by concierges at TOKYO WORLD GATE CoCo Lounge: 1,099

- Increase in the female employee ratio

Female employee ratio at Mori Trust Co., Ltd.: 27.1% (target by FY2025: 25%)

- Implementation of recruitment activities with an awareness of diversity

Quotas for international students and innovation recruitment in the recruitment of new graduates, and comeback recruitment and referral recruitment in the mid-career recruitment

Continuous improvement of compliance and governance

- Strengthening of Mori Trust Group’s legal functions

Number of group legal meetings held: 4

- Raising awareness of management against information leakage

Implementation of crisis management simulations

Mori Trust Group: Total Floor Area Leased or Managed

Number of rental/managed facilities (as of March 31, 2023)

Buildings, housing, and commercial facilities: 66

Hotel & resort facilities: 31 (number of rooms: approx. 4,500)

Mori Trust Group: Summary of Consolidated Companies

Mori Trust Group: Summary of Equity – Method

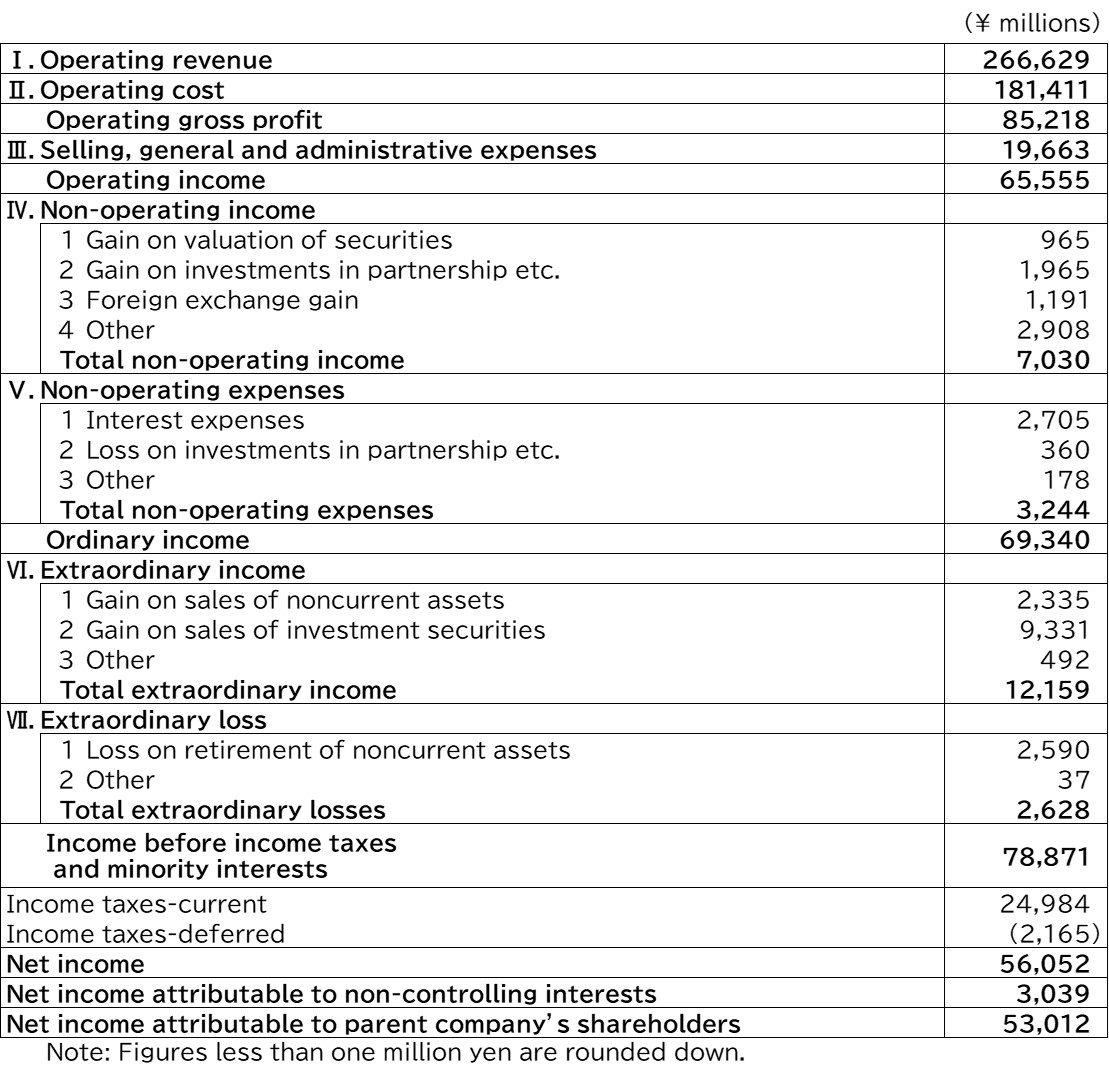

Consolidated Statements of Income (For the years ended March 31, 2023)

MORI TRUST CO., LTD. and its consolidated subsidiaries

Consolidated Statements of Income (For the years ended March 31, 2023)