News Releases

Mori Trust Group Financial Report for the Fiscal Year Ended March 2025

Mori Trust Group recently announced its consolidated business performance for the year ended March 31, 2025 (FY2025).

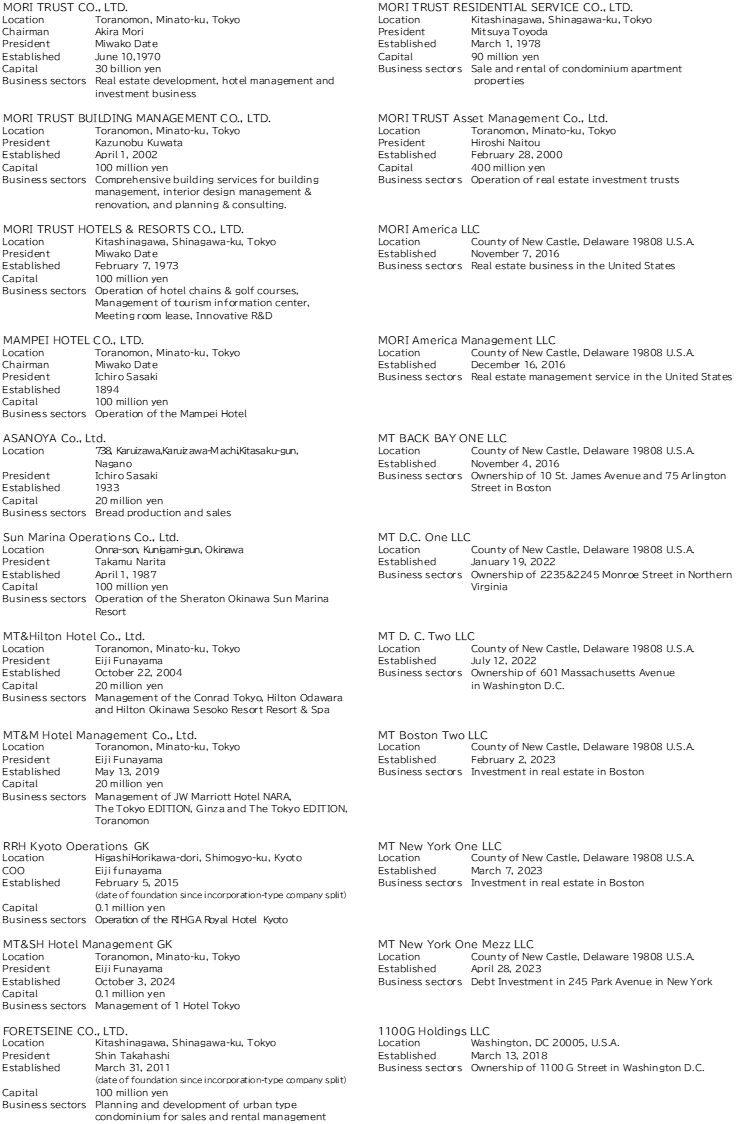

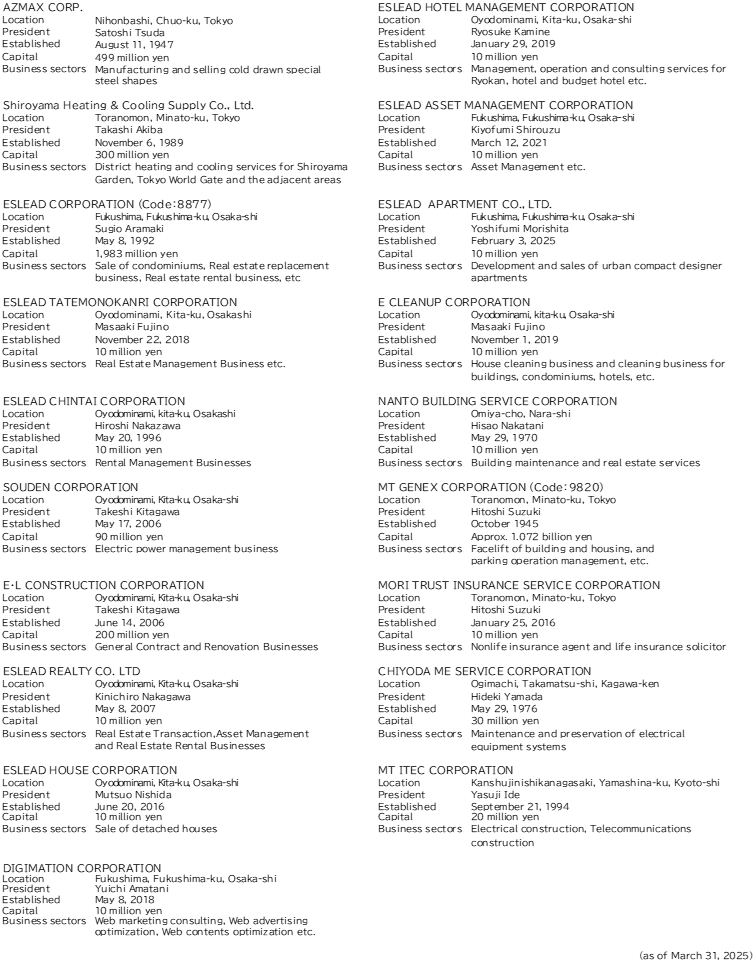

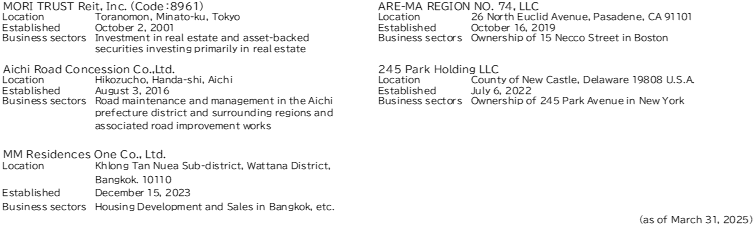

The Group consists of 46 companies, including Mori Trust Co., Ltd., Mori Trust Building Management Co., Ltd., and Mori Trust Hotels & Resorts Co., Ltd., comprising 40 consolidated subsidiaries and five equity-method affiliates.

Mori Trust Group Consolidated Financial Report (April 1, 2024 to March 31, 2025)

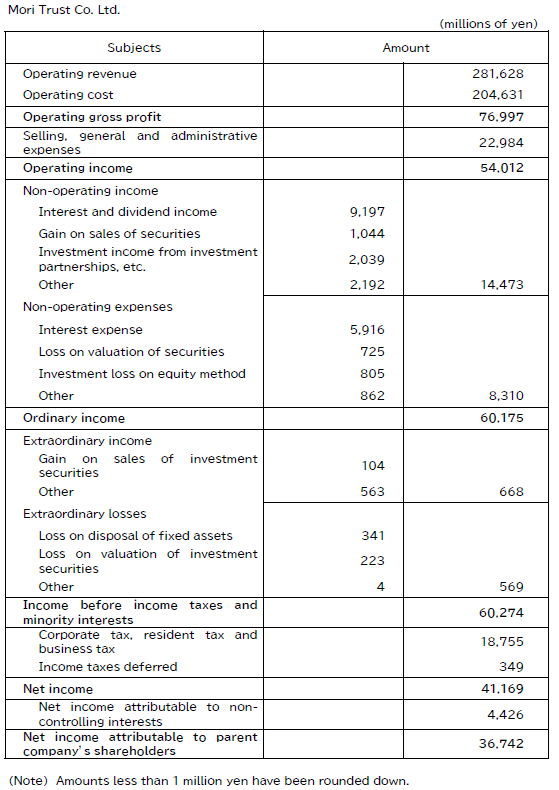

- For the fiscal year ended March 2025, operating revenue reached a record high of 281.6 billion yen (up 7.1% from the previous fiscal year), and operating income was 54 billion yen (up 0.3% from the previous fiscal year). High occupancy rates in existing office buildings due to robust office rental demand and improved hotel occupancy rates due to inbound demand contributed to both rental and hotel-related revenues reaching record highs.

- Ordinary income was 60.1 billion yen (up 2.0% year on year), and net income attributable to shareholders of the parent company was 36.7 billion yen (down 11.2% year on year) due to the decline in real estate sales revenue recorded in the previous fiscal year.

- For the fiscal year ending March 2026, we expect operating revenue to reach 300 billion yen (up 6.5% from the previous fiscal year), the highest level for the second consecutive fiscal year. In addition, operating income is expected to be 59 billion yen (up 9.2% year on year), and net income attributable to parent company’s shareholders is expected to be 35 billion yen (down 4.7% year on year).

Highlights of the Fiscal Year Ended

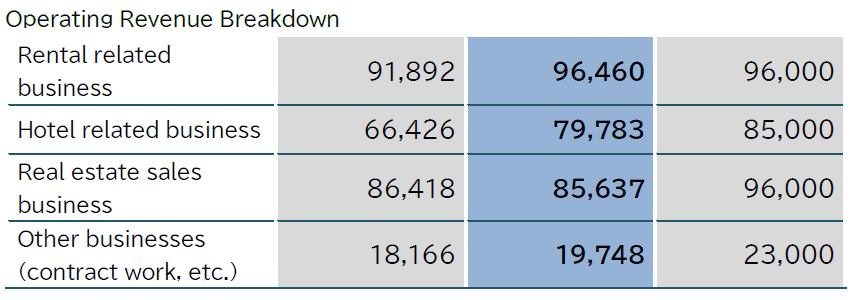

- In the rental related business, operating revenue increased 4.9% year-on-year to 96.4 billion yen, the highest level in three consecutive periods, due to high occupancy rates in existing office buildings.

- In the hotel related business, both city hotels and resort hotels recorded high occupancy rates and average room rates. Luxury hotels in Tokyo performed well, spurred by the booming inbound tourism industry, which saw both the number of visitors to Japan and the amount of spending by visitors to Japan reach record highs in 2024. In addition, the Mampei Hotel, which completed large-scale renovation and reconstruction work and had its grand opening in October 2024, also contributed to the higher operating revenue in the hotel-related business which grew 20.1% from the previous period to 79.7 billion yen, the highest level in three consecutive periods.

- In the real estate sales business, condominium sales by Eslead Corporation continued to perform well, but due to a decline in sales revenue from office buildings that were sold in the previous period, etc., operating revenue in the real estate sales business decreased 0.9% year on year to 85.6 billion yen. In the other business category, operating revenue increased 8.7% year on year to 19.7 billion yen.

As a result of the above, operating revenue reached a record high of 281.6 billion yen, operating income was 54.0 billion yen, and net income attributable to parent company’s shareholders was 36.7 billion yen.

Financial Forecast for the Fiscal Year

- In the rental related business, while revenue is expected to increase due to the new occupancy of “Tokyo World Gate Akasaka Akasaka Trust Tower” and high occupancy rates of existing office buildings, operating revenue is expected to decrease by 400 million yen to 96 billion yen due to the impact of factors such as the closure of three existing office buildings (Mita 3-chome MT Building, Mita 43 MT Building, Mita MT Building) in connection with planning consideration for the (tentative name) Mita 3-chome Project in Minato Ward, Tokyo.

- In the hotel related business, we expect operating revenue of 85 billion yen, the highest ever for the fourth consecutive fiscal year, due to the full-year operation of the Mampei Hotel and Hotel Indigo Nagasaki Glover Street, which opened in the previous fiscal year, strong operations at existing hotels, and the revenue contribution from Asanoya Co., Ltd., which became a subsidiary of the Group in January 2025.

- The real estate sales business is expected to generate operating revenue of 96 billion yen, mainly from the residential sales business, while “other business is expected to generate operating revenue of 23 billion yen.

As a result of the above, business performance for the fiscal year ending March 2026 is expected to see operating revenue of 300 billion yen, the highest ever for the second consecutive fiscal year; operating income of 59 billion yen; and net income attributable to parent company’s shareholders of 35 billion yen.

※The performance forecasts contained in this document are based on judgments made from information available as of the date of publication of this document. Due to various unforeseeable factors, actual performance my differ.

Advance2030

Advance2030 Numerical Targets

Mori Trust Group’s medium-to long-term vision, “Advance2027,” formulated in 2016, was revised in November 2023 to become “Advance2030,” setting a new investment target of 1.2 trillion yen for fiscal 2030, as well as targets of sales of 330 billion yen and operating income of 70 billion yen for fiscal 2030.

Advance2023 Action Plans

(1) Real Estate Business (Leasing and Sales)

| i) Selection and concentration | Intensive investment in areas where we can be highly competitive |

| ii) Optimal combinations | Optimally combine functions to maximize the characteristics of land |

| iii) Strengthening international city functions | Contribute to the kind of urban development which serves to contribute to the strengthening of Japan’s international competitiveness |

(2) Hotel & Resorts Business

| i) Communicating the brand of Japan | Leverage abundant tourism resources to communicate the charm of Japan to the rest of the world |

| ii) Global standards | Providing services based on international standards and global lifestyles to the Japanese market |

| iii) Innovation | Creating new value by integrating Japanese culture with services that are based on international standards |

| iv) Aiming for Japan to become an advanced country in terms of tourism | Contributing through business to the establishment of Japan’s status as an advanced country when it comes to tourism |

(3) Investment Business

In order to build an optimal business and asset portfolio in a manner having us promptly responding to the times, we will ensure that our investments focus on stability, sustainability, and growth potential through the deployment of variety of investment methods for all businesses serving to bring value to greater society.

Business Topics

List of Main Business Topics

| May 2024 | Acquired the land and building of the former residence of Prince Arisugawa, Arisukan, Kyoto City |

| July 2024 | Participation in luxury detached housing development project in Bangkok, Thailand |

| August 2024 | Mori Trust Holdings Inc.’s long-term issuer rating upgraded by one notch to “AA” Tokyo World Gate Akasaka, Akasaka Trust Tower 1st phase completed |

| October 2024 | Mampei Hotel completes large-scale renovation and reconstruction work and holds grand opening |

| November 2024 | Tokyo World Gate Akasaka announces the opening of 1 Hotels on the upper floors of Akasaka Trust Tower, marking its first foray into Japan (the hotel will be called 1 Hotel Tokyo). |

| December 2024 | Hotel Indigo Nagasaki Glover Street opens |

| January 2025 | Asanoya Co., Ltd. is now a subsidiary of the Mori Trust Group |

■ Tokyo World Gate Akasaka 1st phase completed/Japan’s first 1 Hotel Tokyo

Tokyo World Gate Akasaka is a large-scale mixed-use development project that has been certified as a national strategic urban planning building and other development project in the Tokyo Metropolitan Area National Strategic Special Zone (commonly known as the National Strategic Special Zone). With the “Next Destination” block concept, we are working to create a hub that will function as a gateway connecting Japan with the world from both the business and tourism perspectives.

The first phase of Tokyo World Gate Akasaka was completed in August 2024. With the second phase of construction due for completion in October of this year, we are proceeding with the development of large-scale green spaces and a comfortable pedestrian space connecting Tokyo World Gate Akasaka and Akasaka Hikawa Shrine, with the aim of creating a well-being town that contributes to improving physical and mental health and productivity.

Akasaka Trust Tower

| Block Name | Tokyo World Gate Akasaka |

| Building name | Akasaka Trust Tower, NTT Akasaka Building, ATT EAST |

| Address | 2-17-22 Akasaka, Minato-ku, Tokyo (Akasaka Trust Tower) 2-17-28 Akasaka, Minato-ku, Tokyo (NTT Akasaka Building) 2-11-7 Akasaka, Minato-ku, Tokyo (ATT EAST) |

| Site area | Approx. 17,980 m2 |

| Total floor area | Approx. 236,200 m2 |

| Primary use | Offices, hotels, serviced apartments, shops, clinics, historical and cultural facilities, etc. |

Japan’s First Sustainable Luxury Lifestyle Hotel “1 Hotel Tokyo”

“1 Hotels” (read: One Hotels), a sustainable luxury lifestyle hotel operated by Starwood Hotels, an American hotel management company, was invited to the upper floors of “Tokyo World Gate Akasaka” for the first time in Japan. Scheduled to open in autumn 2025 as “1 Hotel Tokyo”.

■ Grand Opening of “Mampei Hotel”

“Mampei Hotel”, located in Karuizawa, Nagano Prefecture, had its grand opening in October 2024 after completing a major renovation and renovation project to commemorate its 130 year anniversary. Based on the concept of ‘”130 years of Mampei Hospitality – Weaving together culture, history and nature,” we aim to preserve the traditions of this valuable historic building in the history of Japanese hotels and provide a dignified stay as a classic hotel for many years to come.

■ “Hotel Indigo Nagasaki Glover Street” opens

The hotel preserves and utilizes traditional buildings located in the historical and atmospheric Minamiyamate area of Nagasaki City (a nationally designated Important Preservation District for Groups of Traditional Buildings), and has opened as “Hotel Indigo Nagasaki Glover Street” in December 2024. “Hotel Indigo” is a lifestyle boutique hotel brand developed by IHG Hotels & Resorts, and this property marks its first arrival in Kyushu. Following in Nagasaki’s DNA as “Wa-Ka-Ran culture,” a blend of the individual characteristics of Japan’s “Wa,” China’s “Ka,” and the Netherlands’ “Ran,” we have created a space with a unique, exotic design that evokes memories of that time, based on the concept of a “Travel through time and space through a Wa-Ka-Ran labyrinth,” creating an uplifting feeling for guests on their trip.

■ Acquired the land and building of “Arisukan, the former residence of Prince Arisugawa”, Kyoto City

In May 2024, we acquired Arisukan, the former residence of Prince Arisugawa (located in Kamigyo Ward, Kyoto City). As a building of historical value, we are considering preserving it and utilizing it in a way that will contribute to Kyoto’s landscape.

■ Participation in luxury detached housing development project in Bangkok, Thailand

In July 2024, in collaboration with Thai real estate developer Major Development Public Company Limited (Major), we joined Malton Gates Krungthep Kreetha 2, a luxury detached housing development project in the eastern suburbs of Bangkok, Thailand. This marks our first investment in ASEAN and our first participation in an overseas housing development project.

■ Asanoya Co., Ltd. becomes part of the Group

Through Mampei Hotel Co., Ltd., Mori Trust Group brought Asanoya Co., Ltd., which operates “Boulangerie Asanoya,” a long-established bakery in Karuizawa that was founded over 90 years ago, into its group umbrella in January 2025.

Mori Trust Group is leveraging Mampei Hotel’s cafe operation know-how to strengthen the cafe business of “Boulangerie Asanoya,” while at the same time utilizing Asanoya’s bread-making techniques for product development for Mampei Hotel’s souvenirs and food department, thereby providing high-added-value services with a synergistic effect.

■ Long-term issuer rating upgraded by one notch to “AA”

Mori Trust Holdings Inc. has had its long-term issuer rating awarded by Japan Credit Rating Agency, Ltd. (JCR) upgraded to “AA.” It was decided that the domestic CP rating would be maintained at the highest level of “J-1+”. (Mori Trust Holdings Inc. is the 100% parent company of Mori Trust Co., Ltd.)

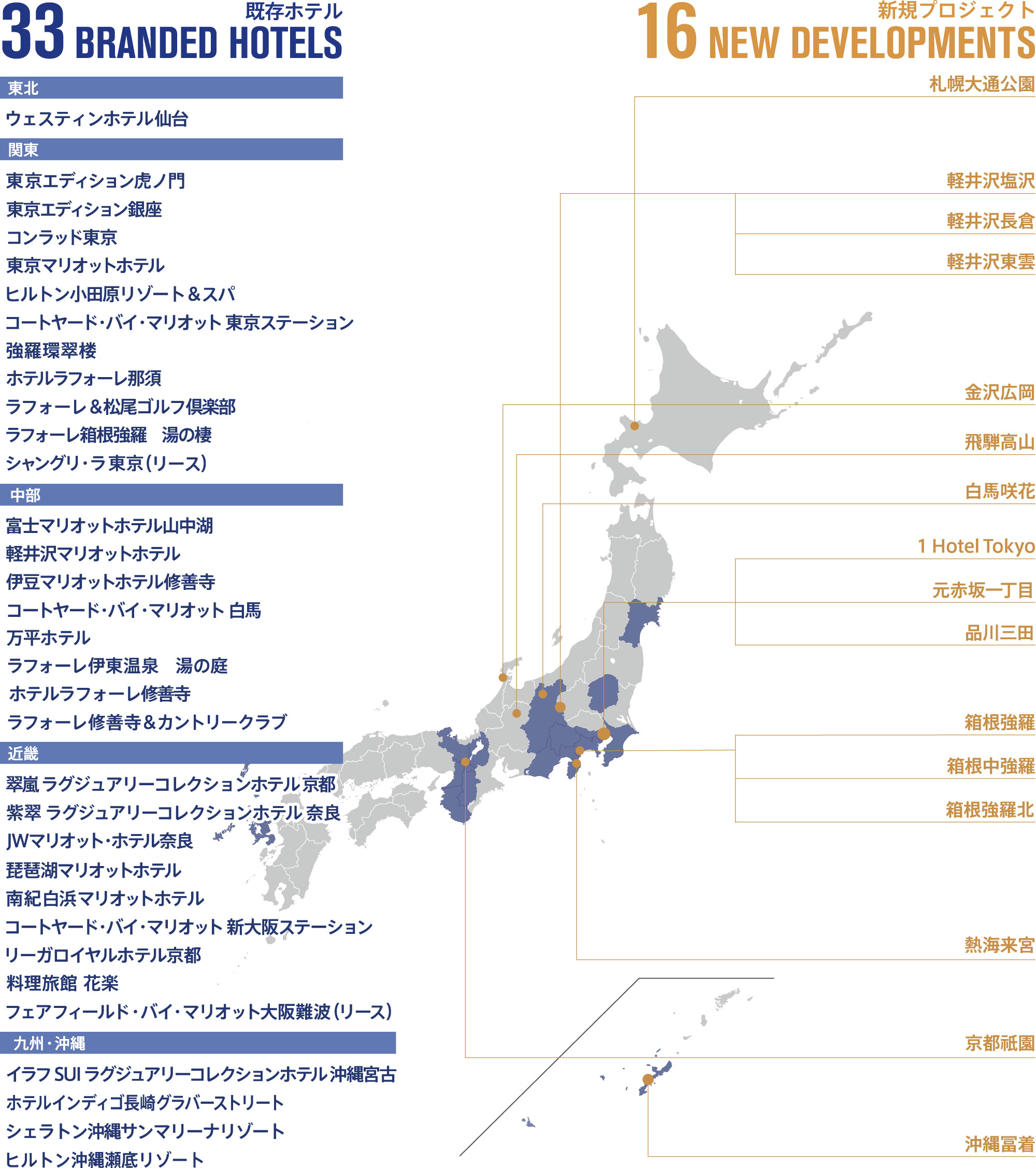

HOTELS & RESORTS

Mori Trust Co., Ltd.’s hotel and resort business, the core of the Mori Trust Group, operates 33 hotel facilities across Japan and is promoting 16 new projects as of March 2025. We are promoting initiatives aimed at expanding inbound demand and increasing spending per traveler. We are providing both domestic and international travelers with comfortable stays that take advantage of the attractive tourism resources in Japan.

List of existing hotels and new hotel projects

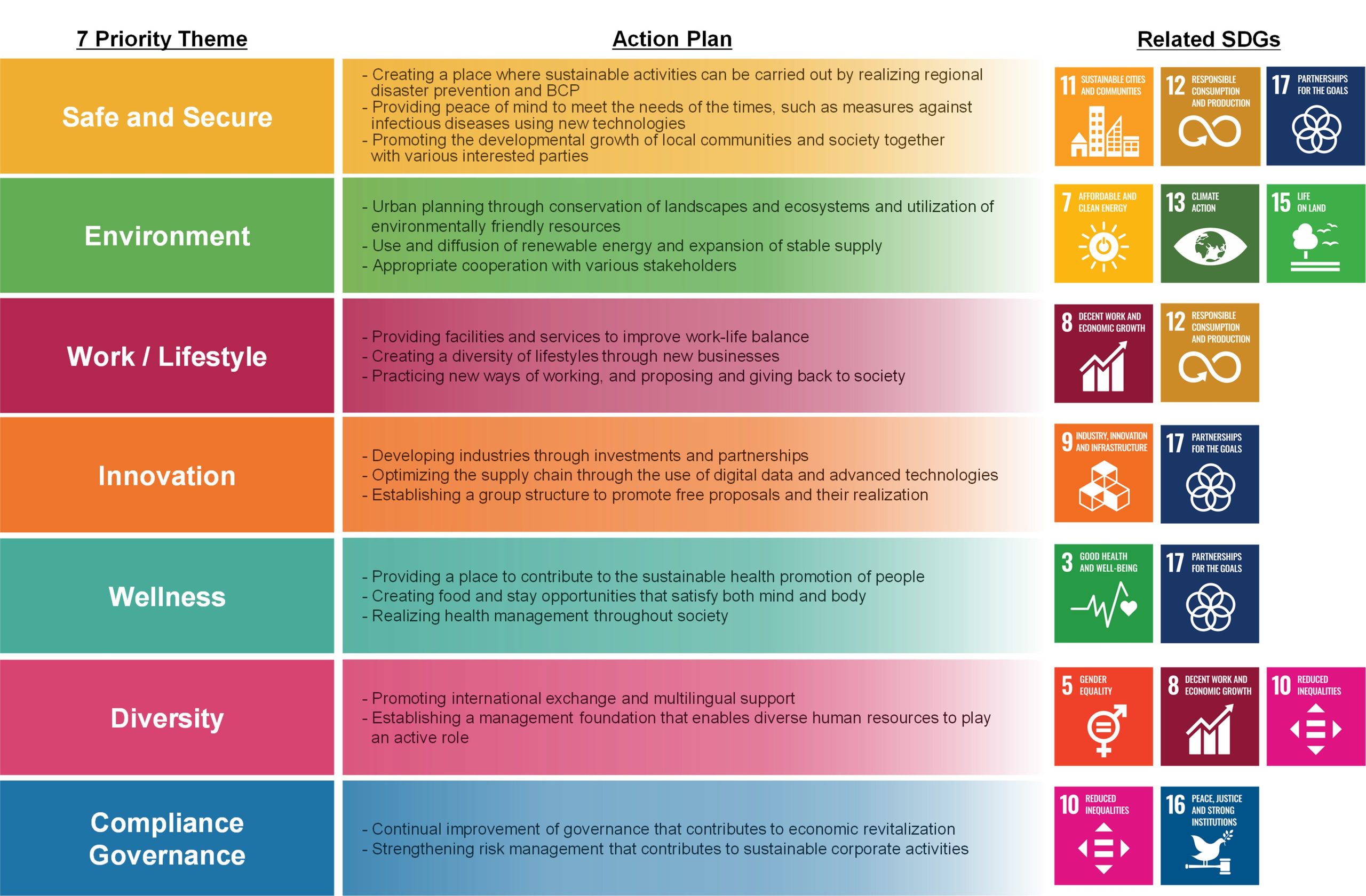

Sustainability Activity Report

Mori Trust Sustainability Vision

From Urban Planning to Future Planning

Under our corporate slogan “Create the Future,” we aim to create an exciting future.

Just as our mission once changed from building planning to urban planning, creating a new society will change us along with society.

Results of Initiatives in the Fiscal Year Ended March 2025 (Excerpt)

■ Safe and secure community development and community revitalization

| Provision of lounge space open to the community | Total annual usage of TOKYO WORLD GATE CoCo Lounge: 388,823 people |

| Building local communities through area management activities | Number of events held in the Kamiyacho, Gotenyama, Marunouchi, and Sendai areas: 38 times |

| Contributing to the local economy by attracting hotels | Implementation of projects that preserve and utilize historical buildings ・Opening of Hotel Indigo Nagasaki Glover Street in Nagasaki City (preservation and utilization of buildings designated as traditional buildings in the Nationally Designated Important Traditional Buildings Protection District) ・Mampei Hotel in Karuizawa, Nagano Prefecture reopens after completing large-scale renovations and reconstruction work to mark the 130th anniversary of the hotel’s founding |

| Preparing for safety through disaster drills | Number conducted: 4 |

■ Realization of a sustainable environment and society

| Introduction of renewable energy power to rental buildings | ・Introduced at “Akasaka Trust Tower” This completes the introduction to properties planned for when the targets for initiatives related to Sustainability Promotion Vision were formulated (FY2022). (As of May 2025, it has also been introduced to the three rental buildings purchased by FY2024.) ・Aiming for 100% adoption rate by fiscal 2025 |

| Reducing the use of specified plastics in hotels | ・Reduction in FY 2024: 19.91 tons (total weight of 21 facilities operated by Mori Trust Hotels & Resorts Co., Ltd.) ・Achieved FY 2024 target of plastic reduction of 15 tons |

| Acquisition of environmental certification for leased buildings | ・Number of new acquisitions: 5 (Akasaka Trust Tower, Kyobashi Trust Tower, Marunouchi Trust Tower Main Building/N Building, Sendai Trust Tower) |

■ Proposing new work lifestyles

| Acquisition of certification related to work environment | Recognized as a KENKO investment for Health corporation (large corporation division) for the sixth consecutive year |

■ Creation of a new era and industrial development

| Incorporating robot-friendly standards into building designs and promoting the introduction of robots | Cleaning robots have been installed in six facilities, and food delivery robots in five facilities. (Installed in a total of 16 facilities operated by our Group.) |

| Exhibits and sales that contribute to the promotion of culture and industry | 52 weeks of exhibition and sales activities at TOKYO WORLD GATE CoCo Lounge |

■ Promotion of business in health promotion and wellness fields

| Development and provision of wellness food |

| Selling herb tea from our own farm on the EC site |

| “Pure wellness room” program to purify indoor environments in 7 steps introduced to 16 facilities |

| Childcare leave acquisition rate: 93.3% in total, 100.0% for women, 90.0% for men (annual target: 100%) |

■ Initiatives for Diversity

| Formulation and publication of human rights policy | Published in February 2025. Held in-house briefing sessions |

| Support for foreign residents by lifestyle concierges | Concierge services at TOKYO WORLD GATE CoCo Lounge: 1,196 |

| Diversity-conscious recruitment activities | ・New graduate recruitment: Global recruitment and workshop selection ・Mid-career recruitment: Implementation of career return recruitment and referral recruitment |

■ Continuous improvement of compliance and governance

| Strengthening the legal function of the Mori Trust Group | Group Legal Meetings: 4 times Held in-house seminars: 5 times |

| Raising awareness of information leakage management | Implementation of crisis management simulation |

Mori Trust Group: Total Floor Area Leased or Managed

■ Number of rental/managed facilities (as of March 31, 2025)

Buildings, housing, and commercial facilities: 64

Hotel & resort facilities: 36 (number of rooms: approx. 5,300)

Mori Trust Group: Summary of Consolidated Companies

Mori Trust Group: Summary of Equity – Method

Consolidated Statements of Income (For the years ended March 31, 2025)

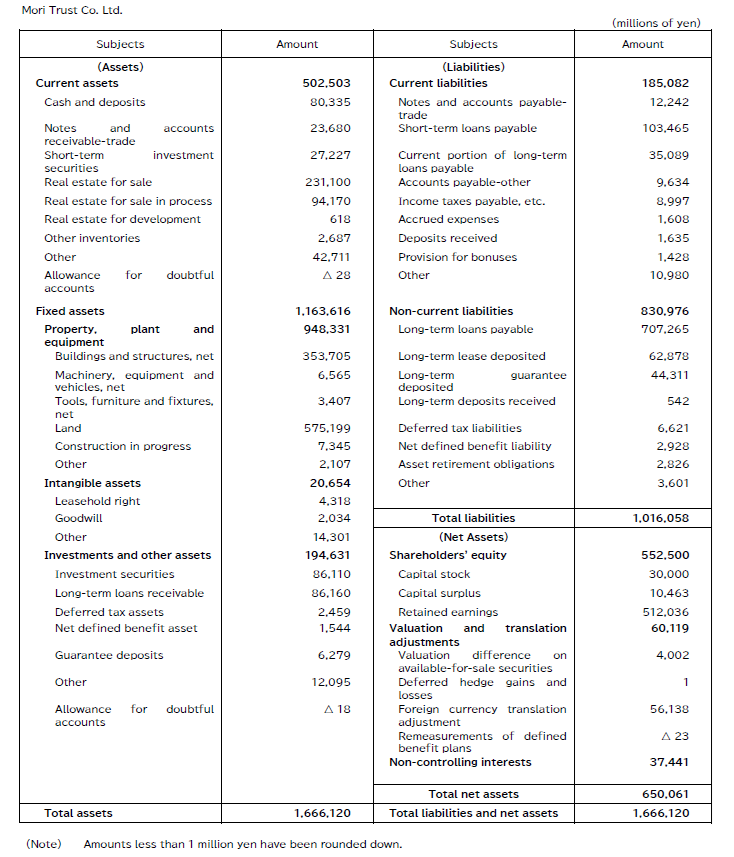

Consolidated Balance Sheets (as of March 31, 2025)